Apparently, the currency market is trying to take a break, catch its breath, and understand what has happened in recent years. Although the scale of throwing quotes from side to side is so great, "stagnation" is still expected. Here, common sense is needed and to speak is not necessary, since it was lost somewhere during the fantastic growth of the dollar. The mass agitation and disinformation media have so thoroughly intimidated everyone with the coronavirus that it is better not to talk about the ability to think rationally. You can only dream. But precisely because of the scale of the dollar's strengthening in previous days, what is happening on the currency market can be called a kind of stagnation. At the same time, everything happens contrary to the published macroeconomic statistics, which clearly indicates that everything in the United States is pretty good, and in the Old World, continue to put out the light. However, investors, scared to hell, could pause due to the rapid spread of coronavirus in the United States, where the number of infected people suddenly began to grow at a frightening pace. Although, in Europe, the situation with this infection is no better, since the number of deaths from a coronavirus in Italy has already exceeded their number in China.

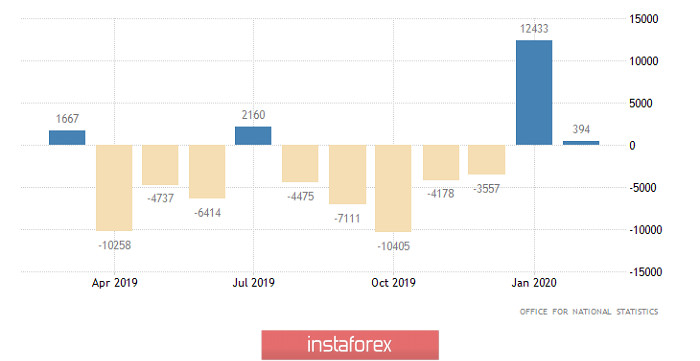

Nevertheless, if you look at macroeconomic statistics, then the single European currency has a lot of reasons for decline. For example, more recently, producer prices in Germany rose as much as 0.2%, and after a recession that lasted for four months. The recession resumed, although only by -0.1%. However, this is still a recession, and in fact, it is quite protracted. Therefore, it is not worth waiting for inflation to increase, which is directly related to producer prices. In addition, I have repeatedly said that we are seeing a banal outflow of capital from around the world to the United States, and the data on the balance of payments of Europe confirm this statement. If the balance of payments of the Old World amounted to 51.2 billion euros in December, then it contracted to 8.7 billion euros in January. At the same time, Italy is suffering from coronavirus, the situation is even worse, since the December balance of payments surplus of 5.1 billion euros can now only be remembered as something good and wonderful. In January, the balance of payments was in deficit, at -0.2 billion euros. And once again, it can be noted that this is data for those months when no coronavirus was ever mentioned in Europe. Therefore, it is wrong to write off everything that happens to the coronavirus. By the way, in Spain, the trade deficit in January was -3.5 billion euros, while in December, it was -2.1 billion euros. As we can see, the situation is not really the most joyful.

Balance of Payments (Europe):

The situation is not better in the United Kingdom, where government borrowing increased by another 0.4 billion pounds. We were waiting for a reduction in the debt burden by 1.0 billion pounds. In addition, London received the good news that there will be no negotiations on a trade agreement with Brussels in the near future. It's just that Michel Barnier, who oversees this issue from continental Europe, became infected with the coronavirus. Therefore, everything goes to the fact that the UK will simply be kicked out of the European market next year. However, the pound was growing, which is contrary to common sense.

Government borrowing (UK):

But in the United States, everything is very good, but only if you do not count the cries of mass agitation and misinformation about the spread of coronavirus. The fact is that home sales in the secondary market jumped 6.5%. If 5,420 thousand houses were sold in January, then it was already 5,770 thousand in February. In other words, the dollar had every reason to continue to grow, which we never saw.

Secondary Home Sales (United States):

Today, no macroeconomic data is published. However, it is worth paying attention to the placement of French government debt securities. If their profitability continues to grow, then the observed kind of stagnation in the currency market is only temporary, and the dollar will continue to grow again. After all, the capital flight from around the world to the United States continues. The answer to this question will just give the French debt.

Nevertheless, the placement of French debt securities will occur quite late, and thus, a single European currency will hang around the level of 1.0700 during the day.

We have a similar picture for the pound. For today, the reference point is the level of 1.1600 only.