4-hour timeframe

Average volatility over the past five days: 88p (high).

The EUR/USD pair continued to trade fairly calmly for most of the day on Tuesday, April 21. It increased during the US trading session, but the rise also ended pretty quickly.

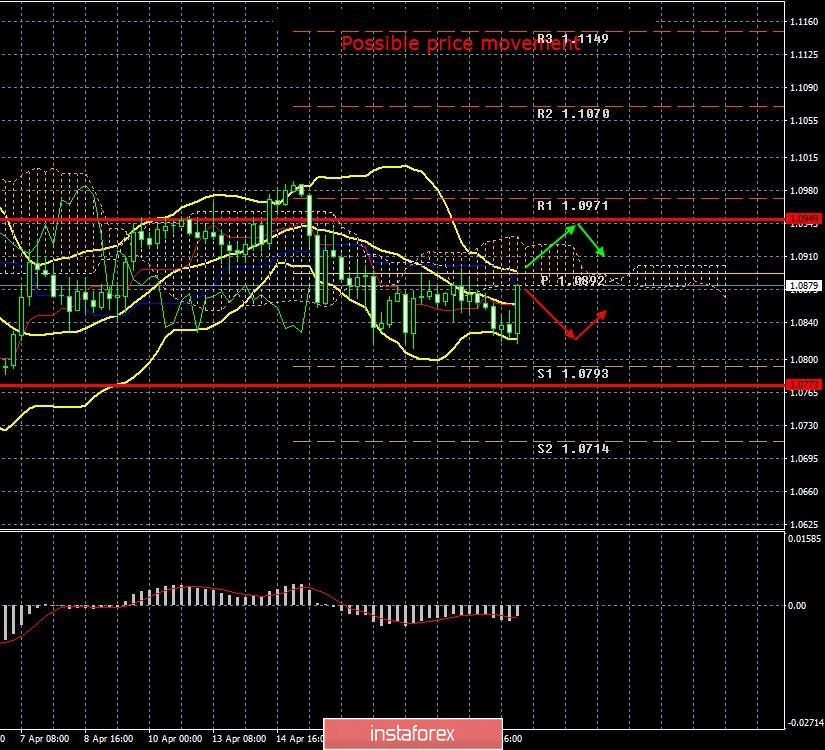

There was no movement that was comparable with the British pound. Thus, firstly, the correlation between the two main pairs is now absent. Secondly, unlike the pound, the euro could actually be located inside the side channel, limited by levels of 1.0817-1.0900. The channel is approximately 100 points. Therefore, at the moment, our hypothesis regarding the pair's consolidation within the 1.08-1.09 channel is coming true. It is hard to say how much time the pair will spend within this range. Another collapse occurred on the commodity market yesterday. WTI crude oil (May futures) fell to negative values, which has never happened before. However, as we saw today, traders of the euro/dollar pair were not interested in this news. Thus, market participants are still calm when it comes to EUR/USD.

Several macroeconomic reports were published during the second trading day of the week, but all of them were of a secondary nature. For example, the ZEW index of current economic conditions for April showed a drop to -91.5. The business sentiment index in Germany unexpectedly rose to 28.2. And in the European Union, the same index rose to 25.2. What do these numbers mean? First, the fact that the current economic situation in the EU remains extremely unattractive. And secondly, that investors have optimistic prospects and believe that the situation will improve in the near future. In other words, investors expect that the quarantine measures will begin to relax and the economy will begin to recover in the next month. Also, investors are not waiting for the second wave of the coronavirus epidemic, which could lead to introducing new strict quarantine measures. But at the moment, these data do not mean anything, as they only reflect the mood of investors. Tomorrow it could change to the opposite.

From a technical point of view, the euro/dollar pair could not overcome the support line of 1.0817 for the third time. Thus, a rebound from it provoked an upward movement to the Senkou Span B. line. In the near future, the euro/dollar pair could also work out the Kijun-sen line, which is located slightly higher. A rebound from any of these lines could trigger a new round of downward movement back to 1.0817. Overcoming this level can provoke the resumption of the trend movement.

