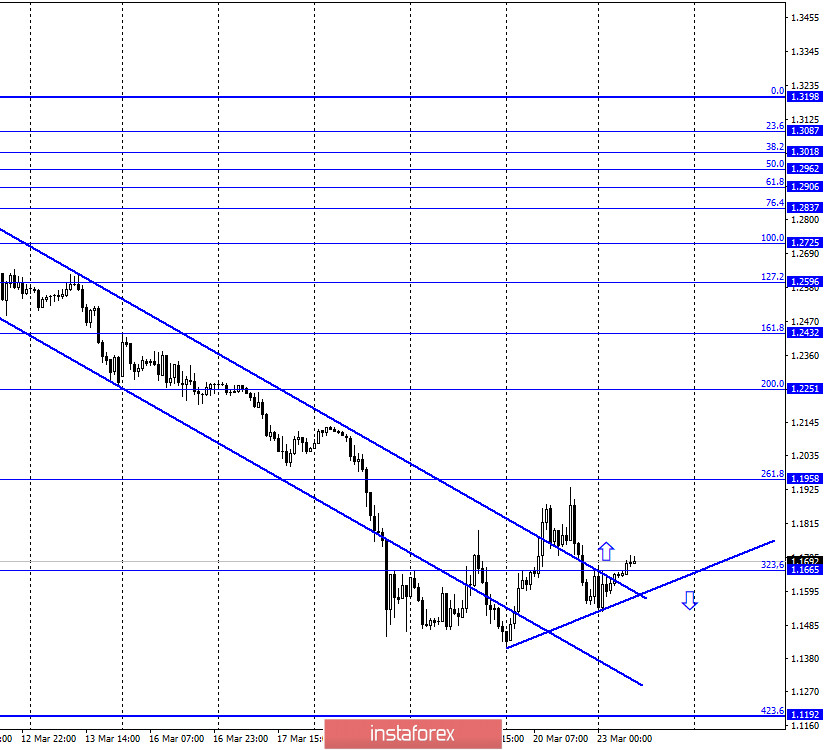

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the strong drop in quotes finally stopped. At the moment, the pound/dollar pair performed a close over the downward trend corridor on the hourly chart, which allows traders to expect some growth. In addition, I have built a new and still very weak upward trend line. Despite its weakness, this line will support bull traders and show the moment when the bears may want to return the pair to a fall. Closing the exchange rate under the trend line will work in favor of the US dollar and resume the fall in the direction of the corrective level of 423.6% (1.1192). Until this happens, traders can expect growth in the direction of the Fibo level of 261.8% (1.1958).

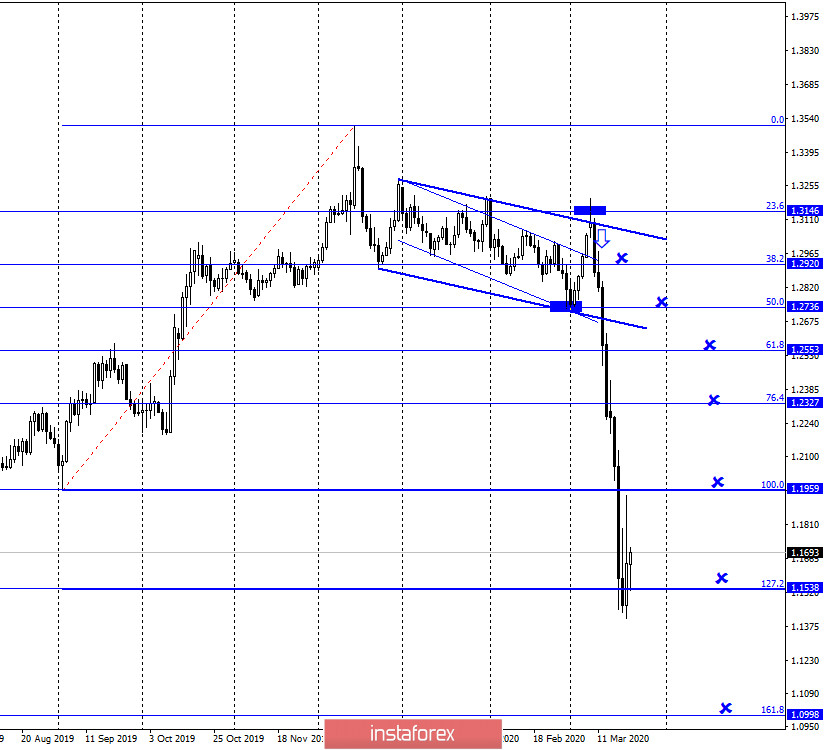

GBP/USD – 4H.

As seen on the 4-hour chart, I removed the grid of Fibo levels, since it is identical to the grid on the hourly chart. There are no new trading ideas on this chart, as there are no special changes in the pair's movement. The British dollar's quotes seem to have performed an upward turn, which allows traders to expect some growth. No indicator shows any new emerging divergences on March 23.

