Hello, dear traders.

Yesterday, the Reserve Bank of Australia (RBA) decided not to amend the monetary policy and leave the key interest rate at 0.25%.The bank expects the global economy to recover after the end of the COVID-19 pandemic. In the meantime, the Australian regulator intends to take all necessary and possible steps in order to mitigate the negative effects of the coronavirus on the country's economy.

The RBA forecasts a significant economic downturn in the second quarter, as well as a dramatic increase in the number of unemployed. If economic conditions improve, the repurchase of bonds can decrease. The introduction of necessary monetary and fiscal programs would help ease the consequences of the economic slowdown in Australia.

It transpired that S&P Global Ratings has downgraded Australia's credit rating from stable to negative due to the economic and financial downturn in the country caused by the spread of the coronavirus. Australia's GDP is expected to plummet by 1.3% this year, while the budget deficit - to reach 7.5% of gross domestic product.

Let's have a look at the technical picture for the AUD/USD pair and try to find relevant trading ideas at this point.

Hello, dear traders.

Yesterday, the Reserve Bank of Australia (RBA) decided not to amend the monetary policy and leave the key interest rate at 0.25%.The bank expects the global economy to recover after the end of the COVID-19 pandemic. In the meantime, the Australian regulator intends to take all necessary and possible steps in order to mitigate the negative effects of the coronavirus on the country's economy.

The RBA forecasts a significant economic downturn in the second quarter, as well as a dramatic increase in the number of unemployed. If economic conditions improve, the repurchase of bonds can decrease. The introduction of necessary monetary and fiscal programs would help ease the consequences of the economic slowdown in Australia.

It transpired that S&P Global Ratings has downgraded Australia's credit rating from stable to negative due to the economic and financial downturn in the country caused by the spread of the coronavirus. Australia's GDP is expected to plummet by 1.3% this year, while the budget deficit - to reach 7.5% of gross domestic product.

Let's have a look at the technical picture for the AUD/USD pair and try to find relevant trading ideas at this point.

Hello, dear traders.

Yesterday, the Reserve Bank of Australia (RBA) decided not to amend the monetary policy and leave the key interest rate at 0.25%.The bank expects the global economy to recover after the end of the COVID-19 pandemic. In the meantime, the Australian regulator intends to take all necessary and possible steps in order to mitigate the negative effects of the coronavirus on the country's economy.

The RBA forecasts a significant economic downturn in the second quarter, as well as a dramatic increase in the number of unemployed. If economic conditions improve, the repurchase of bonds can decrease. The introduction of necessary monetary and fiscal programs would help ease the consequences of the economic slowdown in Australia.

It transpired that S&P Global Ratings has downgraded Australia's credit rating from stable to negative due to the economic and financial downturn in the country caused by the spread of the coronavirus. Australia's GDP is expected to plummet by 1.3% this year, while the budget deficit - to reach 7.5% of gross domestic product.

Let's have a look at the technical picture for the AUD/USD pair and try to find relevant trading ideas at this point.

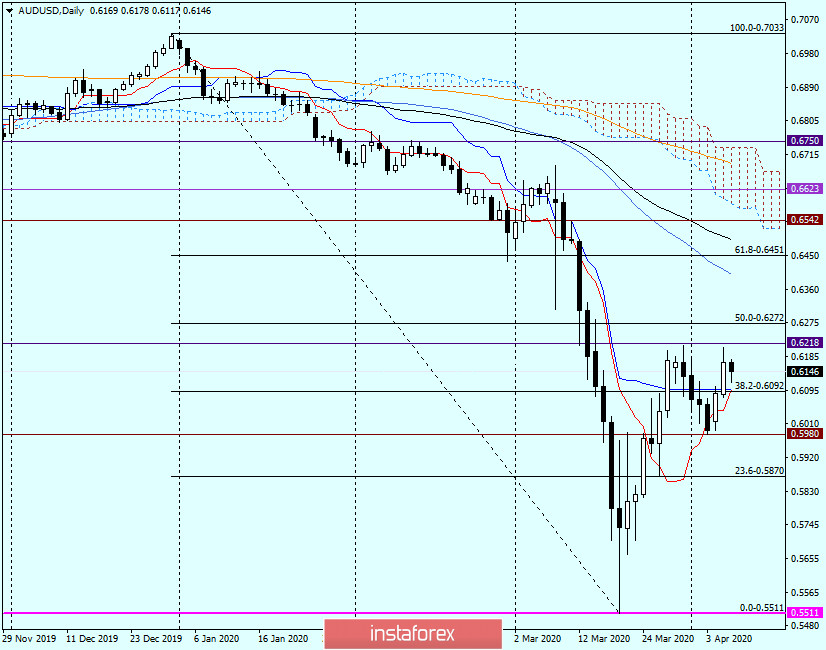

Daily

The pair fell to the level of 0.5511 and started corrective recovery. At the moment, there is no reason to consider the recent rise to be a reversal. Moreover, the pair is trading in a relatively narrow range of 0.5980-0.6218 for the tenth day. That is around Fibonacci retracement level of 38.2 from a decline of 0.7033-0.5511.

