Hello, traders!

According to leading German economists, the German economy will miss 4.2% this year due to the outbreak of the COVID-19 epidemic. At the same time, the forecasts for next year are much more positive, with economic growth in Germany expected to be 5.8%. The German government is preparing for an even more negative scenario and believes that economic losses will amount to 5.7%, which may become a more significant decline than in 2008-2009.

If we take into account that Germany is the largest European economy, the eurozone is waiting for the worst consequences of the coronavirus epidemic.

However, the United States of America is also expecting a serious economic downturn. The country still leads in the number of infected and dead. In the last 24 hours alone, about 2,000 people have died from COVID-19 in the United States. Since the beginning of the epidemic of a new type of coronavirus, this is the world's anti-record.

So far, 400,545 COVID-19 infections have been registered in the United States. Virologists suggest that about 250,000 people may die from the pandemic.

Against this background, the global economic situation is rapidly deteriorating. Millions of people around the world are losing their jobs, and governments are developing measures to support them. Almost all leading economists agree that the consequences of COVID-19 will be much more serious than those caused by the financial and economic crisis of 2008.

All this is very sad, but it is time to move on to the analysis of the main currency pair of the Forex market, and I will start with the events that are scheduled for today in the economic calendar. There will be no macroeconomic data from the eurozone today. The main event on April 8, of course, will be the minutes of the last meeting of the Federal Reserve's Open Market Committee (FOMC), which will be published at 19:00 London time. It will be very interesting to learn how the FOMC members assess the current financial and economic conditions in the country and how their votes were distributed in terms of further monetary policy implementation.

It is clear that we are unlikely to hear positive notes in the current situation with the spread of COVID-19 and the impact of the pandemic on the economy. The degree of negativity and reaction to the protocols of market participants will be important. We have already seen the actual ignoring of the latest labor reports from the US last Friday. Now let's see what will be the reaction of investors to the published FOMC minutes.

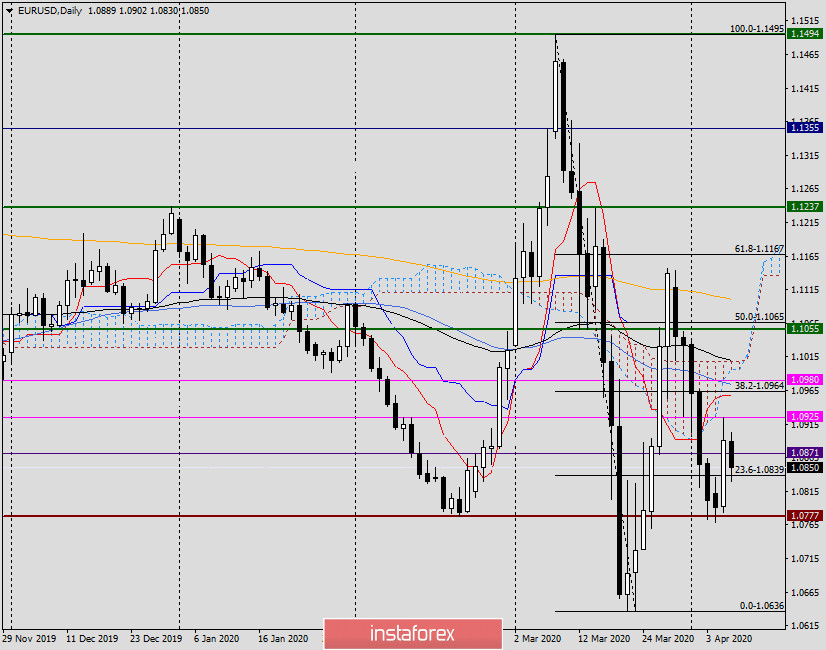

Daily

The euro/dollar currency pair rose following yesterday's trading results. At the same time, the maximum values were shown at 1.0925, after which the pair retreated and ended Tuesday's trading at 1.0890.

Thus, yesterday's trading recommendation to consider opening short positions after the rise of EUR/USD in the price zone of 1.0920-1.0970 turned out to be correct.

At today's trading, the pair declined to 1.0830, where it found support and is trying to recover its current losses, trading near 1.0853. If the euro bulls manage to return the quote to the opening price of 1.0889, it is likely that further growth will follow, the immediate goal of which will be yesterday's highs at 1.0925. If this level is broken, the exchange rate will rise to the area of 1.0958-1.0974, where the Tenkan line of the Ichimoku indicator and the 50 simple moving average are located. The longer-term goal of probable growth will be one of the key psychological levels of 1.1009, near which the 89 exponential moving average and the upper boundary of the Ichimoku cloud are located.

Conclusion and recommendations for EUR/USD:

After yesterday's growth to the level of 1.0925, the corrective rebound may be over, and the pair will return to its main downward dynamics. Another scenario assumes that the exchange rate will continue to adjust to the price zone of 1.0970-1.1010.

In my opinion, the main trading idea for EUR/USD remains sales, which are better to open after the completion of corrective pullbacks, given the candlestick signals. The first price zone for sales is 1.0860-1.0910. We consider further benchmarks for opening short positions after the pair rises to the price area of 1.0965-1.1010.

If we talk about purchases, they are riskier, since they are designed exclusively for correction. However, anyone can try to buy a pair from the price zone of 1.0850-1.0830 with goals in the area of 1.0900-1.0915.

I wish you a successful trading!