The pound significantly fell against the US dollar - for the first time since the beginning of April, the sterling fell into the framework of the 22nd figure, demonstrating a bearish mood. The GBP/USD pair reached its local high on April 14, peaking at 1.2647. But buyers could not break through the 1.2650 mark, after which the pair began to slowly but surely slide down. Today, the downward momentum has strengthened, with the dollar playing a secondary role in this case. The main reason for the downward dynamics of GBP/USD is the slowdown in the British economy. Today's release on the growth of the British labor market once again reminded traders of the negative consequences of the coronavirus epidemic. Apparently, the "bearish feast" will continue tomorrow, especially if the data on British inflation turns out to be more disappointing than the rather weak forecasts.

But let's start with today's release. First of all, it should be noted that we are talking about the February figures, which do not fully reflect the consequences of the pandemic. But the situation has already started to go downhill in February – for example, the number of applications for unemployment benefits rose to 12,000, and the unemployment rate rose to 4% (for the first time since December 2018). But the biggest disappointment today was caused by data on wage growth, although these indicators have been showing a negative trend for six months. Excluding bonus payments (which are inherently unstable), the indicator is declining for the seventh consecutive month – today it came out at 2.9% (for comparison, this indicator came out in the range of 3.9% -3.8% last summer). Taking bonuses into account, this indicator was also in the red zone, and was at the level of 2.8%, reflecting a serious slowdown.

I will highlight the fact that the February figures were published today. The epidemic did not manifest in Britain in February, and not even in March - but in the current month, so the next labor market releases will be much, much worse. However, the demo version impressed investors - they began to actively get rid of the pound, after which the GBP/USD bears quite reasonably entered the 22nd figure.

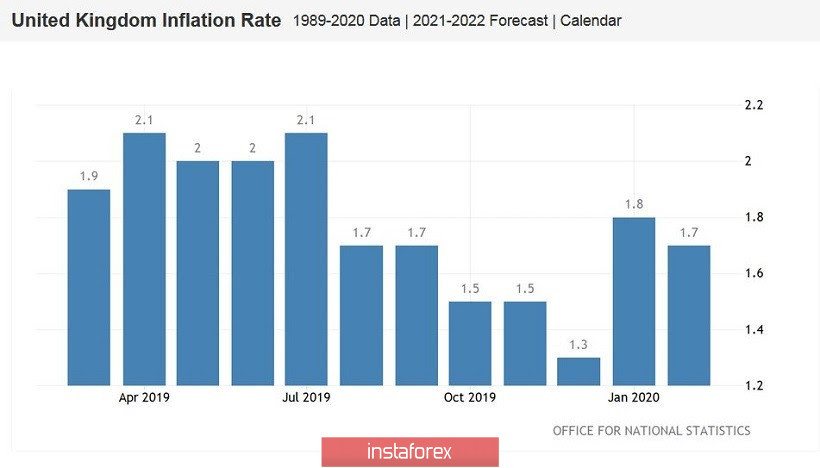

We will learn more about the growth dynamics of British inflation in March by tomorrow. Preliminary forecasts are expected to be negative: the general consumer price index on a monthly basis should slow down to -0.1%, and in annual terms - to 1.5% (after the February decline to 1.7%). Core inflation will show similar dynamics, dropping to one and a half percent. For bulls of the pair, it is important that inflation data come out at least at the forecast level, otherwise the bears will receive a heavy argument for selling the pair.

Data on retail sales in Britain will be published on Friday. This release will be the last puzzle that will form the overall fundamental picture for the pound. According to general forecasts, retail sales will also disappoint GBP/USD bulls, and very much so: the indicator will go into the negative area on a monthly and annual basis, both taking into account fuel costs and excluding this component.

However, GBP/USD traders are unlikely to wait until Friday - according to the results of the release of data on the growth of British inflation tomorrow, the pendulum will swing one way or the other - either the downward momentum of the pair will fade and the price will return to the 23rd figure, or a bearish rally will continue, up to the 1.2160 level (April low) and even to the next support level of 1.2080 (the lower line of the Bollinger Bands indicator on the daily chart).

Chief economist at the Bank of England Andy Haldane could exert additional pressure on the pair today. He was quite pessimistic about the prospects for the British economy - according to him, in the second quarter the decline will be sharper all over the world, including in the UK, while the possibilities of monetary policy to limit the negative impact of coronavirus are very limited.

We must not forget about the next surge in anti-risk sentiment in the foreign exchange market, which was provoked by the situation in the oil market. If yesterday's situation with May futures on WTI was technical, today oil fell on all fronts: for the first time since February 2002, Brent oil futures fell below $20 per barrel, May futures for WTI crude oil remained in the negative zone, while the June ones fell to the current 11 dollars. Uneasiness is growing again in the markets, while the US currency is skimming, using the status of a protective asset: the dollar index is above the 100-point mark.

Thus, the GBP/USD pair retains the potential for a decline - if tomorrow's data on the growth of British inflation disappoints (which is very likely), and the oil market can't get out of a steep low, the pound will not only reach 1.2160, but also test the 20th figure.