Hello, dear traders!

On April 6-10, all major currencies, except the Japanese yen, strengthened against the US dollar. In particular, the main currency pair EUR/USD added 1.27%. We will move on to the technical picture for the euro/dollar a little later, but for now, we will talk about the external background, where the COVID-19 epidemic and its negative consequences on the world economy remain the number 1 topic.

Let me remind you that the European Central Bank (ECB) and the Federal Reserve System (FRS) have taken the path of supporting the economy of their regions by injecting cash to ensure liquidity. Both of the world's leading central banks turned on their printing presses at almost full capacity and decided to issue ultra-cheap loans. However, it is worth noting that any loans will need to be paid sooner or later, and there is complete uncertainty about the timing because no one knows when the rampant coronavirus will end. The pandemic will go down and there will be light at the end of the tunnel.

As for European countries, there are countries with more developed economies that can support their economy. These countries include Germany, the Netherlands, and perhaps Austria and Finland.

Another category of European countries that bear a large debt burden includes Italy, Spain, Greece, Portugal and some other countries where the situation has recently started to change for the better, but the COVID-19 outbreak completely offset these improvements. Ironically, it is Italy and Spain that are at the center of the pandemic, and they urgently need the help of their friends and neighbors.

As you know: "A friend is in need" and attempts by Brussels to introduce so-called "coronabonds" do not find full support from richer countries, which are not in a hurry to help the most needy and affected by COVID-19 states.

As for the United States of America, the world's wealthiest power has been engulfed by the worst outbreak of the pandemic. The number of people infected with coronavirus in the United States has already exceeded 560,000, while more than 22,000 have died from COVID-19. What to say - this is a real tragedy, but the peak of the epidemic, according to experts, has not yet passed.

Since today's economic calendar is empty due to the Easter holidays, we will immediately proceed to consider the charts for the main currency pair.

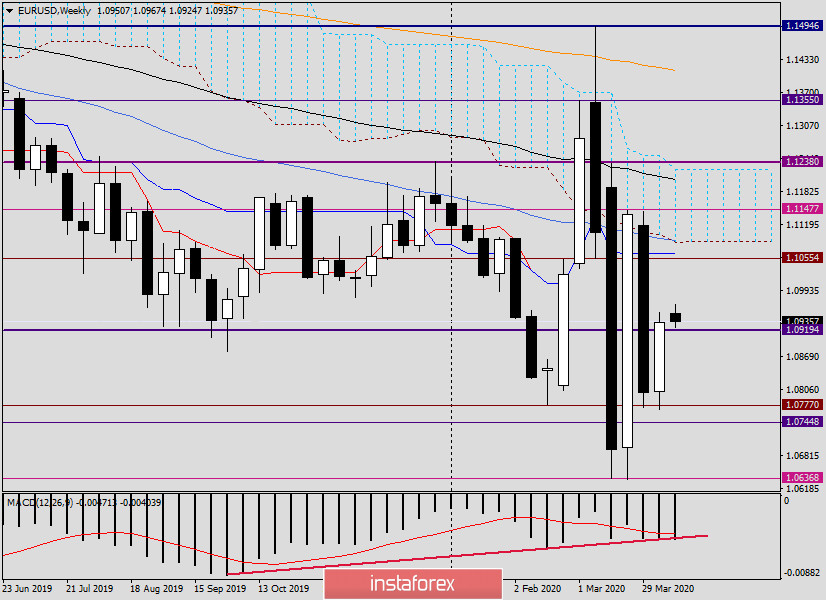

Weekly

As noted at the beginning of the article, the pair strengthened at the auction of the past five days and ended the week's session at 1.0933. Quite a good result for players to upgrade the course. Now the main question is: can they continue to raise the price? Let's figure it out.

In my opinion, the price area of 1.1000-1.1065 is a serious obstacle for the euro bulls. In addition to the psychological mark of 1.1000, a fairly strong technical level of 1.1055 passes in the selected zone, and the Kijun line of the Ichimoku indicator is located at 1.1065. But this is not all the obstacles. Under another significant and important level of 1.1100 are the lower border of the weekly Ichimoku cloud and the 50 simple moving average.

Judging by the weekly timeframe, sales from the selected prices look technically well-founded.

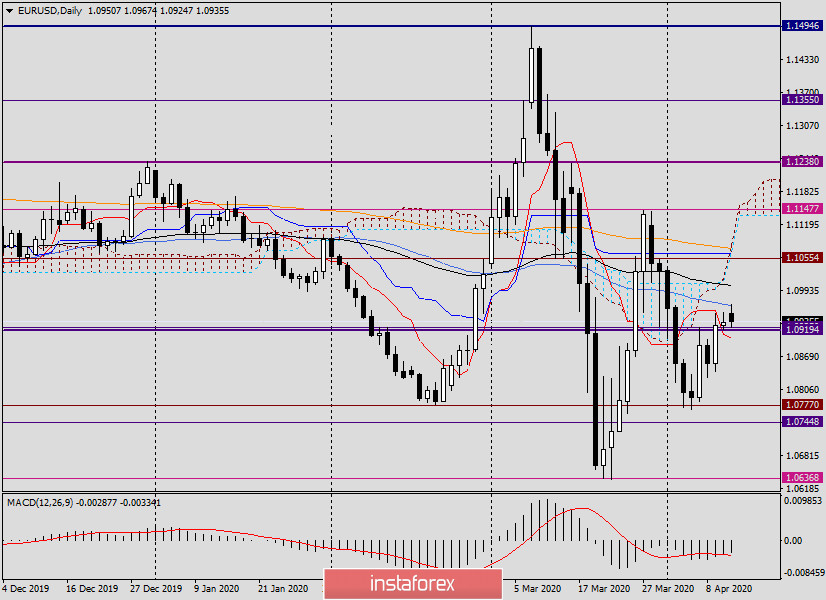

Daily

After a nondescript and very similar to the reversal candle for April 10, the pair started today's trading quite positively, updated Friday's highs, but rested at 50 MA, at 1.0967 and slightly rolled back. However, I do not think that attempts to break through 50 MA have been completed, they will probably still be made. If successful, the euro/dollar will head to the 89th exponential, which passes at 1.1005. The bearish scenario for the euro/dollar pair will be indicated by the breakdown of the mark of 1.0920 and the Tenkan line, with the closing lower.

Today, in a thin market, it is quite difficult to assume the behavior of the price. In my personal opinion, there are options for both purchases and sales. You can look closely at the opening of long positions after a short-term decline in the price zone of 1.0920-1.0900. Sales are risky and aggressive, you can try with current prices of 1.0942. It is less risky to open short positions after an increase in the psychological level of 1.1000.

Tomorrow, when all the participants return to the market, we will try to define the entry points more precisely. And for today, I will refrain from other recommendations.

Be healthy!