Wishful thinking is a distinctive feature of US President Donald Trump. However, investors are very good at counting. Moreover, they cannot find Trump's announcement on Twitter about the reduction of oil production by 20 million barrels per day. Meanwhile, OPEC+ agreed to cut output only by 10 million barrels per day while the US, Canada, Brazil and other countries will contribute another 5 million barrels as their production declines. Where to get the remaining 5 million barrels? It seems like a part of the output will go to replenish strategic reserves of the countries since only few are willing to buy crude under current circumstances, even despite very low prices.

Saudi Arabia, Russia and other OPEC+ member countries agreed to cut output by 9.7 million barrels per day in May-June, which is equivalent to 10% of global demand. In July-December, the scope of obligations will decrease to 7.7 million barrels per day and to 5.8 million barrels in 2021. Meanwhile, the US, Canada, and Brazil are committed to reduce production by 3.7 million barrels per day and the rest of G20 countries - to 1.2 million barrels.

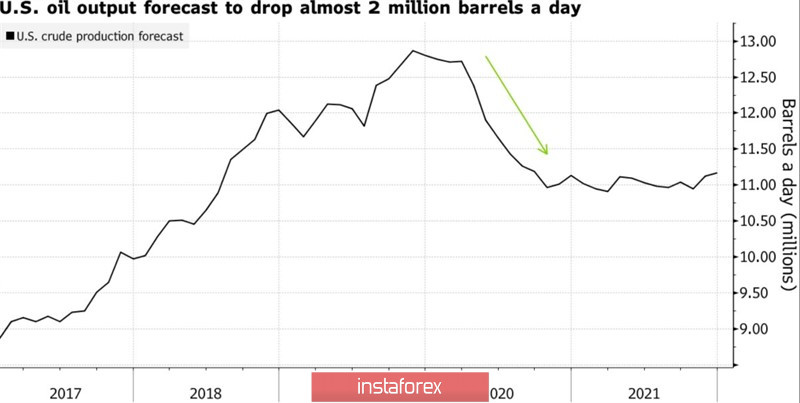

Oil extraction in the US

Oil prices grew amid rumors about the historic OPEC+ agreement. However, they fell later as uncertainty remained. Thus, oil buyers keep on taking profit. Firstly, global oil demand contracted by 23-30 million barrels per day. Secondly, there are rumors in the market that OPEC+ is likely to fail to reduce production by 9.7 million barrels per day. In the best case scenario, output cut is expected to reach only 7-8 million barrels per day. Thirdly, those who rely on the fast recovery of the Chinese economy and associate the growth of global oil demand with this even may actually be wrong.

The Chinese government expects a V-shaped GDP growth in the third quarter. The country has almost defeated the coronavirus epidemic and is getting back to normal. Anyway, China lacks oil. According to Wood Mackenzie, China's national and commercial inventories are likely to grow to 1.15 billion barrels in 2020. China increased aggregate measures from 200 million barrels in 2014 to 900 million barrels in 2020. Apart from that, the country expanded imports of oil by 12% y/y in March, which is the best indicator that China's risk appetite is rising.

It is better not to underestimate China. Cheap oil is only contributing to the V-shaped recovery of the largest economy in Asia. Meanwhile, Donald Trump is not pleased about Brent and WTI's unwillingness to grow. Moreover, US president will not miss the opportunity to remind investors about output cuts in the US and around the world.

According to the daily chart, Brent crude reached the target by 200% on AB=CD pattern and kept rolling back in the direction of the correctional level of 23.6% and Fibonacci retracement of 38.2% from the last descending wave. It is better to hold and increase long positions which were formed at the breakthrough of $28 per barrel level at the end of March if the price breaks through the resistance at $34 and $35.

Brent, daily chart