Today's interests are essentially limited to currencies such as the euro and pound. And yesterday, only a single European currency felt relatively calm. The pound, in turn, confidently lost its positions. And each of them had its own, completely unrelated reasons. At the same time, amid the coronavirus pandemic, panic in the oil market and so on, the situation in the debt market remains almost unnoticed. And there continues what I have repeatedly mentioned. Of course, we love the process of capital flight. For example, the yield on 52-week US bills declined from 0.260% to 0.165% which is quite significant. On the other hand, the yield on 5-year United Kingdom bonds rose from 0.119% to 0.168% while the yield, or rather loss, of 3-month Spanish bills decreased from -0.462% to -0.291%. In the Old World, only German securities show good results, and the loss rate of 2-year bonds changed from -0.65% to -0.68%. At the same time, I want to draw attention to the fact that it will not be possible to write off the decline in the yield of American debt securities to the refinancing rate decline of the Federal Reserve. Firstly, it happened more than a month ago. Secondly, the European Central Bank has not been carrying out any manipulations at the refinancing rate for a long time, and the Bank of England has also reduced its rate, not increased it. Thus, the increase in the yield of European debt securities does not fit into the usual logic unless the factor of capital flight from around the world to the United States will be considered. And since this process continues, large investors proceed from the assumption that the economic situation around the world will only continue to deteriorate. It is clear that there is nothing good in this news. In addition, this clearly indicates the continuation of the trend for a gradual strengthening of the dollar.

If we talk separately about the pound, then everything is very, very interesting with it. In fact, macroeconomic statistics went completely unnoticed, which is not surprising. The unemployment rate rose from 3.9% to 4.0%, while the average wage growth slowed from 3.1% to 2.9%. The situation with the average wage growth rate is even worse, considering refining, which slowed down from 3.1% to 2.8%, which turned out to be slightly worse than forecasts. But that is data for February, not March. So they were not so much interested in market participants, since everything turned upside down in March. However, data were published on the change in the number of applications for unemployment benefits in February , which were almost twice the 2009 anti-record. There should have been 272 thousand, but it turns out to be only 12.2 thousand. That is, the number of applications did not deviate from the usual. It is not surprising that at the sight of such values, market participants were slightly confused. It is completely incomprehensible how to explain and interpret this, and most importantly, what conclusions follow from these data. Thus, the pound practically froze in place at that moment, and then began to slowly decline. After all, the only logical explanation for what happened is that under the conditions of restrictive measures designed to curb the spread of the coronavirus epidemic, the employment services were also closed. That is, people simply could not apply for benefits. In other words, these figures do not reflect the real situation, while in fact the situation is apparently extremely depressing. It will just be seen a little later. As a result, market participants began to carefully discard the pound. But they forgot to be cautious after a few hours, and so the pound began to lose its position much more actively. The blow was struck by British banks, which are screaming about the increase in the number of bad loans. First of all, we are talking about mortgages, as well as loans issued for commercial real estate. In the current environment, when the economy is not functioning, it is extremely difficult for borrowers to pay loan payments. And the real estate market in previous years has greatly inflated, mainly due to mortgages. Due to this, delays in payments are growing on the balance sheets of banks, and with them financial difficulties. In addition, when only grocery stores, pharmacies and a small number of stores selling vital goods are operating, trading networks also cannot service loans taken to purchase retail space. It turns out that exactly the same thing can happen in the UK that once triggered the 2008 crisis. But in the context of a coronavirus epidemic, the result may be more terrible.

