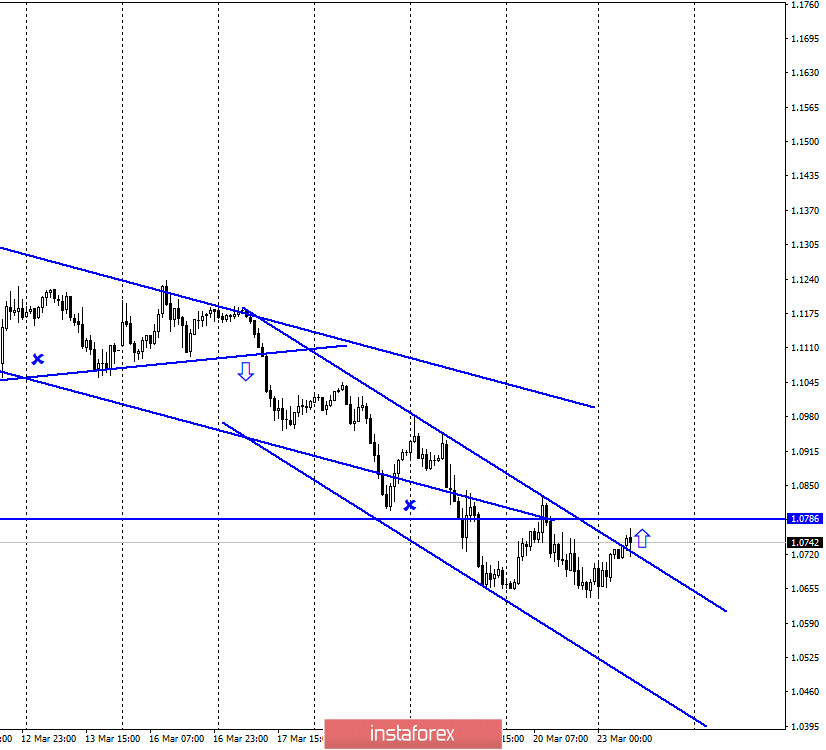

EUR/USD – 1H.

Hello, traders! On March 20, the European currency finally found its strength and did not end the day in the "red zone". The downward trend corridor, which maintained a "bearish" mood throughout Friday, allows its change to a "bullish" on Monday, as the quotes of the euro/dollar pair performed a close over its upper line. However, at the moment, this close is very superficial and can not be considered a clear signal to buy the EUR/USD pair. Nevertheless, the first step in the direction of a new upward trend has been taken. It is not known whether traders are still in a state of shock, but I think we will get an answer to this question today.

