Investors prefer to go to safe havens.

Hello, dear colleagues!

Today's review of the euro/dollar currency pair again has to start with the topic of coronavirus. In European countries, the situation with the spread of COVID-19 and deaths from the pandemic is ambiguous. For example, in Italy and Spain, the daily mortality rate is decreasing. At the same time, the number of deaths from a new type of coronavirus in Italy per day was 454 people. Although this is less than a week ago, the number of deaths in one day is still quite high.

In France, things are worse, but the focus of the epidemic there came later. So, the number of victims from COVID-19 on the last day has increased to 547 people, while in France there are 20,260 deaths since the beginning of the coronavirus epidemic.

German Chancellor Angela Merkel expressed hope that the pandemic has gone down, but this can not serve as an argument for relaxing and neglecting the necessary precautions. This statement was made by the German Chancellor on the first day of easing the quarantine measures.

On the other side of the world, in the United States of America, the situation with daily mortality from COVID-19 has also started to improve somewhat, but the situation is still far from stabilizing. This is the kind of rhetoric expressed by US President Donald Trump, who believes that the country will have to go through another 2-3 very difficult weeks.

The situation on global trading platforms as a whole continues to be tense. There is no appetite for risk, and investors prefer to go to safe havens. Against this background, oil prices fell to $ 25 per barrel, and the stock market ended trading in the red zone.

Let's see how the technical picture for the main currency pair of the Forex market is developing, but first I will outline the few macroeconomic releases that will be published today.

The Eurozone and Germany will present the ZEW index of business sentiment to market participants, which will be published at 10:00 (London time). From the United States today at 15:00 (London time), reports on home sales in the secondary market will be published. That's probably all.

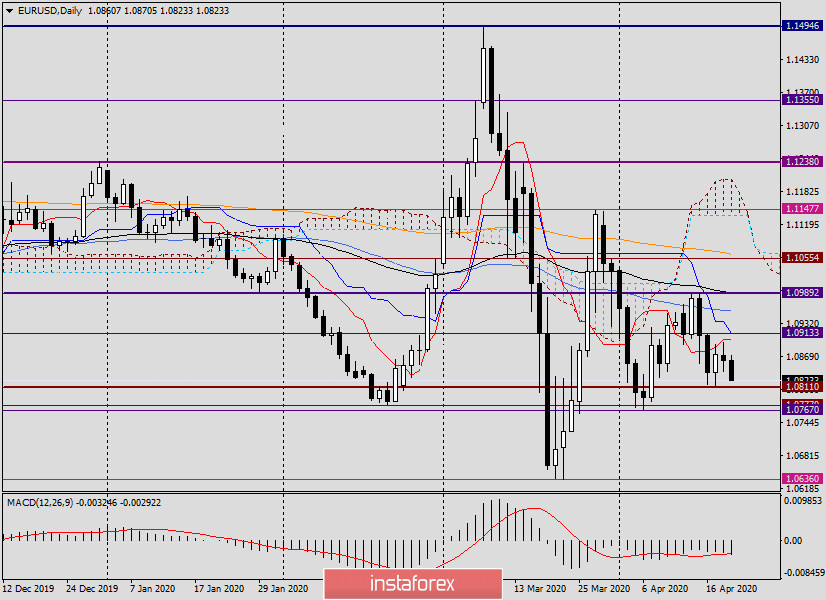

Daily

Following the results of yesterday's trading, the euro/dollar pair fell slightly. At the same time, attempts to grow and overcome the Tenkan line of the Ichimoku indicator ended at 1.0896, that is, just before the next meeting with an important and strong level of 1.0900.

Today, at the time of writing the review, the euro/dollar is declining, demonstrating the intention to once again test the support level of 1.0811. If this level is broken and the pair ends today's trading below 1.0800, the next target for sellers will be a strong technical support zone of 1.0777-1.0767. Everything will depend on the dynamics of trading, perhaps the bears will break through the designated zone today.

It will be extremely important for the bulls to cross the Tenkan line and close trades not only above it but also above the important level of 1.0900. However, as can be clearly seen on the chart, the resistance level passes at 1.0913 and the Kijun line is located, which is able to provide strong resistance and turn the quote down.

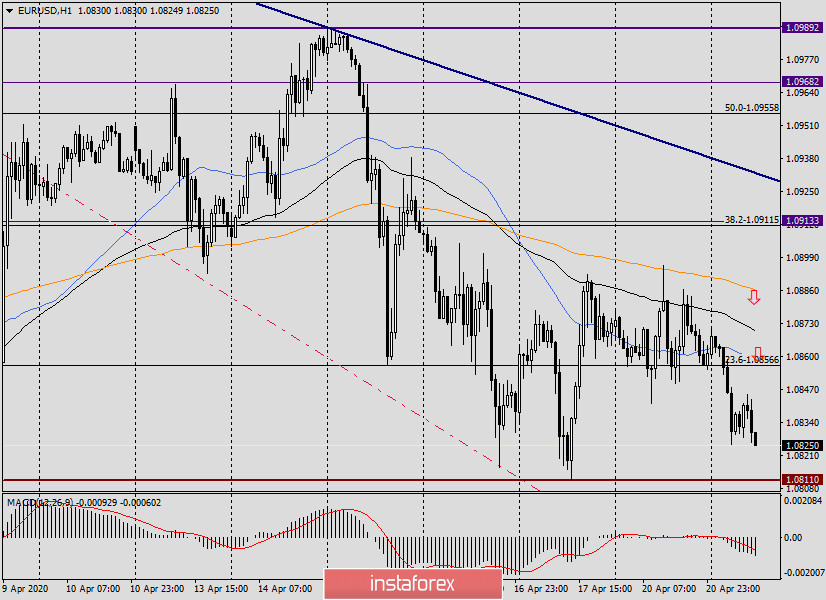

H1

On the hourly chart, the euro/dollar is trading under the moving averages used: 50 MA, 89 EMA and 200 EMA, each of which can provide serious resistance to growth attempts. Given the technical picture on both timeframes, the main trading idea today is sales, which are better to open after short-term rises in the price zone of 1.0860-1.0900. We are looking for more attractive prices for opening short positions after the growth in the area of 1.0910-1.0940, which seems unlikely. However, the market can present any surprises at any time. Especially in these dark times of coronavirus. Given this factor, we can not exclude the possibility for purchases, which is better to use after the appearance of the corresponding candle signals near the support levels of 1.0811 and 1.0777.

Good luck!