EUR/USD – 1H.

Hello, traders! According to the hourly chart on Tuesday, the EUR/USD pair performed first a reversal in favor of the European currency, and then a consolidation over the downward trend line. Thus, traders received a signal to buy and can now count on a certain growth of the euro. From the latest news, we can highlight the preparation by the European Council of a program to stimulate the EU economy in the amount of 0.5 trillion euros. This money will be used to help small and medium-sized businesses, reduce the number of layoffs, and support the economy as a whole and, in particular, the health sector. As for the COVID-2019 virus, the latest data suggest a slight slowdown in the spread of infection, especially in European countries such as Germany, Italy and Spain. However, new cases of coronavirus continue to be admitted to hospitals, so it is too early to talk about a full recovery of the states. So far, we are only talking about reducing the rate of growth of the disease.

EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair also performed a reversal in favor of the EU currency and fixed above the corrective level of 23.6% (1.0840). However, on the 4-hour chart, in addition to the buy signal, there is also a sell signal in the form of a bearish divergence in the CCI indicator. Thus, the pair's quotes have already performed a reversal in favor of the US currency and have begun the process of returning to the Fibo level of 23.6%. Fixing the pair's exchange rate under this Fibo level will again increase the probability of a further fall in quotes. However, I would not recommend rushing with new sales of the euro, after all, only yesterday a break of the trend line was made on the hourly chart. So far, I'm more inclined to continue growing.

EUR/USD – Daily.

On the daily chart, the EUR/USD pair performed a reversal in favor of the euro and fixed above the corrective level of 23.6% (1.0840), which now allows traders to count on some growth in quotes. The picture remains identical to the 4-hour chart since the same grid of Fibo levels is in effect.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair continues to trade near the lower line of the "narrowing triangle". Thus, at the moment, I believe that this line was rejected. If this is the case, then traders can expect the quotes to grow in the long term in the direction of approximately the level of 1.1600 (near the upper line of the "triangle").

Overview of fundamentals:

On April 7, the only report of the day is the industrial production in Germany, which did not interest anyone. The euro began to grow, probably on the news of the upcoming package of support for the EU economy. And perhaps only for graphic reasons.

News calendar for the United States and the European Union:

USA - publication of the minutes of the Fed meeting (20:00 GMT).

On April 8, the EU news calendar does not contain anything interesting, and in America, the minutes of the last Fed meeting will be released late in the evening, at which it was decided to reduce the rate to 0.25%. This document is interesting only as a summary of the results of that meeting of the Monetary Committee and is unlikely to contain important information.

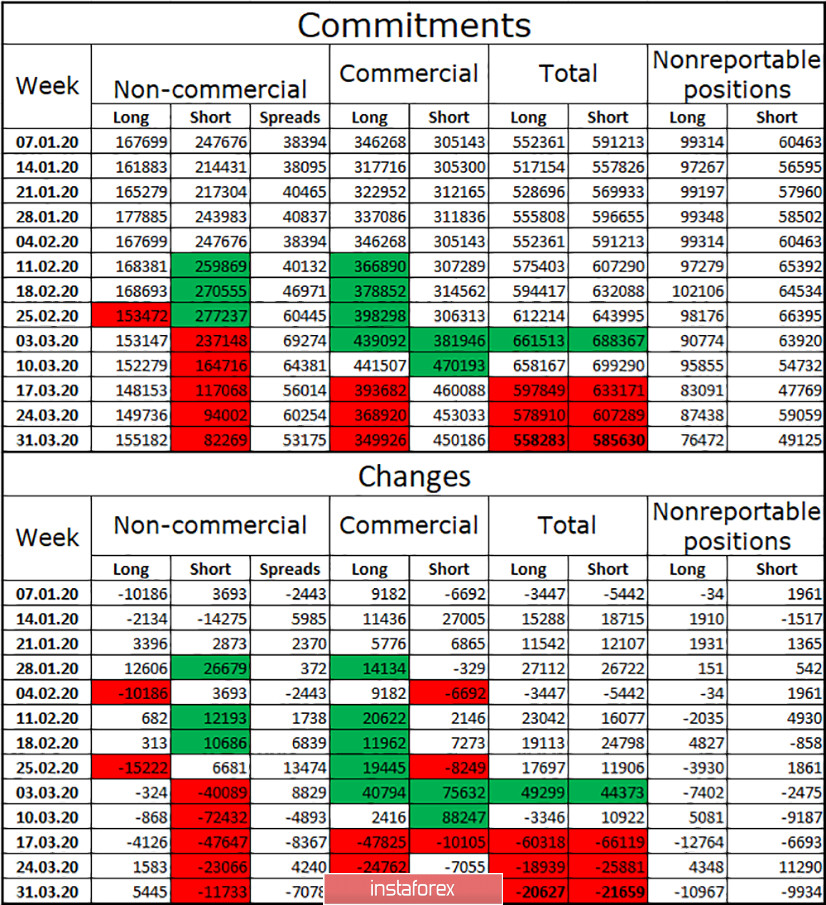

COT (Commitments of Traders) report:

According to the latest COT report, the "bearish" mood among major market players remains. But at the same time, their activity is also falling, as the last three reports of Commitments of Traders showed a reduction in the total number of contracts. Meanwhile, the balance of power between long and short contracts does not change. Thus, we can even assume that the current ratio has already been taken into account in market prices. More contracts are still in the hands of commercial companies that use currency transactions to hedge risks and for operating activities, rather than to generate profits.

Forecast for EUR/USD and recommendations to traders:

Now I recommend being careful with the new sales of the euro, as there are no signals yet. Fixing the pair's exchange rate below the level of 23.6% on the 4-hour chart will allow you to sell with the goal of 1.0638. I recommend buying the pair when the quotes break off from the level of 23.6% with the goal of 1.0964.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.