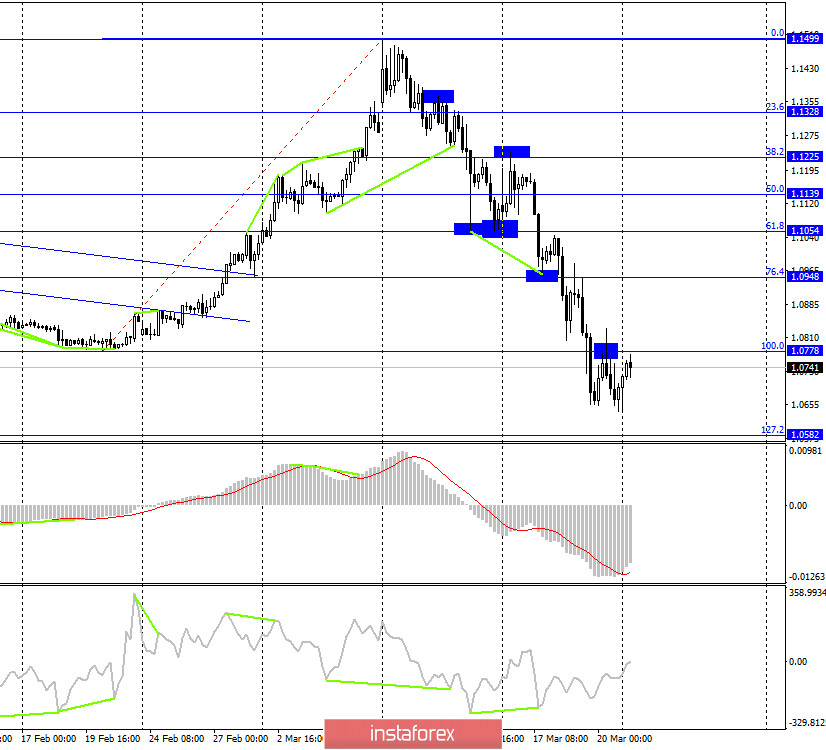

EUR/USD – 4H.

According to the 4-hour chart, the EUR/USD pair returned to the corrective level of 100.0% (1.0778), rebounded from it, fell slightly, updated the previous local low and performed a new reversal in favor of the EU currency with a return to the Fibo level of 100.0%. Thus, the second consecutive rebound of quotes from this level will again work in favor of the US currency and the resumption of the fall in the direction of the corrective level of 127.2% (1.0582), and will also put an end to the attempts of bull traders to slightly raise the pair up. However, closing the pair's rate above the Fibo level of 100.0% will allow traders to expect continued growth in the direction of 76.4% (1.0948) and will increase the chances of ending the strong "bearish" trend that has been observed in recent weeks.

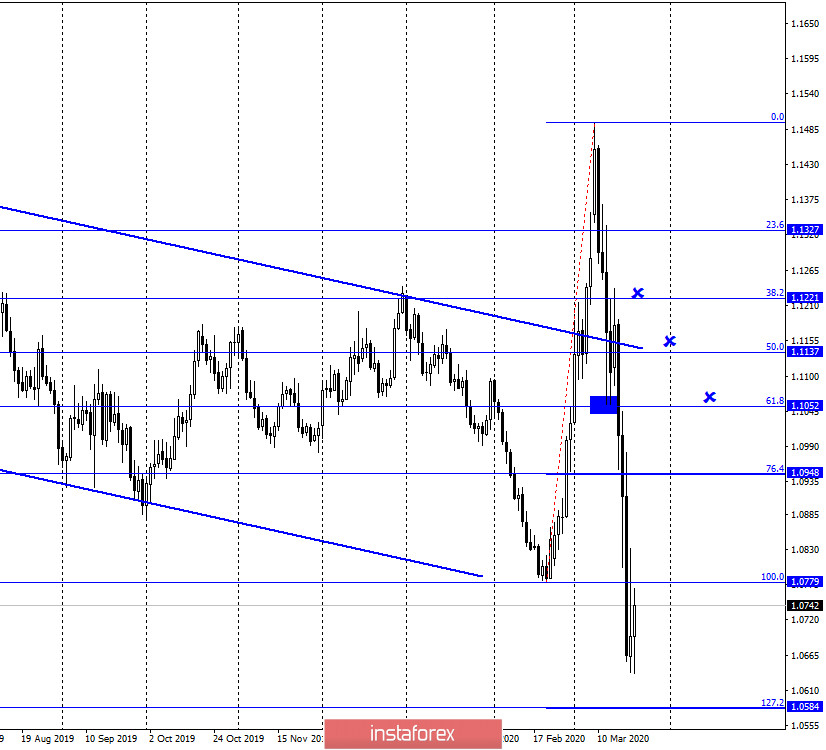

EUR/USD – Daily.

According to the daily chart of the euro/dollar pair, the picture is identical to the 4-hour chart, since the same Fibonacci grid is in operation. Bull traders are starting to show signs of life, but, unfortunately, now everything depends not on them, but on the bears. If they decide to sell the pair again, then, most likely, a strong drop in quotes will be resumed. Bull traders now at all costs need to close above the Fibo level of 100.0% (1.0779). This consolidation will allow us to expect some growth in quotes. However, the coronavirus pandemic continues to spread throughout the world, and nothing can stop it yet. This means that there are no reasons for traders to change their mood to "bullish". After all, nothing has changed in the world in the past few days.

EUR/USD – Weekly.

