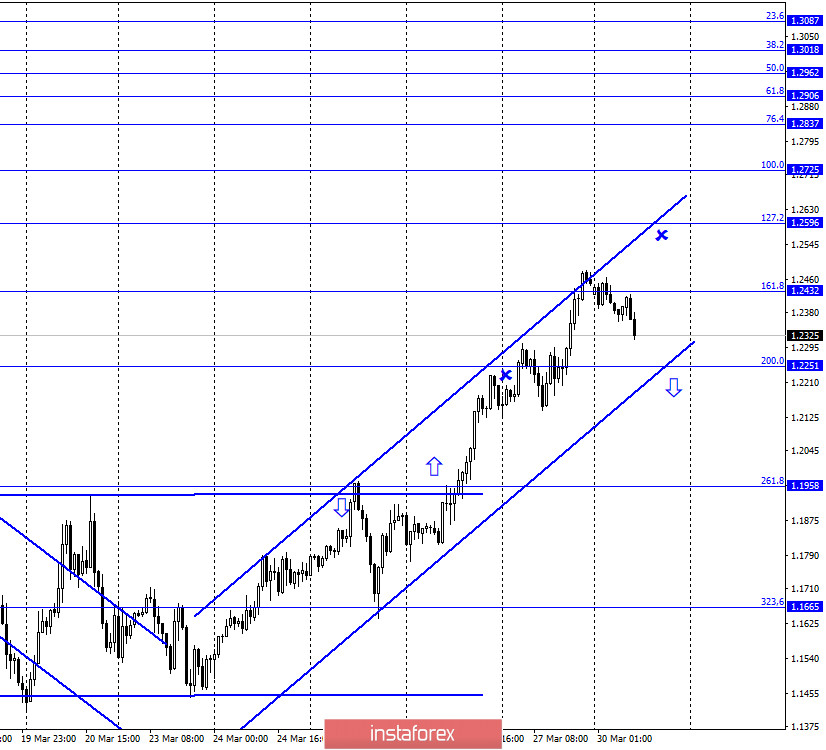

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the GBP/USD pair continues the growth process within the upward trend corridor, which keeps the "bullish" mood of most traders. After reaching the upper line of this corridor and the level of 161.8% (1.2432), the pair performed a reversal in favor of the US currency and began the process of falling in the direction of the lower line of the corridor and the level of 200.0% (1.2251). Thus, the rebound of the pair's exchange rate from the Fibo level of 200.0% will work in favor of the British and the resumption of growth in quotes. At the same time, fixing under the ascending corridor will work in favor of the US currency and change the "bullish" mood of traders to "bearish".

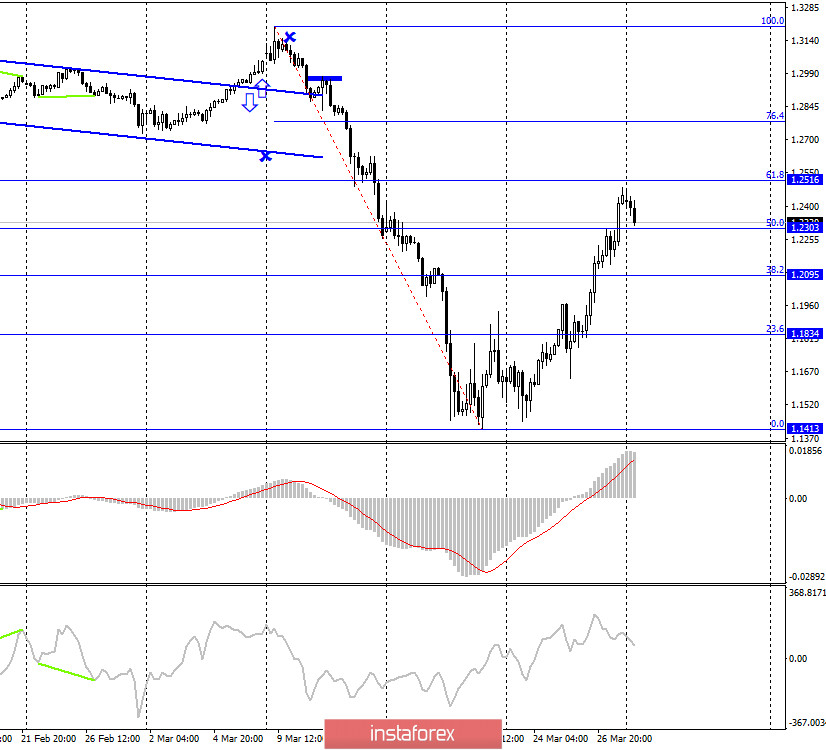

GBP/USD – 4H.

According to the 4-hour chart, the GBP/USD pair made a consolidation above the corrective level of 50.0% (1.2303) and can continue the growth process in the direction of the next corrective level of 61.8% (1.2516). The rebound of quotes on March 30 from the Fibo level of 50.0% will increase the probability of continued growth of the British currency. Today, the divergence is not observed in any indicator. Fixing the pair's exchange rate under the Fibo level of 50.0% will work in favor of the US currency and begin to fall in the direction of the corrective level of 38.2% (1.2095).

