Dear colleagues,

Due to the COVID-19 pandemic, the global margin market ended with a massive injection of liquidity into the markets. So much money was allocated into the system that stock indices rebounded by 50% from their fall and this is despite the economy functioning half its capacity, while many sectors fell to zero and it is not clear when they will recover.

Central banks are struggling to keep afloat what else can be saved, and sometimes they seem to do it with excessive zeal. As of April 8, the balance of the Federal Reserve System exceeded $ 6 trillion, an increase of 2 trillion occurred in just a month and a half, which is an absolute world record since Weimar Germany. At the same time, the governments of the countries of the so-called "golden billion" very well understood the rule formulated by Margaret Thatcher: "As the history of the Weimar Republic in Germany shows, nothing undermines society more than ruining people as a result of a loss of savings. " The Russian government, which arranges for its citizens to reset their accumulations every 5-6 years, would also do well to listen to these words of the "Iron Lady", but today is not about that, but about gold and its prospects.

Investors around the world are now in a difficult situation when a fall in interest rates in key currencies to zero values led to the absence of assets, in which one could invest capital and do this with predictable risks. The only asset that ensures the safety and augmentation of funds today and from the very beginning of a person's existence is gold, and in case of danger, investors actively invest in it. At the same time, long distance gold provides investors with an 8 percent increase in capital in US dollars annually.

Gold, along with government treasury bonds, has traditionally been a protective asset, but in bonds, yields after falling rates have fallen dramatically. Government bonds of Russia with maturity in 2028 and China with maturity in 2039 now generate income in dollars of only about 3% per annum, all other bonds of developed countries give a maximum of 1.5%.

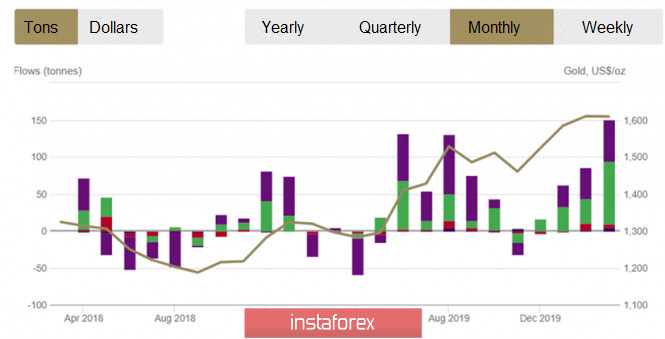

The report of the World Gold Council on investments of exchange-traded funds in the first quarter of this year showed a record increase in investments, by 298 tons (Fig. 1), this has never happened in the history of observations. Investors from the USA were especially zealous, adding 83.7 tons to the bins, Great Britain - +37.1 tons, Germany - +20.5 tons and Switzerland, adding 19.4 tons of precious metal.

As you can see, investors from developed countries prefer gold to all other investments in anticipating inflation and not having promising assets for investments. They do this in the context of the "buy and hold" strategy. Moreover, their trust in funds investing in the so-called "paper gold" is rather high.

However, traders who trade gold in InstaForex terminals may face significant losses after having made an incorrect transaction using leverage, while having unlimited profit potential. This emphasizes the need for strict observance of money management rules.

Figure 1: Monthly flows of global gold exchange ETFs

If we talk about the dynamics of the price of gold, in the long term from one to six months, then for the analysis we are best suited for the daily time. As follows from the diagram, the increase in the price of gold in the second half of March and the first half of April led to a price hike at the level of $ 1,750 per troy ounce. After that, a correction occurred on the market that we can use to open buy positions, and here it is very important to have a trading system that helps the trader generate signals. The fact is that now it is impossible to predict how deep the correction will be and how long it will last.

On the one hand, it can be stated that as a result of the price movement between March and April, gold formed a general support at the level of $ 1,450 and another support of lesser importance at the level of $ 1,550, from the values Of which traders would get excellent shopping opportunities. On the other hand, the growth impulse was so strong that the question now is, will gold even go down to $ 1,650? Where, in case of receiving a signal, one could buy gold with targets at the levels of $ 1750 and $ 1850. Less significant levels of $ 1,630 and $ 1,600 (Fig. 2) can also be used as supports and pivot points from which it is possible to buy gold in the direction of the above goals. At the same time, traders can place orders for fixing losses below the value of $ 1,550, having profit and risk ratios of 2 to 1 and 3 to 1,

I am often asked when this or that event will happen. I still have no answer to this question. At the same time, I have a clear understanding of how long a particular transaction will remain in the market, which is very important from the point of view of determining the costs of maintaining a position. As a rule, with a probability of 70% daily time, it takes one to three months to find a position in the market. Suppose that our purchase will be a plus and stay in the market for 90 days. Then, as follows from the specification of the contract in the InstaForex terminal, for each calendar day a negative swap of -20.8 points will be charged on our position, which is equivalent to $ 0.21 of the price of gold. Consequently, swap charges for a period of 90 calendar days will amount to approximately $ 19 dollars, which will need to be deducted from profit or, God forbid, add to losses.

Figure 2: Schematic representation of estimated gold price dynamics - Gold

Today, the National Bureau of Statistics of China reported that in the first quarter of 2020, its economy decreased by 6.8%, which became the first negative value in 28 years. It should be borne in mind that China dealt with the consequences of the epidemic much earlier than other countries, and the epidemic itself was not as widespread as it became in the EU and the USA. In this regard, we can assume that the publication of statistics for the first quarter and corporate reports will lead to a shock in the stock markets. This is supposed to send markets down and lead to massive purchases of gold by investors in the US and the EU, who determine the price of gold to the greatest extent, despite the massive injections of liquidity by central banks.

Be extra careful, follow the rules of money management and let the coronavirus pass us.