As seen on the weekly chart, the pair's quotes closed under the lower line of the narrowing triangle. Thus, the probability of resuming the fall increases sharply, although the consolidation does not look clear and strong. However, I believe that this point is extremely important for the pair. Either the pair will soon return to the triangle area, or, most likely, the euro will continue to fall.

Overview of fundamentals:

On March 20, the European Union and the United States did not release any economic reports. By and large, all the news now comes down to measures taken by governments around the world to prevent the collapse of the world economy due to the shock associated with the epidemic. But, as we can see, these actions are not reflected in the EUR/USD currency pair.

News calendar for the United States and the European Union:

On March 23, important economic reports and events are again not included in the calendar of the European Union and the United States.

The information background that really interests traders is still only about the coronavirus and its spread around the planet. All other news is ignored by traders.

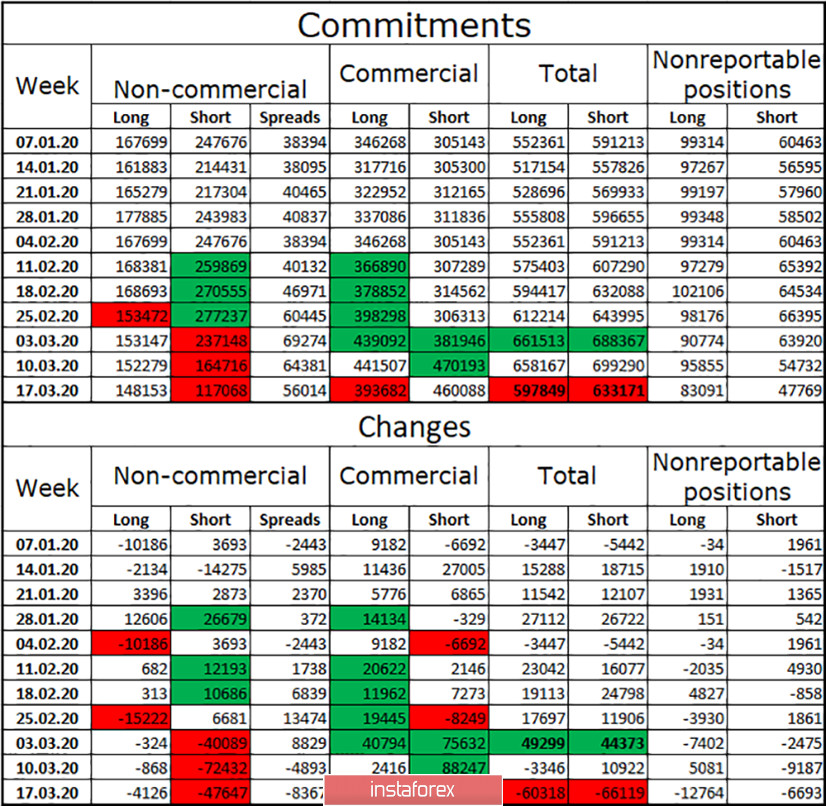

COT report (Commitments of Traders):

The new COT report is out! And I must say, it is very interesting. First, I would like to draw your attention to the fact that the total number of commercial group contracts is much higher than the number of non-commercial contracts. This allows us to conclude that now the "rule the ball" is not speculators, but corporations that hedge risks. Second, the total number of long and short positions for all groups of traders has significantly decreased. However, the short still remains longer. And in the "Commercial" group - much more. Third, speculators, according to part of the table "Changes", all week until March 17, diligently got rid of short contracts and corporations - from long contracts. In total, this has resulted in approximately 120,000 fewer contracts. Thus, among the major market players, bears still prevail, but their advantage is not so obvious, so a change to a "bullish" trend is possible.

Forecast for EUR/USD and recommendations for traders:

The situation for the EUR/USD pair is a bit confusing. It is unclear whether the pair's fall will continue. The COT report suggests that bear traders remain strong, but a change in the picture is also possible. Thus, I recommend buying the pair at the close above the level of 1.0778, and selling - in the event of a rebound from this level. The goal is the next Fibo levels.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on prices.