Yesterday will truly go down in history as a day of new records. Let's just say that our horizons expanded significantly yesterday and now, we know what it means to fall low. Indeed, history has never known such a rapid and deep decline in business activity indices, especially in the service sector. However, this is only preliminary data for March, when the whole world has already faced the coronavirus to its fullest extent. The authorities of all countries of the world massively impose various restrictions and seek to force people to sit at home and forcibly closed places of mass crowds, especially bars, cafes and restaurants. Moreover, shopping centers and movie theaters were not also left out. In the UK, everything was closed, except for grocery stores, as well as stores selling goods vital to the household. No wonder the service industry was a little sad after all and it is not yet clear how widespread the losses will be. State officials, of course, were feeling guilty and continue to promise that they will not leave unfortunate entrepreneurs in trouble and will help them in every possible way. But the losses may turn out to be so widespread that even central banks will shrug their hands and say that the printing press can no longer work. As a result, we will almost certainly wait for the mass ruin of small and medium-sized entrepreneurs just from the service sector. The big ones, of course, will help, but everyone else will probably have to rely only on their own strength throughout Europe and North America. However, it is not much better in other parts of the world. But given the rate at which the coronavirus is spreading across Europe and the United States, it is entirely possible that the anti-record may even be broken. Well, the funny thing about all this is that the dollar noticeably weakened at the end of the day, which, at first glance, seems absurd, given how terrifying the decline in the indices in Europe was. However, there is logic in all of this, since in the United States itself the data came out not much better. And the dollar was overbought quite seriously, so at least a local rebound was urgently needed. But the fact that this is just a rebound strongly shows the dynamics of the debt market. But first things first.

Europe was the first to report, and it was wonderful. Let's just say that France set the tone for the whole day, because the index of business activity in the services sector of the Fourth Republic collapsed from 52.5 to 29.0. Moreover, the composite index fell from 52.0 to 30.2. Both indicators set new historical lows, simultaneously setting a record for the scale of a one-time decline. The best looked at the index of business activity in the manufacturing sector, which fell from 49.8 to 42.9. And these results showed what awaits everyone else, since the results were fundamentally no different in other countries. All the same new anti-records and a rapid fall. The difference is only in the details. For example, in Germany, apparently because of the quarantined Chancellor, the index of business activity in the services sector fell from 52.5 to 34.5. Following it, the composite business activity index collapsed from 50.7 to 37.2. The manufacturing business activity index also fell from 48.0 to just 45.7. So the picture is just terrifying and it becomes even worse when considering pan-European indices. Thus, the index of business activity in the service sector collapsed from 52.6 to 28.4, and the composite index from 51.6, right down to 31.4. The manufacturing business activity index looked a little better, as it crashed from 49.2 to only 44.8. So there is reason to be sad, although I didn't just give the data separately for France and Germany, that their situation is slightly better than in the entire euro area as a whole especially in Germany. Given the weight of the two largest economies of the euro area in European statistics, this suggests that in other European countries the situation is even worse. After all, an index below 50 points indicates stagnation or even recession. As a result, a recession in the economy is clearly inevitable.

Composite Business Activity Index (Europe):

But do not think that only continental Europe set records. On the other side of the channel, they were not going to be left behind in this bizarre capitalist competition. The index of business activity in the UK services sector just fell from 53.2 to 35.7. and given that a decree was only issued yesterday to close all crowded places, this is far from the limit, and in April, the service sector can set a new record that will be proud of for centuries. At the same time, the index of business activity in the manufacturing sector decreased from 51.7 to a modest 48.0. So, as in Europe, the production index showed generally good results. In any case, the service sector has much more weight, so the composite business activity index fell from 53.0 to 37.1. And apparently, this is not the limit.

Composite Business Activity Index (UK):

Oddly enough, the picture in the United States was exactly the same. And, apparently, the expectation of just such a result was the reason that, despite extremely weak data, neither a single European currency, nor a pound was in a hurry to get cheaper in relation to the dollar. So, the index of business activity in the service sector simply collapsed from 49.4 to 39.1, which, as you might guess, has become a new historical low. Moreover, the industrial business activity index fell from 50.7 to 49.2, which turned out to be much better than forecasts. But in any case, the composite business activity index fell from 49.6 to 40.5. So overall, judging by the numbers, the situation in the United States is slightly better, and this dollar was supposed to grow. However, it should be noted that in Europe, emergency measures that harm the service sector began to be taken much earlier than in North America, so the effect is still a little less. And the rapid growth in the number of people infected with coronavirus in the States began just the other day. Thus, American businessmen have not yet fully felt what is happening. Here is the answer to why the indicators are better in the States. This is for now. So, in general, the indices overlapped each other, and, in a good way, the currency market should have stood still. However, all points on the "i" dotted the sale of new homes fell by 4.4%. The total number of sales decreased from 800 thousand to 765 thousand. It turns out that just more negative news came from the United States yesterday including coronavirus, which continues to spread through North America. Yet, the dynamics of the yield of US government debt securities indicates that all this is temporary and is only a local rebound. So, the yield on 52-week bills simply collapsed from 1.27% to 0.26%. The yield on 2-year bonds decreased slightly from 1.188% to 0.398%. So yes, investors continue to massively buy US government debt securities, and most of all the shortest ones. So, the capital flight from around the world back to the United States continues. It may not be as widespread as it was last week, but the trend is still there and the shortest in the first place.