If the pair breaks through the resistance level at 0.6218, the aussie can rise to 0.6400-0.6450. This is the level where there are the 50-day moving average and Fibonacci retracement of 61.8. The 89-period simple moving average is at 0.6490. If the pair can increase to this level, it is likely to find resistance.

The pair is likely to fall, if it can break through the support level of 0.5980. In this case, the targets will possibly be at 0.5870 and 0.5700. The bearish trend is likely to extend, if the price drops to the lows of March 19 and breaks through the support level of 0.5511.

Yesterday, the pair strengthened and consolidated above the Tenkan and Kijun lines of the Ichimoku indicator. As a result, the lines can be seen as the immediate support level for the pair. Since the price fell to the level of 0.5980 and started to rise again, there is a possibility that the pullback of the Australian dollar has not yet finished and the pair can try to break through the resistance at 0.6218.

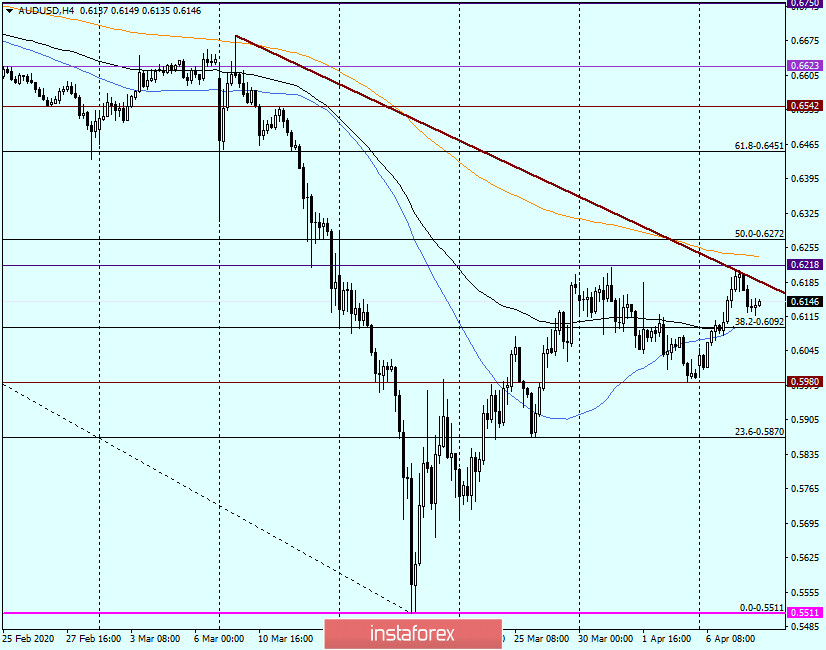

H4

This timeframe shows that the pair is trapped between 89 EMA/50 MA and 200 EMA, which are the support and resistance levels for the AUD/USD pair, respectively. It is necessary to take into account the brown resistance line that is formed at 0.6686-0.6209.

Thus, the price zone of 0.6178-0.6218 is the resistance level which is trying to restrain the pair from growing.

Conclusion and trading ideas for the AUD/USD pair.

As the currency pair is in a downtrend, the recent growth is perceived as a correction to the previous decline. That is why it is better to open sell deals after the retracement is completed. Currently, the main question is whether the correction is completed or it can continue.

There is a possibility that the aussie can try to break above the level of 0.6218. In this case, it is likely to be stuck at 0.6220-0.6270. If reversal patterns of Japanese candlesticks appear on the daily, four-hour and hourly charts at these levels, it is possible to open sell deals with targets near the level of 0.6000. In case of a deeper correction, it is better to open short positions from the strong technical zone at 0.6400-0.6450.

Bear in mind that it is risky to open buy deals at the moment. However, those who wish can try to open buy deals at 0.6145 or after the price falls to the level of 0.6100. The nearest resistance level is 0.6218.