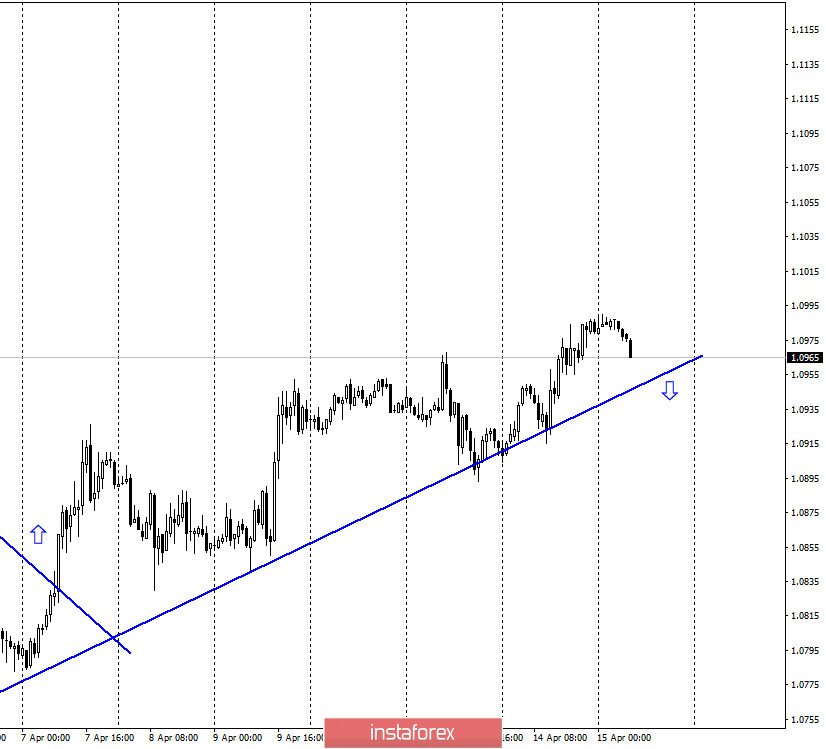

EUR/USD – 1H.

Hello, traders! On April 14, the euro/dollar pair continued to trade above the upward trend line. There were three more attempts to gain a foothold under the trend line, and all three ended in failure. Thus, the "bullish" mood of traders remains. Nevertheless, the pair's quotes have already performed a reversal in favor of the US currency and started a new process of falling in the direction of the trend line. A new rebound of quotes from this line will again work in favor of the euro and the resumption of the growth. Closing the pair's rate below it will allow traders to expect a slight fall and change the overall mood to "bearish". There were no economic reports for yesterday. I can note, perhaps, only the speech of the ECB Vice-President Luis de Guindos, who made very unpleasant forecasts about the European economy, saying that the recovery will begin no earlier than 2021, and it will take at least 1.5 trillion euros to maintain it. Let me remind you that the last aid package for the European economy was 540 billion euros. It turns out that another three times the amount will be needed.

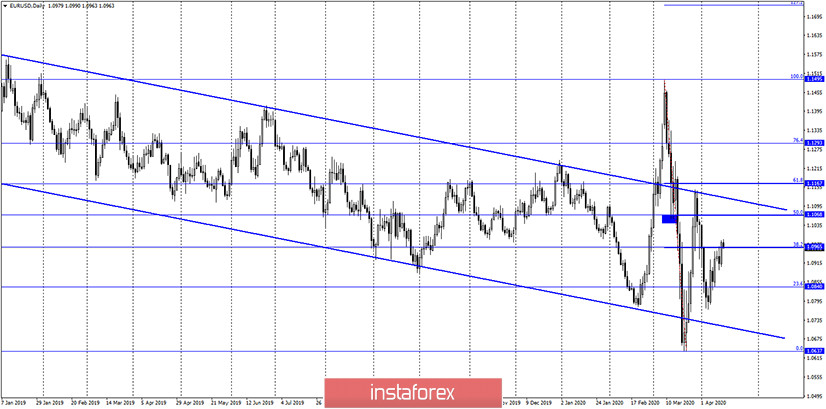

EUR/USD – 4H.

As seen on the 4-hour chart, after the formation of a bullish divergence, the pair's quotes performed a reversal in favor of the European currency and fixed above the corrective level of 38.2% (1.0964). Thus, today the growth can be continued in the direction of the next corrective level of 50.0% (1.1065). No new emerging divergences are observed in any indicator today. Fixing quotes under the Fibo level of 38.2% will work in favor of the US dollar and some fall in the direction of the corrective level of 23.6% (1.0840), and will also coincide with the closing under the trend line on the hourly chart. This way, traders can get a double sell signal at once.

