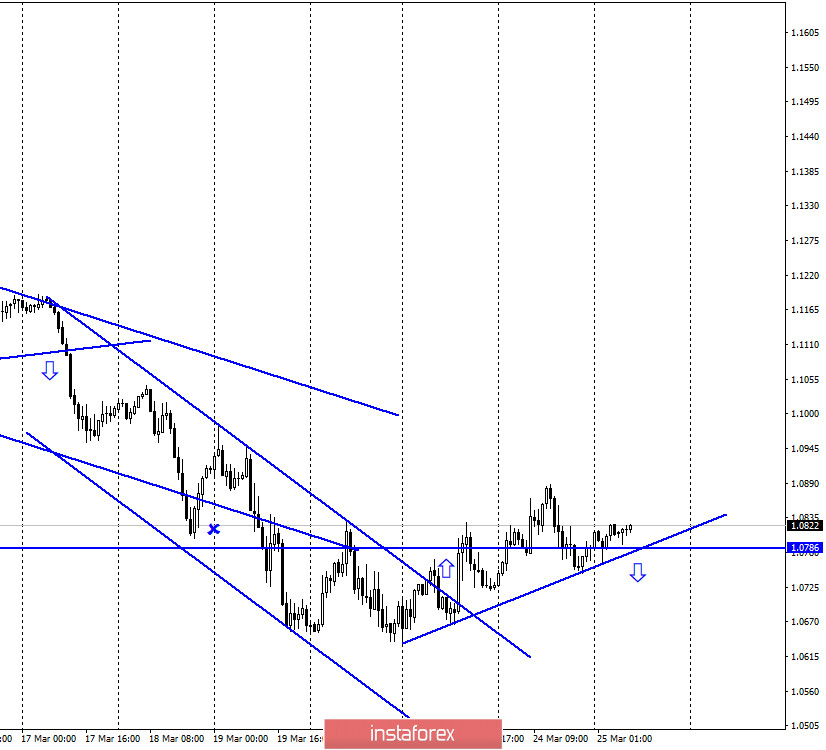

EUR/USD – 1H.

Hello, traders! On March 24, the European currency continued its rather heavy growth. The upward trend line continues to characterize the mood of traders as bullish. However, only on the hourly chart and very uncertain. At any moment, fixing the pair's exchange rate under the trend line will work in favor of the US currency and the resumption of the fall in the euro currency quotes. Thus, I would not hope for the strong growth of the EU currency in the current conditions. The number of people infected with the COVID-2019 virus over the past day exceeded 400,000. Thus, the currency and stock markets remain in a state of shock.

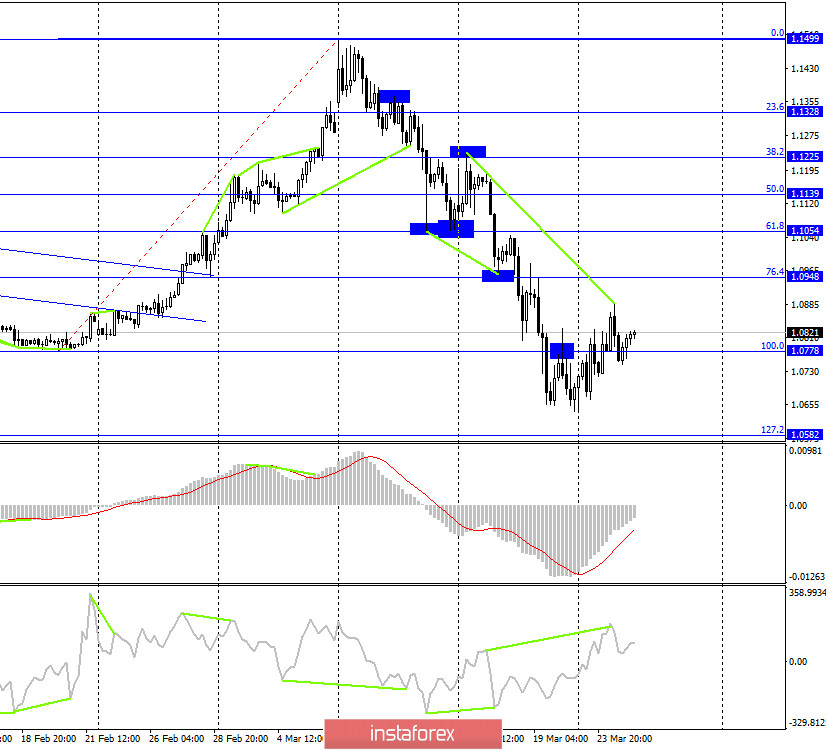

EUR/USD – 4H.

