To open long positions on GBPUSD, you need:

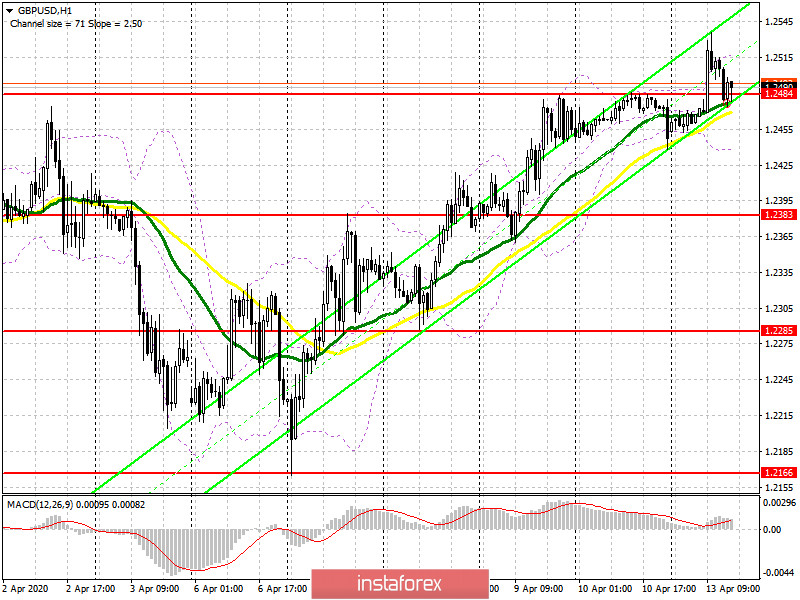

The attempt of the bulls to break above the resistance of 1.2484, which was made today in the first half of the day, was apparently based on only one enthusiasm of speculative traders, which is gradually declining, like the British pound. Returning to the level of 1.2484 and closing the day below this range will again return the market to the sellers' side. Therefore, in the second half of the day, the bulls, as usual, need to make a second attempt to strengthen the GBP/USD to the resistance area of 1.2605, from which it will be possible to reach the highs of 1.2686 and 1.2744 without any problems, where I recommend fixing the profits. If the demand for the pound remains low in the second half of the day, it is best to return to long positions on a false breakout from the support of 1.2383 or buy GBP/USD immediately on the rebound from the minimum of 1.2285.

To open short positions on GBPUSD, you need:

Sellers of the pound are trying to regain the level of 1.2484, fixing below which will only increase the pressure on GBP/USD and push new players away from purchases. This scenario may lead to a repeated decline of the pair to the middle of the side channel of 1.2383, and then to an update of the lower border in the area of 1.2285, where I recommend fixing the profits. If there is no activity from the bears in the second half of the day, it is best to postpone short positions until the update of the larger resistance of 1.2605 or sell immediately on the rebound from the maximum of 1.2686. Given the fact that there will be no important fundamental statistics today, volatility and trading volume may decrease significantly again, and speculation will continue around the resistance of 1.2484.

Signals of indicators:

Moving averages

Trading is conducted in the area of 30 and 50 daily averages, which indicates the preservation of the side channel.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break in the lower border of the indicator around 1.2440 will increase the pressure on the pound, while a break in the upper border of the indicator around 1.2520 may lead to a larger increase.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 2