GBP/USD – Daily.

On the daily chart, the picture remains the most interesting. The GBP/USD pair performed a fall to the corrective level of 127.2% (1.1538) but failed to perform a clear closing under it. Thus, you can interpret this attempt to overcome it as a rebound. In this case, the pound/dollar pair also performed a reversal in favor of the British dollar and began the growth process in the direction of the Fibo level of 100.0% (1.1959). However, much now depends on the information background, which has shocked traders in recent weeks. Thus, if there is news that will add panic to the markets, then all the graphical constructions and hopes of bull traders will collapse. However, now we can still count on some growth of the pair.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a fall to the lower line of the "narrowing triangle", however, it remains unclear whether the closing is performed under it or not. On the lower charts, the pair shows a desire to perform a reversal in favor of the British currency. Then the breakdown may be false on the weekly chart. Thus, I believe that this point should be kept in mind, but do not yet interpret the development of the lower line as a breakdown.

Overview of fundamentals:

On Friday, no important economic reports were published in the UK and the US. Both America and Britain remain in strict quarantine and now we can only wait for the number of infections with the COVID-2019 virus to decrease. Stock markets on Friday again experienced not their best day, and oil remained near the minimum values.

The economic calendar for the US and the UK:

On March 23, important economic reports and events are again not included in the calendar of the UK and the US.

The key place among all the news is still occupied by news about the coronavirus. In the UK, the epidemic continues to spread, but it is good that the rate is not too high and the total number of sick citizens does not yet exceed 5,000. In America, the situation is much worse, about 25,000 people have already been infected there.

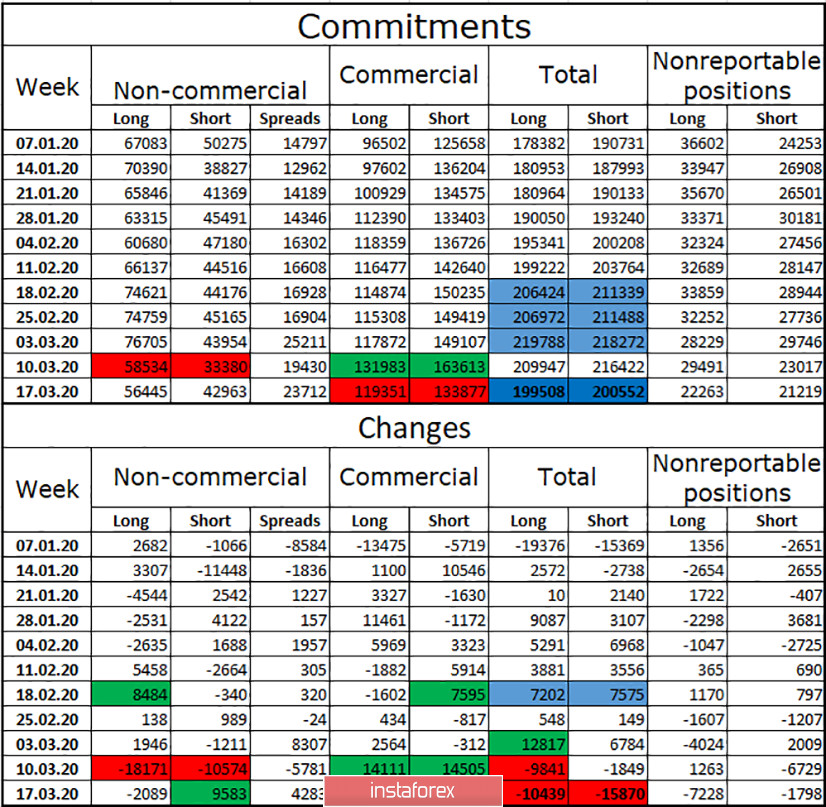

COT report (Commitments of Traders):

The new COT report, released on Friday, again showed no major changes in the number of contracts between groups of speculators and hedger companies. The total number of long and short contracts has decreased slightly but remains almost equal. The "Commercial" group immediately dropped 30,000 short contracts and 12,000 long contracts at once. A group of speculators increased long contracts by 9,000. The small number of contracts owned by speculators suggests that players who are pursuing the goal of making money on exchange rate fluctuations do not favor the pound/dollar pair now, considering it excessively dangerous. The "Commercial" group, which owns a larger number of contracts, reduces short positions. Thus, I believe that the grounds for completing the free fall of the British are there. But everything will depend again on the information background.

Forecast for GBP/USD and recommendations to traders:

I believe that in the current conditions, opening any transactions is still associated with high risks. Even major players do not like the GBP/USD pair too much, preferring the EUR/USD pair. However, the COT report allows for the end of the "bearish" trend. On the hourly chart, there is an ascending trend line, from which bull traders should start. The nearest target is 1.1958. Closing quotes below the trend line will allow you to sell the pair with the target of 1.1192.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on prices.