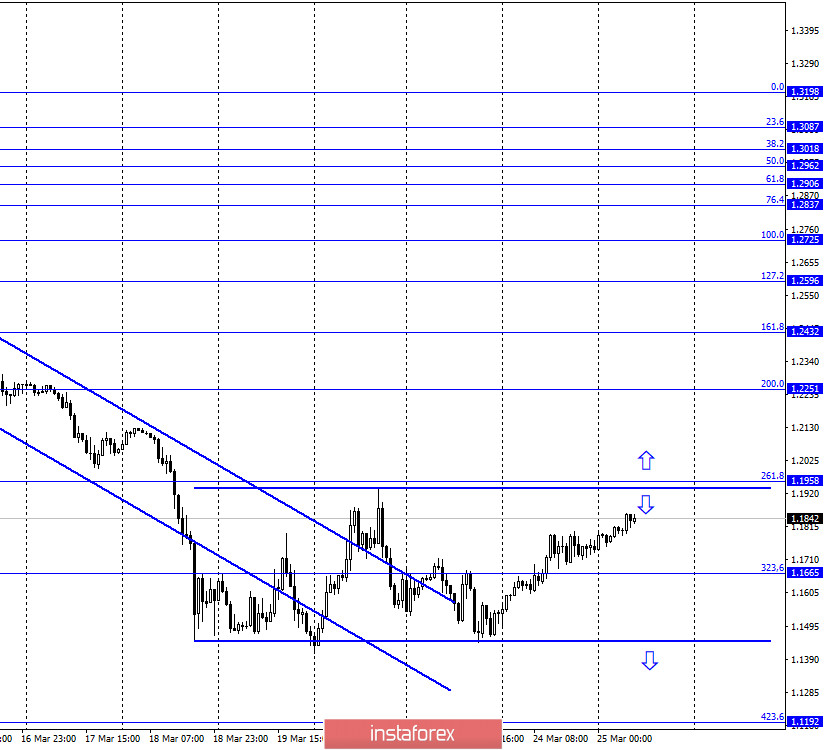

GBP/USD – 1H.

Hello, traders! On the hourly chart, the fall in the British dollar's quotes stopped. However, it is too early to talk about a new upward trend. Bull traders hardly move the pair in the direction of the upper line of the side corridor, where the pair has been placed in recent days. The rebound of quotes from the upper line of the corridor will work in favor of the US dollar and resume falling in the direction of the lower line of the corridor. And only the closing of the pound/dollar exchange rate over the side corridor will allow traders to expect further growth of the pound in the direction of the corrective level of 200.0% (1.2251). And then a new Fibonacci grid will be built, which will give us more accurate target levels. Pressure on the US dollar is now being exerted across the entire spectrum of the market, as after the Fed's strong stimulus measures aimed at saving the economy, the US government plans to allocate another $2 trillion to support it. This is clearly a "bearish" factor for the dollar.