Change in the number of applications for unemployment benefits (UK):

Frankly, the macroeconomic situation in the euro area is not much better than in the UK. For example, construction in Italy fell by 0.3% in February. So the decline will only continue, and it will turn out to be quite deep. Spain's trade deficit was 2.1 billion euros. It traditionally has a negative trade balance, so there is nothing new in this. At the same time, it is simply not very loud to say that many European countries will not be able to service their public debts in the near future, although many of them have rates of return on these same debt obligations are negative. And of course, the period of limited quarantine is a serious burden on the budget and financing all this is possible only through new debts. The economy is practically not working, which means there are no tax revenues. And European countries can only dream of reserves. But the only thing that saves the single European currency so far is that this problem is practically not talked about, and there is hope that the European Central Bank will come up with another way to fill European countries with free money. However, the effectiveness of free distribution of money raises too many questions, since over the years of this practice, no one has seen rapid economic growth. Rather, it only helps to postpone the solution of the problem in a long box.

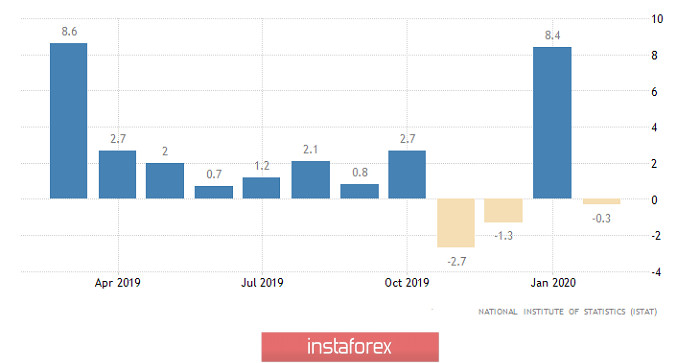

Scope of construction (Italy):

Everything is bad now in terms of the economy including the United States. Sales of housing on the secondary market fell by 8.5%, from 5,760 thousand to 5,270 thousand. At the same time, this is data for March, and one should not forget about such a thing as incomplete transactions for the sale of housing. That is, the March report included those transactions that were actually concluded in February, but they were carried out only in March for technical reasons. Moreover, the coronavirus epidemic hit the United States only in mid-March. That is, the economy was still functioning relatively fully for the first half of the month. Therefore, the April report should show a significant decline in sales, but this is just one more addition to a whole bunch of economic problems that the United States faces. Among them is the mess that is happening in the domestic oil market.

Secondary Home Sales (United States):

As expected, the oil market is slowly trying to come to its senses. WTI crude oil prices even increased yesterday, although Brent crude oil was declining. It's just that the scale of the decline in WTI was so impressive that Brent still needs to catch up with it. What is happening is just a feast for speculators. However, the cause of the problem has not been resolved. Several oil-filled oil tankers drift off the coast of California. They have nowhere to unload, because all storage facilities in the United States are full. In some cases, the tankers themselves are used to store oil. So the problem lies in the volume of production in the United States itself, which leads to an excess of oil and falling prices. Well, the drop in prices affects the profits of oil companies, who are forced to increase production in order to maximize profits and be able to service previously taken debts. Obviously, attempts to solve the problem of financial stability of American oil companies by means of pressure on oil-exporting countries so that they reduce production volumes will not solve this problem. So there will be a panic in the oil market for some time. It will end only with the bankruptcy of a sufficient number of American oil companies. The largest oil-exporting countries, such as Saudi Arabia and Russia, can wait, as they have sufficient financial reserves. Incidentally, today's data on stocks of crude oil and petroleum products in the United States will be of considerable importance in this regard. However, this data is unlikely to have an immediate impact. Rather, they will reflect how events may develop in the near future.

The pound is also trying to slightly recover its position, and in this case, inflation helped a little, which fell from 1.7% to 1.5%. The help is that they expected a slowdown in inflation to 1.3%. So the data were slightly better than expected. Yesterday's decline itself was quite provoked by speculations. British banks have only outlined a problem that could possibly be solved. Thus, it's too early to draw any conclusions regarding the fact that the British financial sector will collapse right now and bury the entire economy of the United Kingdom.

Inflation (UK):

The single European currency will most likely continue to remain stable, so the trampling around the level of 1.0850 will be delayed for today.

The pound will try to return around the level of 1.2400.