EUR/USD – Daily.

On the daily chart, the euro/dollar pair performed an increase to the corrective level of 38.2% (1.0965) and anchored above it. The picture remains identical to the 4-hour chart since the same grid of Fibo levels is in effect.

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows traders to count on some growth of quotes in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair's exchange rate under the "triangle" will work in favor of the US currency and, possibly, a new long fall.

Overview of fundamentals:

On April 14, the European Union and America did not publish any economic reports or news. Thus, the influence of the information background on the pair's movement was absent.

News calendar for the United States and the European Union:

USA - change in retail trade volume (14:30 GMT).

USA - change in the volume of industrial production (15:15 GMT).

On April 15, the EU news calendar is again empty, and the US contains reports of average significance. Both involve a strong reduction in comparison with February. The question is whether the reaction of traders to almost guaranteed weak reports on American statistics will follow. I would suggest yes. Thus, today the dollar has a chance of continuing to fall. However, the graphic picture speaks more about the opposite.

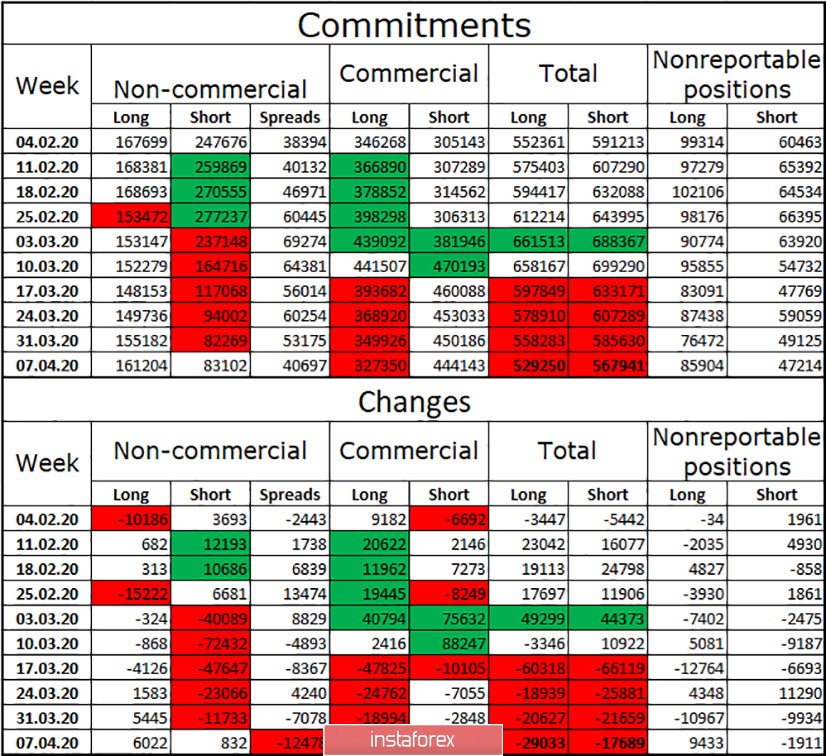

COT (Commitments of Traders) report:

On Friday afternoon, a new COT report was released, according to which the total number of short and long contracts among the major market players again decreased: -29,000 Short and -18,000 Long. Thus, among the major market players, of which there are 255, according to the COT report, there is a desire to close contracts, rather than enter into new ones. At the same time, the overall reduction in the number of contracts was due to hedgers, as speculators (the "Non-commercial" group), on the contrary, increased their positions. Thus, in the week before April 7, the number of long contracts decreased by a greater value than short. The total number of contracts remains overweight for short: 568,000-529,000. The last four weeks have shown that the number of both categories of contracts is decreasing. This means that activity among major players is falling, and the advantage remains with the bears.

Forecast for EUR/USD and recommendations for traders:

At this time, I recommend preparing for the sale of the euro currency, as sales signals are brewing on the hourly and 4-hour chart. Closing quotes under the trend line on the hourly chart and under the Fibo level of 38.2% on the 4-hour chart will allow you to open sales with the goal of 1.0840. I recommend buying the pair when it breaks away from the trend line on the hourly chart with the goal of 1.1065.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.