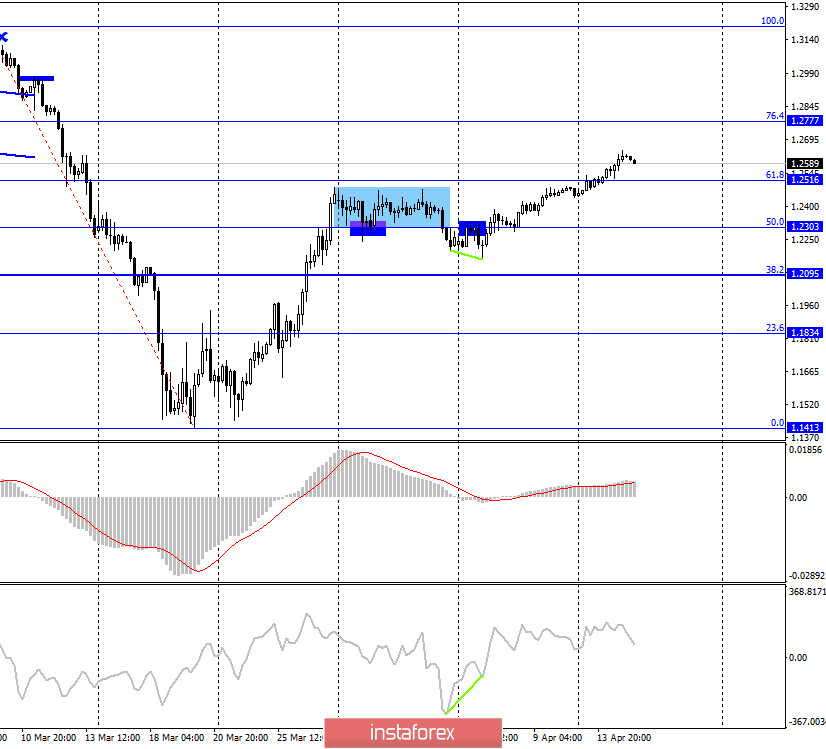

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair continues to move in a very narrow upward corridor. I still believe that the growth of the pair's quotes is slowing down, so today I expect a consolidation under the corridor, which will allow us to count on a reversal in favor of the US dollar and the beginning of a fall. Several attempts were made to close below the corridor yesterday, all without success. Today, the pair may also rebound from the lower line of the corridor, which will again work in favor of the British dollar and resume growth. From the news on the British pound yesterday, there is nothing special to highlight. There were no economic reports. Moreover, there are no plans for the entire current week in the UK. According to forecasts, Britain may become the most affected country in the European Union by the COVID-2019 epidemic. So far, the country has not yet passed the peak of the pandemic, unlike Spain or Italy, and the percentage of deaths from the total number of diseases in Britain is one of the highest in the world.

GBP/USD – 4H.

As seen on the 4-hour chart, the pound/dollar pair continues the growth and made a consolidation above the corrective level of 61.8% (1.2516). Thus, on April 15, the growth of quotes can be continued in the direction of the next Fibo level of 76.4% (1.2777). No indicator has any pending divergences today, and fixing the pair's rate on the hourly chart under the ascending corridor will be a signal to sell, which can be confirmed on the 4-hour chart by fixing it under the corrective level of 61.8% (1.2516). In this case, traders will be able to count on the fall of the British dollar in the direction of the corrective level of 50.0% (1.2303).

GBP/USD – Daily.

On the daily chart, the pair's quotes secured above the corrective level of 50.0% (1.2463). As a result, the growth can be continued towards the next Fibo level of 61.8% (1.2711). At the same time, I recommend now paying more attention to the hourly chart, which may change the mood in the near future.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the two upper trend lines.

Overview of fundamentals:

There were no major reports released in the UK and the US on Tuesday. Thus, the information background had no effect on the course of trading of the pound/dollar pair.

The economic calendar for the US and the UK:

USA - change of the volume of retail trade (14:30 GMT).

USA - change in the volume of industrial production (15:15 GMT).

No news from the UK is expected again on April 15. The information background will be reduced to not the most important reports from America, which, however, may be followed by the reaction of traders. Given the fact that the British dollar is balancing on the verge of a new fall, reports from the US should be stronger than forecasts or traders should ignore them.

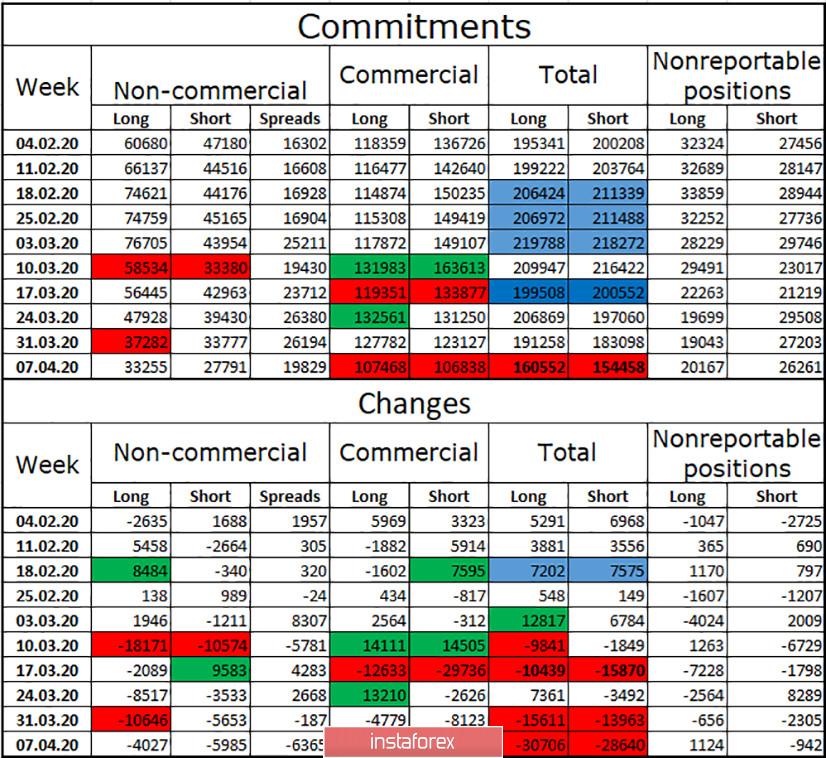

COT (Commitments of Traders) report:

On Friday, another COT report was released, which showed a new reduction in the total number of contracts for major market players. Both groups of speculators and hedgers got rid of both long and short contracts. Thus, the attractiveness of the pound/dollar pair for large investors is getting lower and lower. Hedging companies were most likely to get rid of contracts against the pound, but speculators were also engaged in closing positions. In general, this means that the pound continues to lose its attractiveness in the eyes of major market players. Moreover, this process has been going on for at least two weeks. The overall advantage remains on the long side, but it is absolutely minimal: 160,000-154,000.

Forecast for GBP/USD and recommendations to traders:

I believe that today we should consider selling the British dollar with the target of 1.2516 when fixing quotes on the hourly chart below the ascending corridor. If the pair closes at 1.2516, then sell with the target of 1.2303. I recommend buying the British currency with the target of 1.2777 if the pair performs a new rebound from the lower border of the corridor.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.