Technical analysis recommendations for EUR/USD and GBP/USD on April 21

Economic calendar (Universal time)

Among the events in today's economic calendar, we can highlight the publication of data on economic sentiment in Germany (9:00) and on sales in the secondary housing market in the United States (14:00).

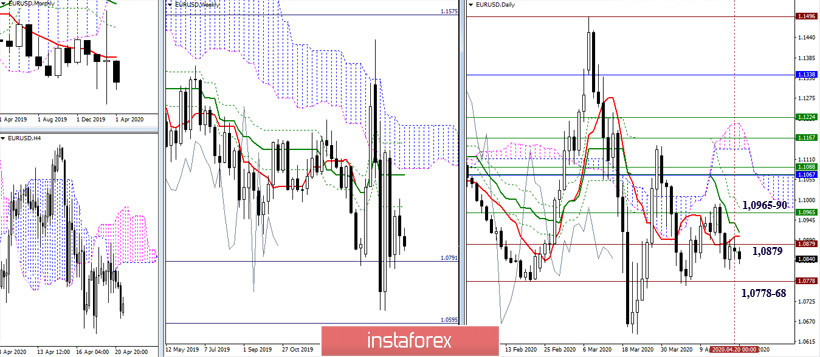

EUR / USD

No productive movement was observed yesterday. The pair remained in the zone of attraction and influence of 1.0901 - 1.0879. In this situation, uncertainty prevails, with a small margin in favor of the bears. On the other hand, the downward targets can be noted at 1.0812 (last week's low) - 1.0778-68 (historical level + minimum extreme). Consolidating above levels (1.0901-1.08879) can serve to strengthen the bullish moods. In this case. the closest reference point for players to increase will be the resistance area of 1.0965-90 (Fibo Kijuna daily and weekly + maximum extreme).

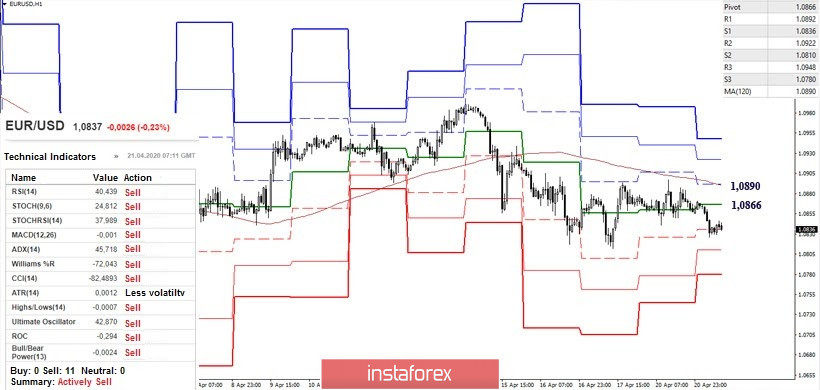

Despite the lack of directional movement, the main advantage remains on the downside of the players due to the location below the key levels of lower halves and the preferences of technical indicators. Today, support for the classic Pivot levels are located at 1.0810 (S2) and 1.0780 (S3). To change the current balance of forces and the appearance of upward prospects for the euro, it is necessary to rise and consolidate above the key H1 resistances, which are currently at 1.0866 (central pivot level) and 1.0890 (weekly long-term trend).

GBP / USD

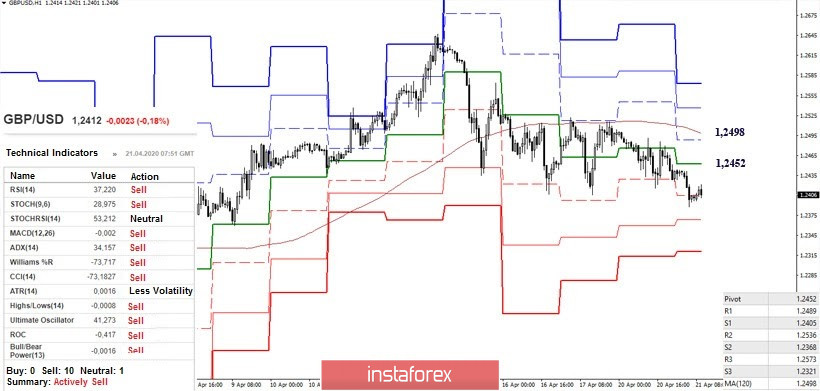

The pair is still subject to the influence and attraction of the zone of accumulation of levels 1.2540 - 1.2450 (monthly Tenkan + weekly Kijun and Senkou Span A + monthly Fibo Kijun + daily Tenkan), so uncertainty and reflection dominate. Nevertheless, the players to decline managed to close below the zone yesterday, which increased their chances of continuing the decline. Further support today can be noted at 1.2305 (weekly Tenkan) - 1.2213-1.2175 (weekly Fibo Kijun + daily Fibo Kijun) - 1.2029 (daily Kijun). Changes in moods and preferences are possible with reliable consolidation over the zone of attraction 1.2540-1.2450.

In the lower halves, the players to decline confirmed their advantage today, marking a new low. With continued decline, the support inside is the classic Pivot levels, located at 1.2368 (S2) and 1.2321 (S3) today. In the case of a slowdown and the development of an upward correction, the main value on H1 will be the key resistances responsible for the distribution of advantages. At the moment, these levels are located at 1.2452 (central Pivot level) and 1.2498 (weekly long-term trend).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)