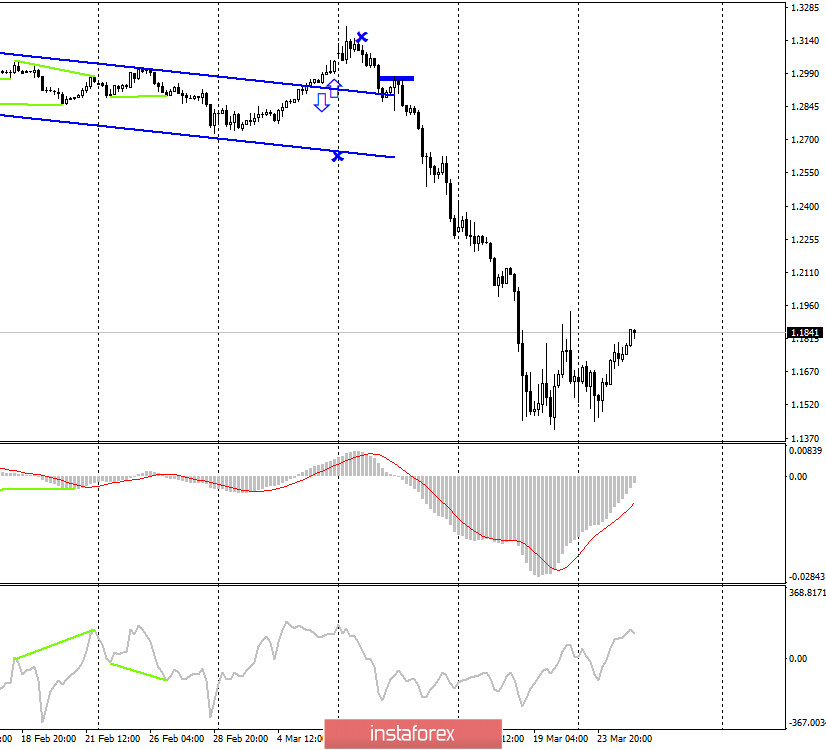

GBP/USD – 4H.

According to the 4-hour chart, I have not yet built a new grid of Fibonacci levels, since the overall picture is very similar to the hourly chart. There are no new trading ideas on this chart, as there are no special changes in the pair's movement. Quotes of the British pound have started the growth process, but it is unclear how long it will continue, especially given the side corridor on the hourly chart. No indicator shows any new emerging divergences on March 25.

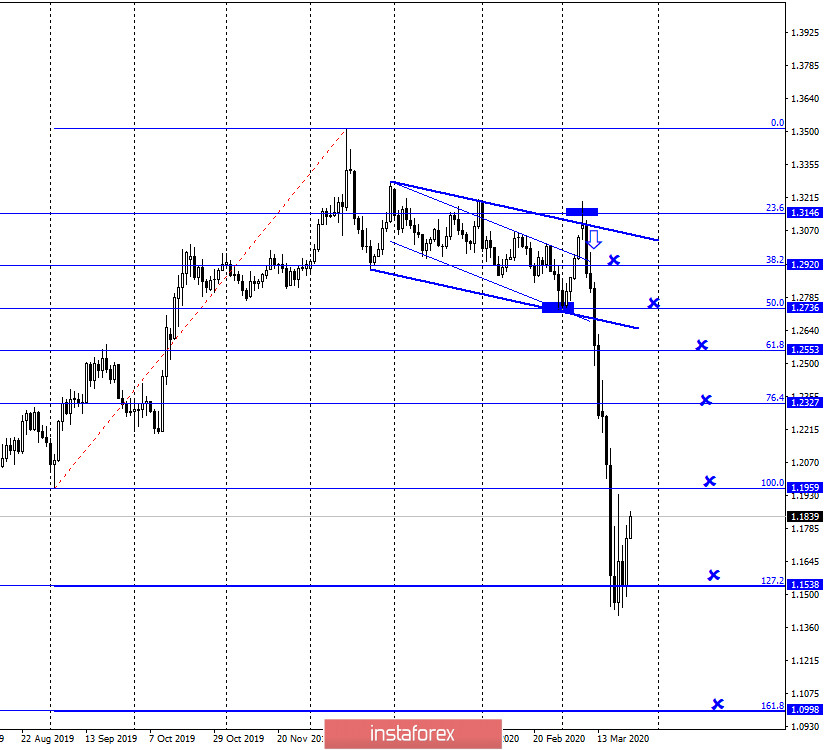

GBP/USD – Daily.

As seen on the daily chart, the picture remains the most interesting. The GBP/USD pair rebounded from the corrective level of 127.2% (1.1538), but it is not clear and accurate. Nevertheless, it performed a reversal in favor of the British currency and began the growth process in the direction of the corrective level of 100.0% (1.1959). The US dollar, as in the case of the euro, remains under little pressure from traders, as the Fed and the US government pour huge amounts into the economy to save and stimulate it. However, the more dollars that are publicly available, the greater the offer. And if the demand remains the same, the currency begins to fall in price. It seems that this is what is happening now with the dollar. At the same time, the shock state of the market continues to persist. The amplitude of the pair's movement is very high.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a fall to the lower line of the "narrowing triangle", but the breakdown may be false. So far, it is difficult to say what exactly happened near the lower line of the triangle. A false breakout will give a high probability of growth to the first downward trend line.