According to the 4-hour chart, the EUR/USD pair performed a reversal in favor of the US dollar and a slight fall in the direction of the corrective level of 100.0% (1.0778) after the formation of a bearish divergence in the CCI indicator. However, near the corrective level of 100.0%, the pair performed a reversal in favor of the euro currency and resumed the growth process in the direction of the Fibo level of 76.4% (1.0948). Thus, the process of falling was short-lived. No new emerging divergences are observed in any indicator today. The rebound from the Fibo level of 100.0% turned out to be unclear and it can not be used as a signal to buy the pair.

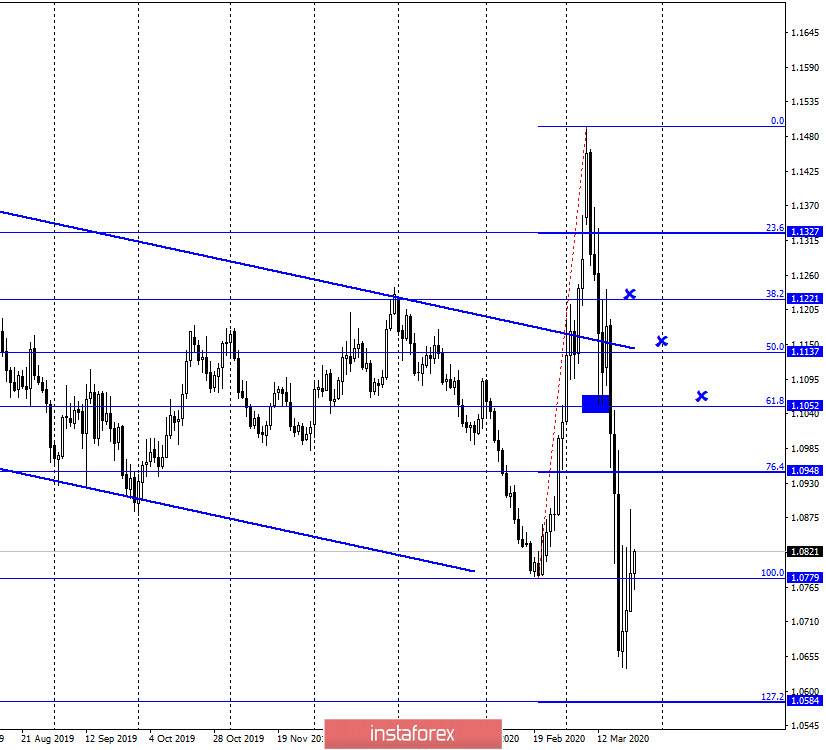

EUR/USD – Daily.

As seen on the daily chart, the picture for the EUR/USD pair is almost identical to the 4-hour chart. There are still no clear and accurate signals to buy. There is only an indirect signal, and even then not the strongest, in the form of a possible consolidation above the corrective level of 100.0%. However, for the last three days, the pair stubbornly performed a rebound from this level. And, perhaps, even there was no rebound, just after each section of growth, the pair is strongly corrected. Anyway, some chances of growth remain, but so far everything looks extremely unstable, and there are no clear signals to buy.

EUR/USD – Weekly.

As seen on the weekly chart, the pair's quotes also continue the process of weak growth. And if it continues throughout the week, then the breakdown of the lower line of the "narrowing triangle" can really be considered false. In this case, the euro currency will have a very good chance of resuming the growth process in the direction of the level of 1.1600 or the upper line of the triangle.

