The downbeat statistical data on the US industrial production and retail sales should have deteriorated the buyers' sentiment on the S&P 500 and EUR/USD. In fact, everything turned the other way round, and the fall in stocks has aggravated the desire of investors to buy cheaper assets. Besides, the stock market has quickly won back its losses and continued the rally which knocked down the US dollar. Even the data on initial jobless claims in the US did not change the situation. Over the past 4 weeks, the number of claims has totaled 22 million, which is equivalent to 13% of the workforce.

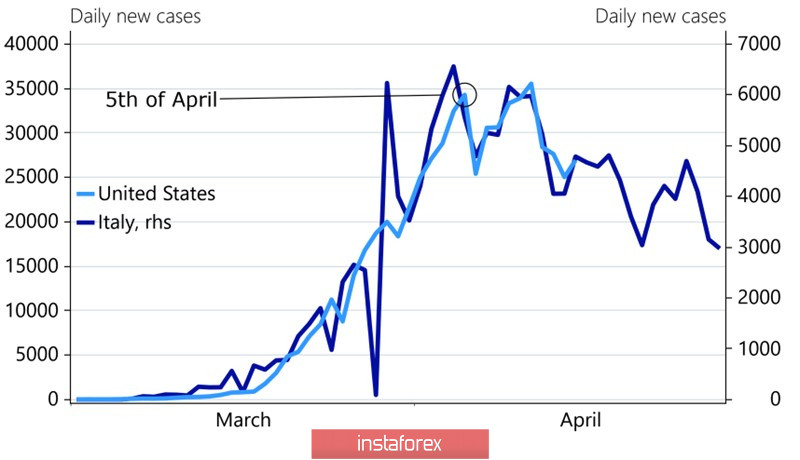

Perhaps someone was surprised that a sharp decrease in the federal funds rate and unlimited purchases of treasuries under the QE did not stop the S&P 500 bears in late March. Nevertheless, the situation with the coronavirus outbreak in the world was rapidly deteriorating at that time, and the scale of the global recession was not determined then. In addition, the process of agreeing on a fiscal stimulus package in US Congress brought more uncertainty to the markets. Since then, the stock index has grown by 19%. So in fact we can assume that the Fed has fulfilled its mission. The decrease in the daily number of new coronavirus cases in the US contributed largely to the rally of the American stock market. It seems that the US is following the scenario observed in Italy where the situation around coronavirus is gradually improving.

The daily number of new confirmed coronavirus cases in the US

The higher the S&P 500 goes, the larger is the number of US stocks buyers. Everyone knows that in the years of previous recessions, the recovery of the stock index had begun long before the recovery of the economy. There is still a risk of missing the last opportunity to gain the profitable stocks. Interesting enough that from the fundamental point of view the rally looks quite justified: P/E is steadily increasing, and the rise of the multiplier in the past served as a reliable signal for the S&P 500 bulls.

S&P 500 and P/E dynamics

For some traders, the V-shaped recovery of the stock index is an unexpected gift while for others it means that the recession is going to be extremely deep. According to some estimates, it may become the steepest economic downturn since the Great Depression in the 1930s, but it is expected to be shorter. If so, some investors see no need in increasing the share of safe haven assets, including the US dollar, in their investment portfolios. The American currency has done its job in March, now it is time to sell it.

The euro does not look better, however. First, according to the IMF, the decline in the eurozone will be deeper than in the US. European GDP will drop by 7.5% in 2020 and will not be able to fully recover in 2021. Secondly, the EU reluctance to issue bonds led to an increase in the yield of Italian bonds, and to an expansion of spreads on rates with their German counterparts. This may indicate a rising risks of the collapse in the currency block. Finally, there are speculations that the ECB will double the QE.

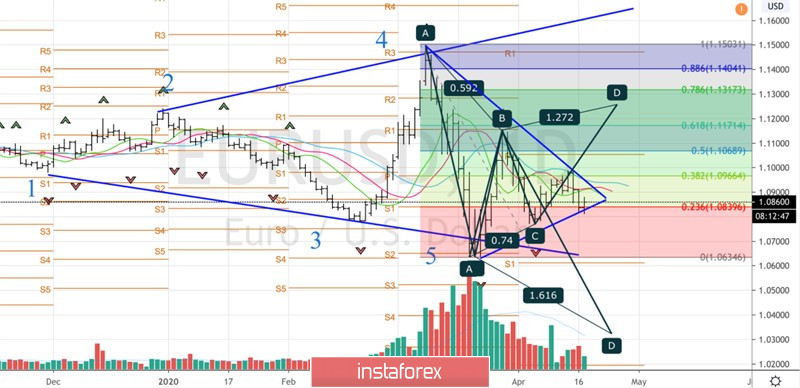

Technically, the attempts of the EUR/USD bears to go beyond the diamond pattern failed. Perhaps the second attempt to break through the support level at 1.081 will be more successful and will allow placing short deals. On the contrary, a breakthrough of the resistance level at 1.0965 will give a signal for long positions on the pair.

EUR/USD daily chart