Last week, the Fed announced a program to buy back investment grade securities in the amount of up to $ 2.3 trillion. It immediately led to two serious consequences in the financial markets. Firstly, the dollar declined to most G10 currencies, especially to commodity currencies, which was facilitated by the conclusion of the oil deal. Secondly, stock indices showed impressive growth, completely ignoring data on a sharp increase in unemployment and the expected fall in GDP.

The Fed's balance sheet has grown by almost $ 2 trillion US dollars over the past four weeks, while similar ECB programs are still significantly behind in terms of volume of infusions. In previous times, the difference in volumes was decisive for the EUR/USD spot; if this dependence continues at the current moment, one should expect not only strong growth in EUR/USD, but also a total weakening of the dollar across the entire spectrum of the market.

In favor of this scenario, there is also the political fragmentation of the eurozone, due to which the ECB cannot begin the development of the corona bond, which means that the gap will remain.

Australia and New Zealand came out of Easter holidays this morning. There are no significant macroeconomic publications or comments from financial authorities were made public, so the movement of NZD and AUD was determined largely by global factors, two of which continue to dominate - the oil deal and the fight against coronavirus.

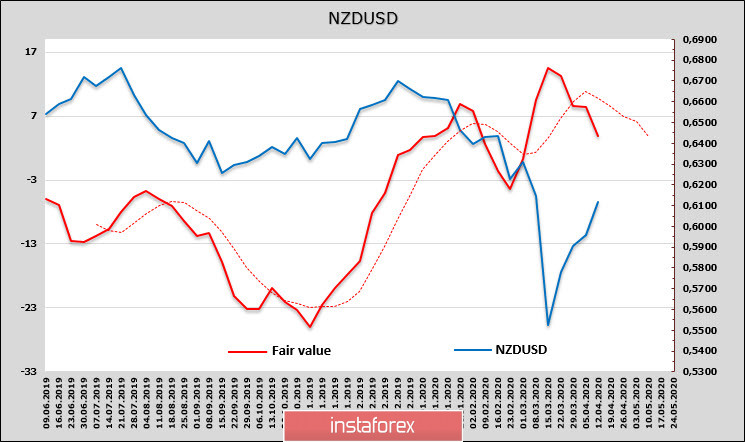

NZD/USD

Obviously, public debt will increase sharply in the next few years, while New Zealand's fiscal policy has not experienced sharp changes, as the budget revenues continued to replenish, but it is clear that the budget deficit from March will begin to increase sharply. ANZ Bank expects that the issue of government bonds will grow to $ 45 billion in the next fiscal year, and QE RBNZ will reach 60 billion. At the same time, New Zealand's total GDP is about 215 billion, that is, the volume of financial measures will reach 50% of GDP.

All these measures will only mitigate the financial blow. It is assumed that GDP will decrease by 22% in the first half of the year, and unemployment will rise to 11%.

The short position of NZD has slightly decreased over the past week to -876 billion, but overall, the long-term trend remains negative. The estimated level of fair price as of the morning of April 14 is slightly higher than 0.64, there are still chances for continued correctional growth, but the overall dynamics are obviously negative, and the growth may end at any moment.

On Thursday, the first figures for March will finally appear, a monthly inflation report from ANZ will be published. On the other hand, the Consumer Price Index for the 1st quarter will be released on April 20. Perhaps some more visible guidelines will appear, to which the RBNZ and the Government of New Zealand will respond, according to the depth of the reaction, the reaction of the Kiwi can also be expected.

The short-term impulse has not yet been exhausted. Therefore, with a decrease to the level of 0.6070, growth is likely to resume with the target of 0.6450, however, we must proceed from the fact that the growth is corrective in the long-term and the peak can take form in the middle of the channel at around 0.6280.

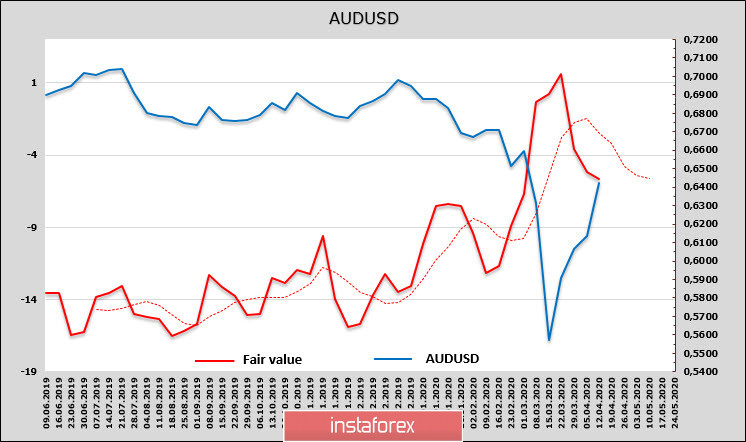

AUD/USD

The Australian Business Confidence Index collapsed in March to -66p, which is more than half the previous low of -32p in February 2009. Such a deep drop indicates a complete lack of guidance in Australia's business environment.

According to the CFTC report, the aggregate short position increased to -2.184 billion, the estimated price is almost equal to the spot.

The dynamics of the estimated price is negative, hence, the conclusion is that the current growth is not supported by fundamental data. The oil deal stimulates the growth of commodity currencies, an unprecedented pumping of liquidity weakens the dollar, so growth can still continue up to 0.6660 / 90. However, a downward reversal can begin at any time. Consequently, the short-term strategy - buying at a pullback of 0.6360, stop 0.6320, target 0.6660 / 90, and if the price moves below the level of 0.6310, we will strengthen sales with the target of 0.60.