4-hour timeframe

Average volatility over the past five days: 132p (high).

In contrast to the European currency, the GBP/USD faced intensive trading on April 21. The British pound started to fall in the morning and continued to do so for most of the day. The worst thing is that volatility has increased again, and the pound/dollar pair has passed about 200 points during the day. Thus, firstly, the trend movement resumed, and our fears about the pair's transition to the flat were not confirmed. It's good. Secondly, the British pound is again inclined to fall against the US dollar and we need to understand the reasons for this. Although over the past two months,it was not always necessary for traders to invest in the US currency. However, several fairly important reports have been published in Britain today and there is some reason to assume that traders have reacted to them this time. However, it is hardly possible to state this with certainty, because the package of macroeconomic data can be interpreted in absolutely different ways. However, it will be sorted out in order. We note that the market is not processing all the news related to the coronavirus. Therefore, the reason for the pound's fall does not lie in the possibility that the focus of infection has transitioned from Europe to the UK.

According to today's data, unemployment in Britain rose to 4%. This is a very small increase and can be called a banal noise. An increase of 0.1% of unemployment in the country cannot be called a negative factor. Given that 4% is, in principle, a very low value. In addition, this value is for February, not March. Thus, on the one hand there is a negative report, on the other hand, it is for February, not March, and on the third, the report itself is still negative. Furthermore, the salary report for February was also weaker than forecasts and previous values. Salaries excluding premiums showed an increase of 2.9% against the forecast of +3.0% and the previous value of +3.1%. Salaries including premiums showed an increase of 2.8% against the forecast of +3.0% and the value for February + 3.1%. Thus, again, on the one hand, this value is for February (and we know that traders are now interested in data for March and the following months, when the epidemic began to gain momentum), on the other hand, there is a negative trend. And the most important report, from our point of view, the application for unemployment benefits for March (!!!) unexpectedly turned out to be much better than the expectations of traders and experts. It was predicted that the number of Britons who lost their jobs will be from 175,000 to 272,000 in March. However, the actual value of the indicator is 12.2 thousand. That is, according to this report, there are no epidemics and quarantine in the UK at all. Nobody lost their job, the British do not need unemployment benefits. A value lower than 12.2 thousand applications was recorded only five times over the past two years. And we are talking about 24 months without a crisis. Thus, we believe that there is some kind of error. This simply cannot happen, so that during the time of the global epidemic and quarantine in Great Britain (which can objectively suffer more than others), the situation on the labor market will not worsen. The whole package of statistics can be interpreted in different ways. It is absolutely ambiguous. If you close your eyes to a completely unimaginable report on applications for unemployment benefits, then the pound reasonably fell today. On the other hand, how many significant macroeconomic data from both the United States and Britain have traders been ignoring over the past two months? Almost all.

Recommendations for EUR/USD:

For short positions:

The EUR/USD pair continues to adjust inside the side channel on the 4-hour timeframe, which it could not leave today. Thus, sales orders now formally remain relevant, but we advise you to wait for the price to be confidently consolidated below the 1.0817 level and only then should you sell the euro again with the first goals of 1.0793 and 1.0773.

For long positions:

It is recommended to return to purchases of the currency pair only after the price has been consolidated above the Kijun-sen critical line and the upper side channel line - 1.0900 with the first targets of 1.0949 and 1.0971.

Recommendations for GBP/USD:

For short positions:

The pound/dollar pair resumed an increasing downward movement. Thus, traders are advised to sell the pound with targets at 1.2276 and 1.2147 until the MACD indicator turns up or up to an eloquent price rebound from any target.

For long positions:

It is recommended that you consider new purchases of the GBP/USD pair before consolidating the price above the Kijun-sen line with the first target at a volatility level of 1.2583.