Overview of fundamentals:

On March 24, the European Union and the United States released reports on business activity in the services and manufacturing sectors. All reports on manufacturing sectors were slightly better than traders expected. All reports on the service sector were significantly worse than the traders' expectations. This applies to the United States, the European Union, and Germany. So I can't say that this data supported the euro or the dollar. Rather, as usual, they did not arouse the interest of traders. Moreover, the most interesting topic for traders is the Chinese pneumonia virus and everything related to it.

News calendar for the United States and the European Union:

Germany - IFO business environment indicator (11:00 GMT).

Germany - IFO current situation assessment Indicator (11:00 GMT).

Germany - IFO economic expectations Indicator (11:00 GMT).

US - change in the volume of orders for long-term goods (14:30 GMT).

On March 25, Germany will release rather weak reports on economic expectations and business sentiment, and in the US – an important report on orders for durable goods. However, I believe that these reports will be held by traders in the same way as yesterday.

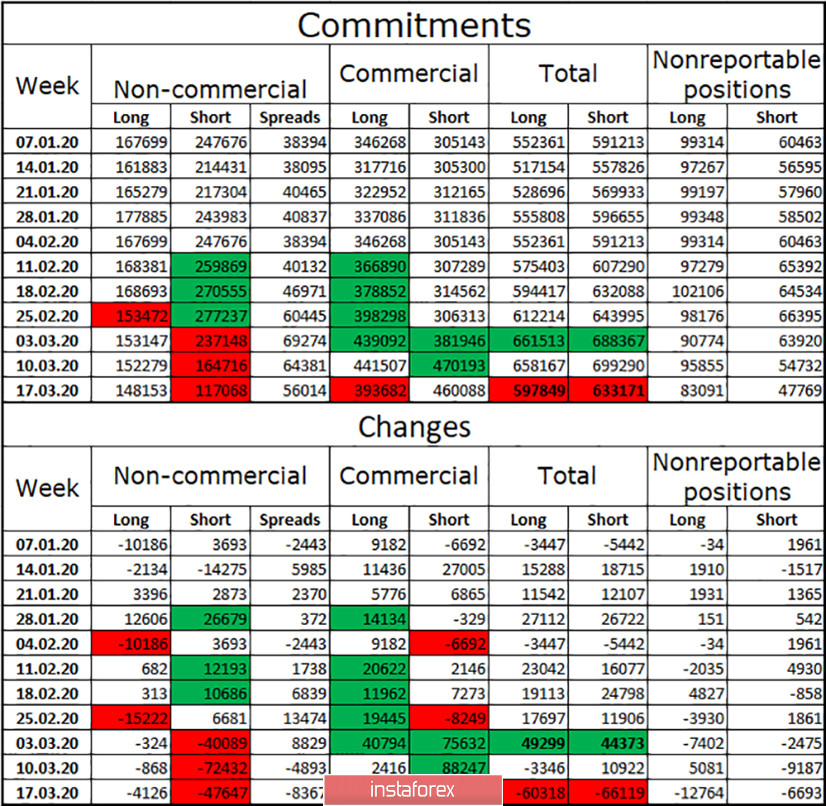

COT report (Commitments of Traders):

Until March 17, 2020, both groups of major market players were reducing the number of contracts. The total number of long contracts decreased by 60,000, and short – by 66,000. "Commercial" group continues to move the market, as it is the hedgers who have the largest number of contracts in their assets. Speculators also got rid of short-contracts, not believing in a further fall in the euro currency. Thus, a group of traders who are professionally engaged in studying rates and forecasting them, do not believe that the euro will continue to fall. The overall advantage of bears is not great. If the next COT report again shows a reduction in the total number of short positions and it is higher than the reduction in long positions, this may mean that the major players are really starting to look towards the euro currency.

Forecast for EUR/USD and recommendations for traders:

The situation for the EUR/USD pair is a bit confusing. The COT report suggests that bear traders remain strong, but a change in the picture is also possible. Thus, I recommend buying a pair with the target of 1.0948 and the stop-loss level under the trend line on the hourly chart, and selling – if it is fixed under the trend line on the hourly chart with the goal of 1.0582.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.