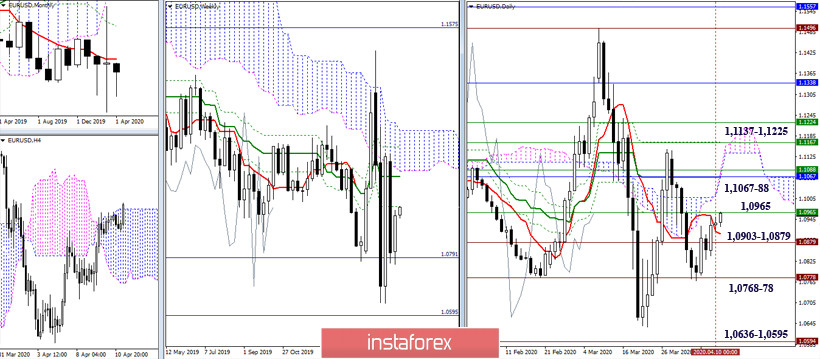

EUR / USD

The pair worked in a narrow range throughout Friday, since none of the parties decided on active actions. However, it can be stated that last week the previous decline was stopped and the players on the increase have plans to further restore their positions. Among the upward targets and tasks in the current situation, we can note the nearest resistance 1.0965 (weekly Fibo Kijun) and 1.1067-88 (daily Kijun + weekly Kijun and Senkou span A + monthly Tenkan). Then, to swing the March uncertainty into side, the players to increase will need to break through a fairly wide and important resistance zone 1.1137 - 1.1225 (daily cloud + final border of the weekly cross and the upper border of the weekly cloud + maximum extreme of the previous decline). As for the downside players, their benchmarks at the opening of the new week retained their location-1.0903-1.0879 (daily Tenkan + historical level) - 1.0768-78 (the minimum extreme of last week + historical level) - 1.0636 - 1.0595 (the minimum extreme of March + the target level of 100% of the weekly goal for breaking the cloud).

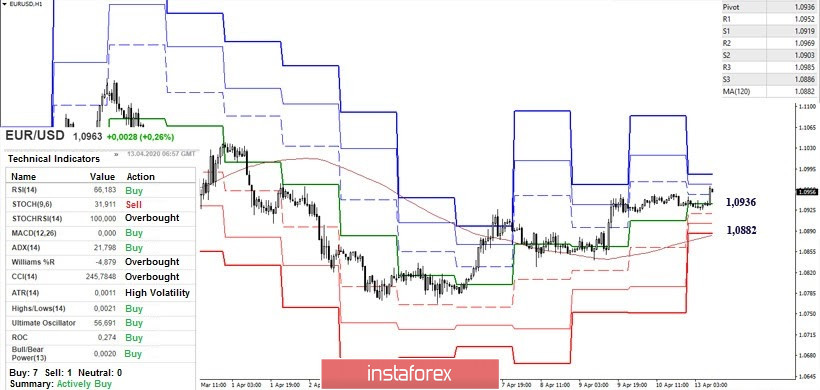

At the moment, the main advantage in the lower halves on the side of the players is to increase, who left the correction zone and restored the upward trend. Resistance within the day may be R2 (1.0969) and R3 (1.0985). The breakdown of these resistances will open the way to the highs of 1.1067-88. Today, key support on H1 is located at 1.0936 (central Pivot level) and 1.0882 (weekly long-term trend). Consolidating below will change the current balance of forces and will serve as the beginning of the formation of rebound from the encountered resistances of the higher time intervals.

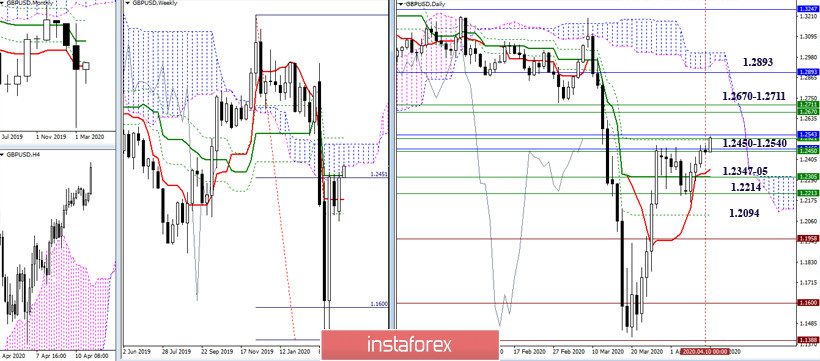

GBP / USD

Nothing significant happened at the close of last week. On Friday, the pair practically remained in place, but with the opening of a new week, the players to increase are trying to realize a failed breakdown of important resistance. The resistance zone, which now combines the efforts of many important levels of different time intervals, still remains within the range of 1.2450 - 1.2540. Now, reliable consolidation above will allow players to increase their thinking in other categories and focus on new horizons. The next significant upward orientations in this case will be the levels of 1.2670-1.2711 that allow to eliminate the weekly dead cross and enter the bull zone relative to the weekly cloud and 1.2893 - the level of the monthly medium-term advantage. The nearest support for protecting the interests of downside players today is located at 1.2347 - 05 (daily Tenkan + weekly Tenkan) - 1.2214 (weekly Fibo Kijun) - 1.2094 (daily Fibo Kijun).

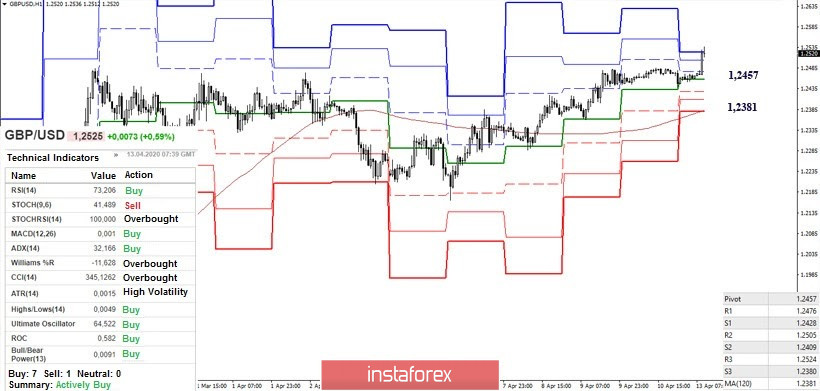

At H1, we are now observing the development of an upward trend. The final resistance of the classic Pivot levels of the current day (1.2524) is strengthened by the resistance of the higher halves (1.2540) at the moment, so in the current situation, much depends on the result of the interaction. Key support on H1 today is located at 1.2457 (central Pivot level) and 1.2381 (weekly long-term trend). A decrease in support, and even more so consolidation under the levels, will serve as the basis for the implementation of rebound from the encountered resistance.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)