Composite Business Activity Index (United States):

The weakening dollar may continue despite the impressive demand for US debt securities today, although at a much more moderate pace. After all, the UK has already presented some pretty good news in the form of lower inflation from 1.8% to 1.7%. This news is good for the simple reason that they predicted a decrease of up to 1.5%. And in the current context, this is indeed becoming good news. Moreover, such a slowdown in inflation is not a sufficient reason for the Bank of England to somehow expand incentive measures and soften the parameters of monetary policy. However, the UK is still waiting for the CBI report on retail sales, which should show a decrease in the index from 1 to -14. Well, this is just a reflection of what the service activity index in the service sector has already shown.

Inflation (UK):

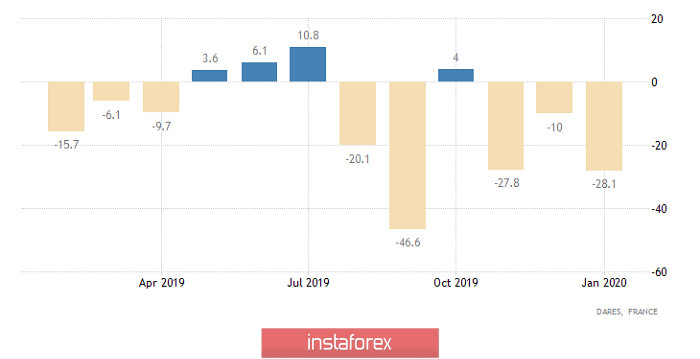

Spain reported on production orders, the growth rate of which slowed down from 2.7% to 1.7%. Thus, the widespread deterioration of the economic situation continues. For example, in Germany, the IFO may show a decline in its indices. At the same time, the business climate index should decline from 96.0 to 87.7. The index of economic expectations may decline from 93.2 to 82.0. Well, the index of current economic conditions is from 99.0 to 93.8. However, given what is happening, it is surprising that they expect such a slight decrease. On the other hand, good news may come from France, where the number of applications for unemployment benefits should decrease by 16.0 thousand. If these forecasts are confirmed, this will mean that the number of applications has been declining for the fourth month in a row, which means that the situation on the labor market is improving. But the data is only for February, whereas in March a real explosion can happen. Nevertheless, the situation on the French labor market was getting better and better before the coronavirus epidemic that covered Europe, which is a rather optimistic and encouraging factor, as it says that after the epidemic is over everything will return to normal.

Number of applications for unemployment benefits (France):

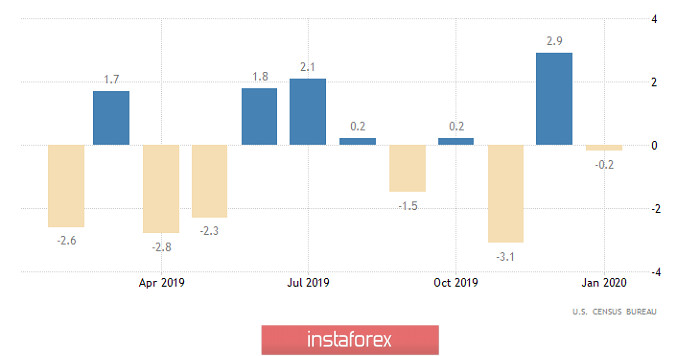

But the main factor for weakening the dollar today will be its own American statistics. After all, the volume of orders for durable goods should be reduced by 0.7%. At the same time, it was already declining in the previous month, although only 0.2%. That is, the volume of orders has been declining for the second month in a row, which, of course, pleases no one. Nevertheless, housing prices in the United States for the month may grow by 0.2%, which, of course, pleases realtors and sellers, but these data look faded amid the orders for durable goods.

Durable Goods Orders (United States):

So, the single European currency has every chance to increase to the level of 1.0900 today. However, the tendency for the flow of capital to the United States remains, and if data on orders for durable goods turn out to be better than forecasts, then we should expect a decrease to the level of 1.0725.

In principle, the situation for the pound is exactly the same. So, if everything goes according to plan, then the pound will grow to the level of 1.1950. In the case of good statistics from the United States, the pound will drop to the level of 1.1700. The pound still has incredibly high volatility.