Economic calendar (Universal time)

There is no important news in the economic calendar today.

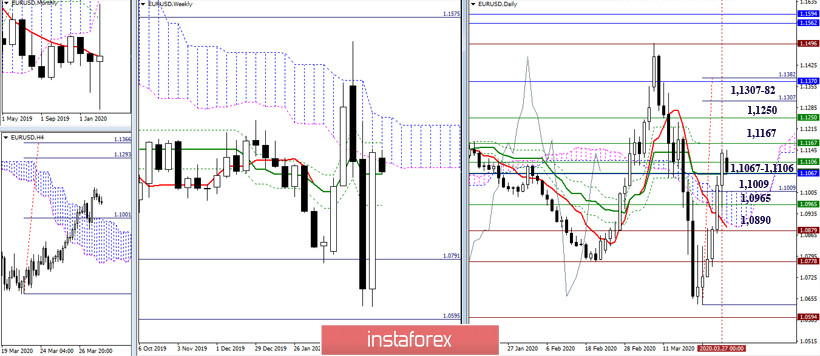

EUR / USD

The players to upgrade were optimistic about closing the previous week. Now, the close of the month is nearing. Maintaining current moods will allow us to consider further bullish prospects and build far-reaching plans, but for now, it can be noted that 1.1167 (weekly Fibo Kijun) - 1.1250 (upper border of the weekly cloud) – level of 1.1307-82 (monthly Fibo Kijun + daily target for the breakdown clouds + goal breakdown of the H4 cloud). The attraction is now 1.1067 – 1.1106 (monthly Tenkan + daily and weekly Kijun). The nearest significant support is concentrated in the area of the daily cloud 1.1009 (Senkou span B) – 1.0965 (weekly Fibo Kijun) - 1.0890 (daily Tenkan + lower border of the daily cloud + historical level).

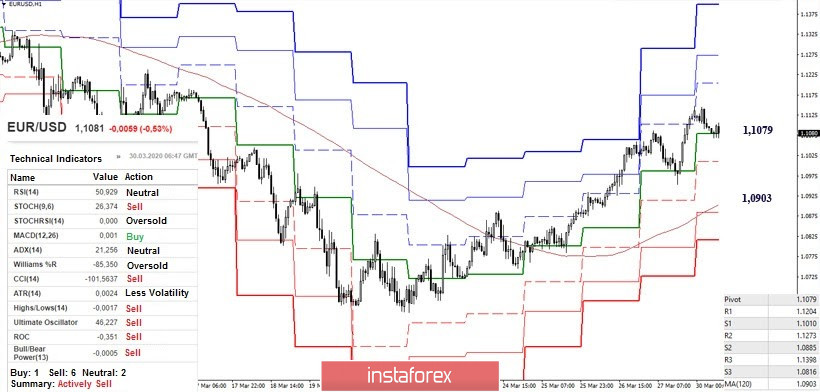

At the moment, the pair in the lower halves is in the zone of a growing downward correction and is testing the first key support level - 1.1079 (central Pivot level). Technical indicators have already shifted to support bearish sentiment, so if fixed under key support (1.1079), we can talk about the initial advantage of bears on H1 and the continuation of the decline. S1 (1.1010) and 1.0903 (weekly long-term trend) will serve as downward targets. If the pair is now able to maintain the central Pivot level (1.1079) as support, then updating the high of the past (1.1147) and consolidating above will be most important. In this case, the resistance of the classic Pivot levels 1.1204 - 1.1273 - 1.1398 will act as bullish signs within the day.

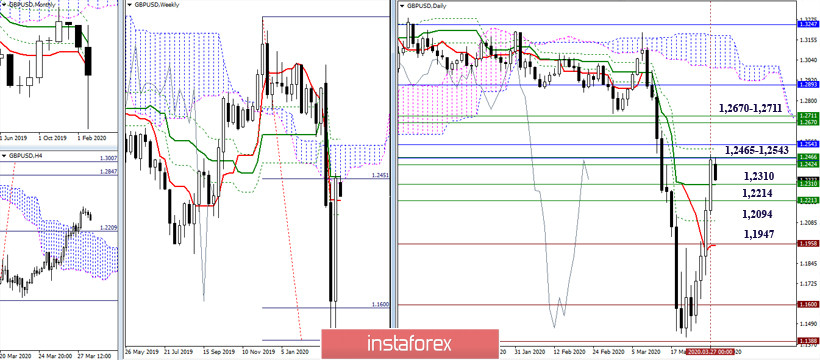

GBP / USD

Last week was marked by promotion players who were able to absorb the opponent's achievements a week earlier. To date, the pair has accumulated various levels of resistance at higher time intervals, so we can expect the bulls to take a break before the liquidation of the daily and weekly dead cross, as well as before the breakdown of the weekly cloud. As a result, the most significant immediate upward reference points can now be noted at 1.2465 - 1.2543 (daily Fibo Kijun + weekly Kijun + monthly Tenkan and Fibo Kijun) and 1.2670 - 1.2711 (upper border of the weekly cloud + final line of the weekly dead cross). Support today is located at 1.2310 (daily Kijun + weekly Tenkan) - 1.2214 (weekly Fibo Kijun) - 1.2094 (daily Fibo Kijun) - 1.1947 (daily Tenkan + historical level).

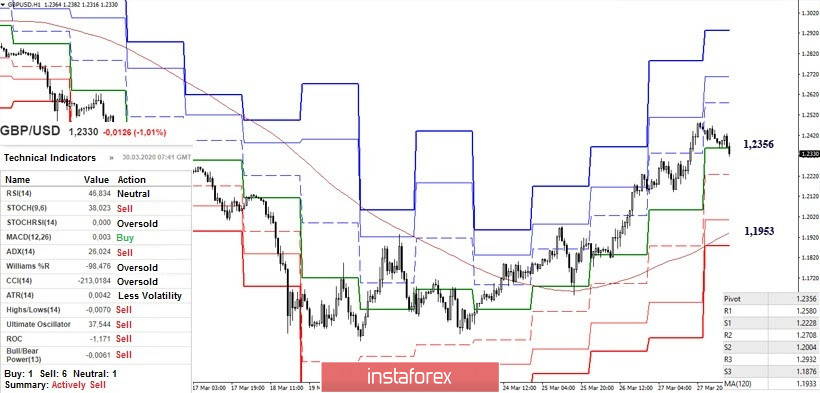

On H1, we observe the development of a downward correction. Consolidating below the support of the central Pivot level of the day (1.2356) will strengthen the position of the players on the decline, who have already managed to secure the support of most of the analyzed technical indicators. Further, the main interest of the players to decline will be the conquest of the weekly long-term trend located at the time of analysis at 1.1953, intermediate support can be noted at 1.2228 (S1) and 1.2004 (S2). In the case of failure of the bears and the formation of a rebound from the met support of the central Pivot level (1.2356), the next extreme guideline for the restoration of positions by the bulls will be the maximum extremity of the last week (1.2484). Further milestones inside the day are located today at 1.2580 (R1) - 1.2708 (R2) - 1.2932 (R3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic ), Moving Average (120)