Overview of fundamentals:

On Tuesday, the UK and US released reports on business activity in the services and manufacturing sectors for March. In the UK, the same pattern was observed in the European Union. The services sector was significantly worse than traders expected, and the manufacturing sector was better, but still, both sectors showed a serious drop compared to the second month of the year.

The economic calendar for the US and the UK:

United Kingdom - consumer price index (09:00 GMT).

United States - change in the volume of orders for long-term goods (14:30 GMT).

Today in the UK, the consumer price index for February has already been released, which fell from 1.8% y/y to 1.7% y/y. The pound continues to grow, so traders are not interested in this report. In the second half of the day, an equally important report on orders for durable goods for February will be released, but it is unlikely to interest traders.

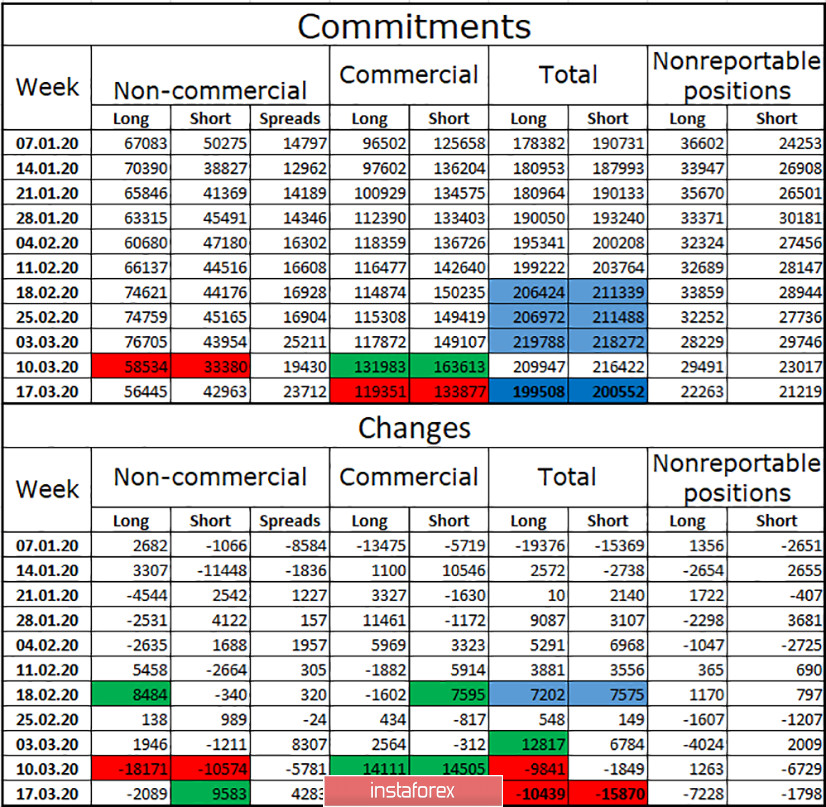

COT report (Commitments of Traders):

The new COT report, released on Friday, again showed no major changes in the number of contracts between groups of speculators and hedger companies. The total number of long and short contracts has decreased slightly but remains almost equal. The "Commercial" group immediately dropped 30,000 short contracts and 12,000 long contracts at once. A group of speculators increased 9,000 short-contracts. Thus, speculators believe that the pound can resume the process of falling, but they have half as many contracts in their hands as in the hands of large companies that hedge their risks in the foreign exchange market. I assume that the British dollar continued to rise in price against the backdrop of serious stimulus measures by the Federal Reserve and the US government. The new COT report will show whether something has changed in the total volumes of long and short contracts.

Forecast for GBP/USD and recommendations to traders:

Major players do not like the GBP/USD pair too much, preferring the EUR/USD pair. Nevertheless, the COT report allows for the end of the "bearish" trend. In my opinion. I recommend buying the pound when closing quotes above the side corridor on the hourly chart with the target of 1.2251. Sell – when rebounding from the upper line of the side corridor with the target of 1.1450.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.