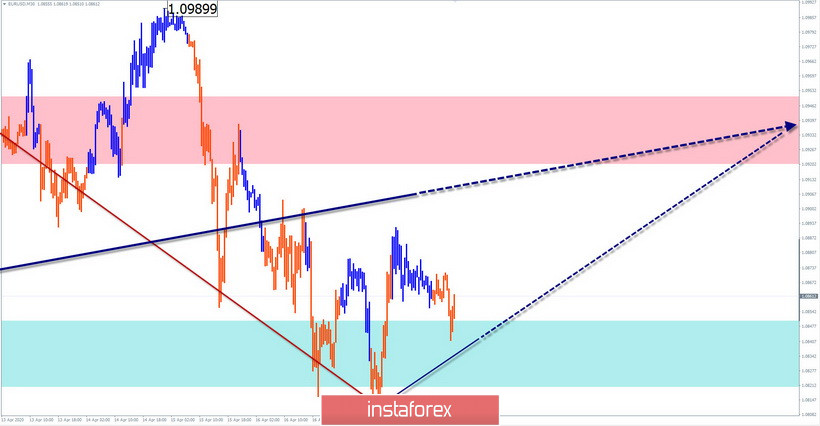

EUR/USD

Analysis:

The direction of the euro's price trend in the market since March 20 is set by an upward wave. As part of the final part (C), a bearish correction of the wrong type is formed from April 9. The price rise that started at the end of last week has a high potential and may be the beginning of a reversal pattern.

Forecast:

Today, the price rise that started earlier is expected to continue. In the first half of the day, the price is likely to move sideways. The increase in volatility and growth of the exchange rate can be expected by the end of the day.

Potential reversal zones

Resistance:

- 1.0920/1.0950

Support:

- 1.0850/1.0820

Recommendations:

Euro sales today can be risky. It is recommended to search for signals to buy the instrument.

AUD/USD

Analysis:

Since March 19, the Australian currency quotes have been moving to the "North" of the chart. The wave reached a large-scale reversal zone. A week ago, I began a corrective decline in the form of the side of the pennant. At the time of analysis, the correction is not complete.

Forecast:

Today, the general flat mood of the movement is expected. In the nearest trading session, a sideways trend is likely, no further than the lower support limit. Then you can count on price growth. The upper limit of the daily course is limited by the resistance zone.

Potential reversal zones

Resistance:

- 0.6410/0.6440

Support:

- 0.6340/0.6310

Recommendations:

Selling the Australian dollar today may be risky and is not recommended. It is more promising to track reversal signals and entry points to long positions.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of arrows shows the formed structure, and the dotted ones show the expected movements.

Note: The wave algorithm does not take into account the duration of the tool movements in time!