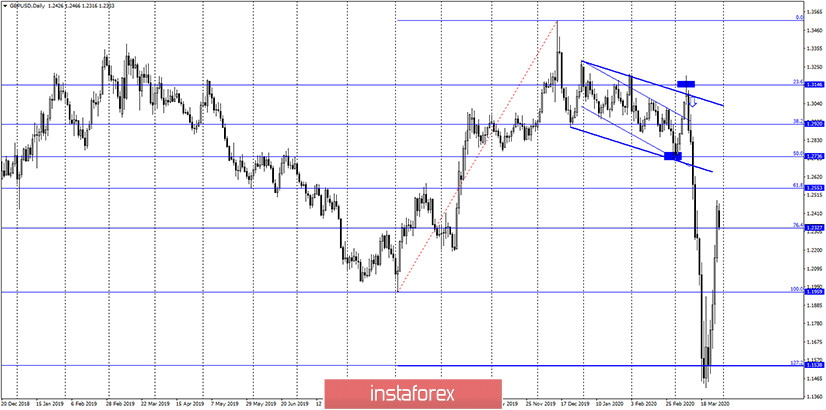

GBP/USD – Daily.

As seen on the daily chart, the picture remains the most beautiful. The GBP/USD pair, after rebounding from the corrective level of 127.2% (1.1538), continues the growth process and secured above the Fibo level of 76.4% (1.2327). Thus, the growth of the British pound can be continued in the direction of the next corrective level of 61.8% (1.2553). Last week, a fairly large amount of economic news was received from America, which could not support the demand for the dollar. Data for March are beginning to arrive gradually, and the first reports show a strong increase in unemployment. This week, employment reports such as Nonfarm Payrolls and the ADP report may show the strongest reduction. If these reports are also extremely weak, then demand for the US dollar is likely to remain low. At the same time, it should be noted that the pair retains the probability of resuming the downward trend. After the fall on March 9, the quotes have already made a correction of 61.8% (almost).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the two upper trend lines.

Overview of fundamentals:

There was no economic news in the UK on Friday. The entire news stream concerned the newly infected with the coronavirus, in particular Boris Johnson. Thus, the country remains in quarantine, just like the US.

The economic calendar for the US and the UK:

As of March 30, the US and UK news calendar does not list any important news and events.

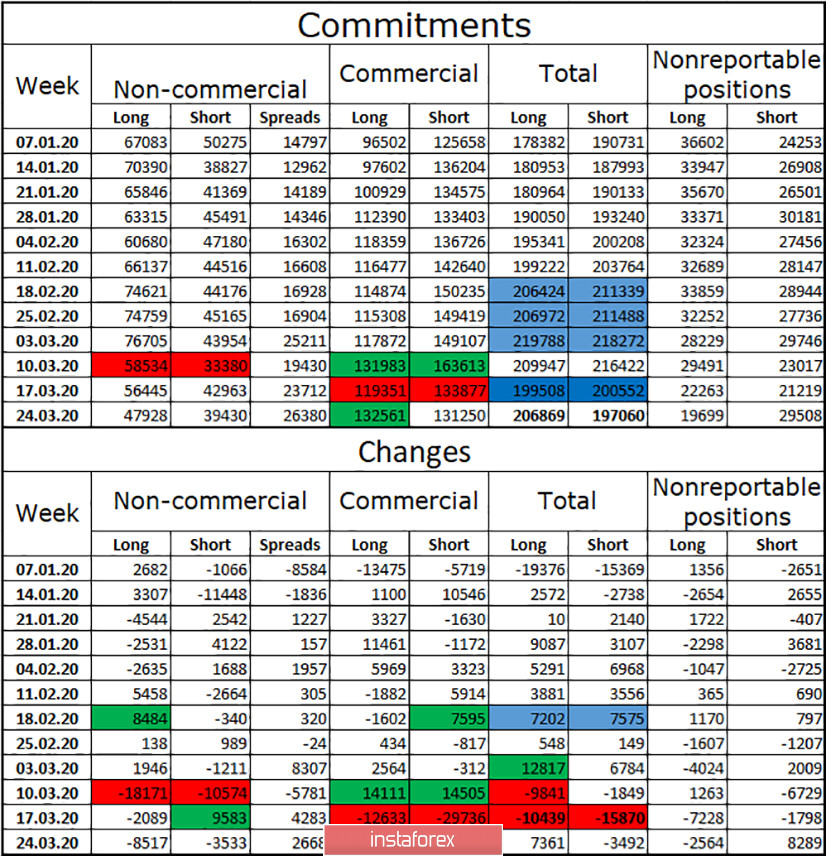

COT report (Commitments of Traders):

A new COT report showed that in the week of March 24, the total number of long contracts increased by 7,500 and the total number of short contracts decreased by 3,500. Traders could make this conclusion without the COT report, as the British dollar has been growing for seven days in a row. The total number of long contracts among major market players now exceeds the number of short contracts, which preserves good prospects for the growth of the British pound in the future. However, the markets are still in a state of shock. It is not known what the world will expect in the near future since the spread of the epidemic has not yet been overcome.

Forecast for GBP/USD and recommendations to traders:

The key graphical construction now is the channel on the hourly chart. Thus, the rebound of quotes from its lower line or the level of 200.0% will allow you to buy the pair again with the goals of 1.2432 and 1.2596. I recommend selling the pound not earlier than the closing of quotes under the trend corridor on the hourly chart with the goals of 1.2095 and 1.1834.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.