Technical analysis recommendations for EUR/USD and GBP/USD on April 8

Economic calendar (Universal time)

There are no important indicators in the economic calendar today.

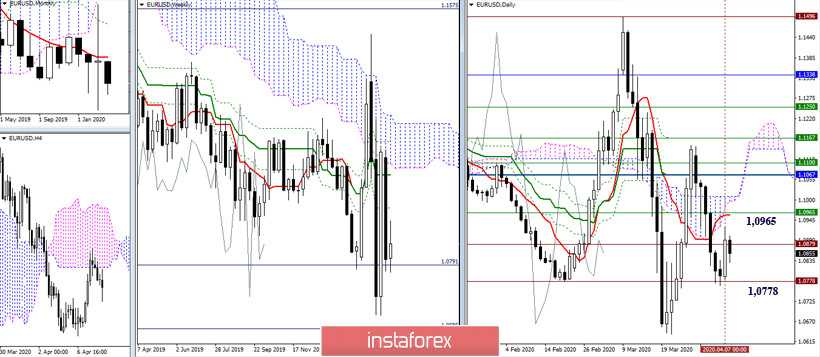

EUR / USD

The slowdown at the historical support of 1.0778 led to some recovery of the players on the rise, but so far, they have not managed to reach important resistance. These significant resistances are now consolidating in the region of 1.0965 (daily Tenkan + weekly Fibo Kijun), while further resistance remains at 1.1009 (daily cloud) - 1.1067-1.1100 (accumulation of important levels of the monthly and weekly halfs). Maintaining your position and working above the level of 1.0778 will help to maintain the situation and further restore the players' positions for promotion.

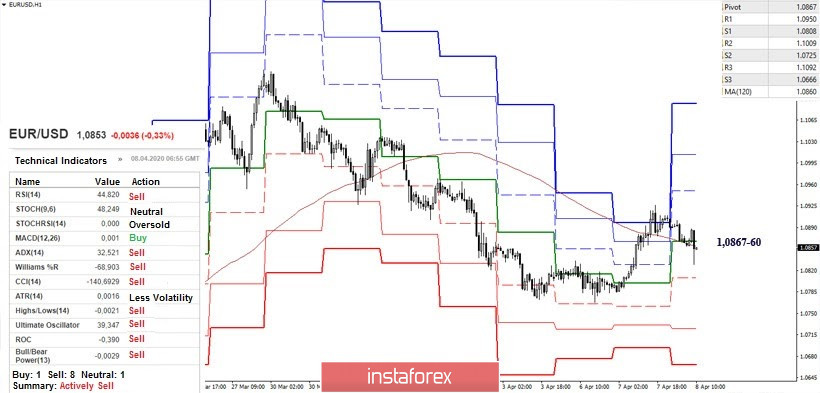

Yesterday, players on the rise managed to rise above the weekly long-term trend. Today, the question is being decided whether this level can work as reliable support. Now, the central Pivot level of the day arrived in time to help the long-term trend. As a result, the key zone determining the distribution of forces on H1 today can be determined in the zone of 1.0867-60. The victory of the bulls will be the development above these supports, the reversal of the moving and the continuation of the rise when updating the maximum (1.0926). The uncertainty will be prolonged if the euro remains in the zone of attraction of these levels, which will eventually take a horizontal position. Moreover, bearish prospects will appear when the minimum is broken (1.0768) and the support of the higher halves is reliably broken down (1.0778).

GBP / USD

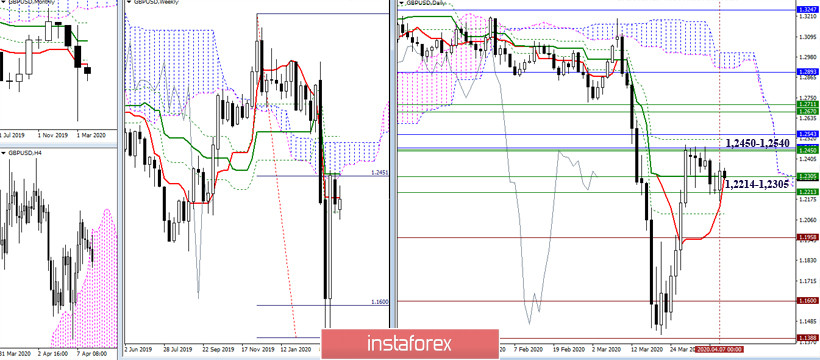

Short-term daily trend has moved into the support zone. The key support for this still maintains its location and relevance at the zone of 1.2305 - 1.2214 (daily Kijun + weekly Tenkan and Fibo Kijun). As a result, the situation in its conclusions and expectations has not changed. Now, the players to upgrade need the development of daily rebound from supports and a new resistance test 1.2450 - 1.2540 (monthly Tenkan + weekly Kijun and Senkou Span A + final line of the daily cross + monthly Fibo Kijun), with the goal of breakdown. For the opponent, everything still rests on the support of 1.2305 - 1.2214.

In the lower halves, the key levels for today joined forces in the zone of 1.2295 - 1.2328 (central Pivot level + weekly long-term trend). Consolidating and developing under the levels will give preference to the players to decline who will seek to push support for the higher halves 1.2305 - 1.2214. Meanwhile, rising higher and the formation of new current highs will help strengthen players to increase, who, in turn, will be engaged in realizing a breakdown of the resistance of high halves by 1.2450 - 1.2540.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)