Trump in his own style. The EU is waiting for the summit.

Hello, dear colleagues!

Today, the publication of macroeconomic reports does not promise anything interesting. From the United States of America at 14:00 (London time), insignificant data for market participants on the housing price index will be received. The Eurozone at 15:00 (London time) will publish the consumer confidence index, which is also not a particularly significant report for investors. In the absence of important statistics, the price dynamics of the main currency pair of the Forex market will be determined by technical factors, as well as statements by high-ranking officials, including bankers and heads of state.

In this regard, I would particularly like to note the position and actions of the American President Donald Trump, who signed a decree banning legal immigration to the United States for a period of 60 days. However, some categories of immigrants will not be affected by this decree, but this is not the point. Trump in his style, his speeches and comments continue to be very ambiguous, vague and often contradictory. Sometimes it's just a collection of some of the words and (or) phrases.

While about 45,000 people have already died from COVID-19 in the United States, and the number of people infected with the new type of coronavirus has exceeded 824,000, the US President is in favor of lifting quarantine measures in order to restart the world's leading economy as soon as possible. Everything is clear - the presidential election is ahead, and Donald Trump really wants to be re-elected for a second term. To do this, it needs a strong economy, not the 30 million Americans who lost their jobs due to the coronavirus epidemic. As for the life and health of its citizens, this is less important for the US President than the stabilization of the economic situation in the country. The opinions of ordinary Americans were divided about equally. Some are in favor of removing quarantine measures, while others prefer to maintain self-isolation and, first of all, take care of their health. There were even quite small rallies with demands to return to normal life, which caused Donald Trump to delight.

Meanwhile, the Upper House of the US Congress passed a second aid package for businesses and the health care system, which amounted to $ 500 billion. Regarding the removal of the quarantine, decisions will be made by the governors.

In the European Union, disagreements continue over the provision of business assistance and the rescue of the EU economy. Spain supports the introduction of a plan for the economic recovery of the region. Tomorrow, the next EU summit will be held, at which measures to adopt a large-scale package of financial assistance to EU countries whose economies are most affected by the COVID-19 epidemic can be approved and agreed.

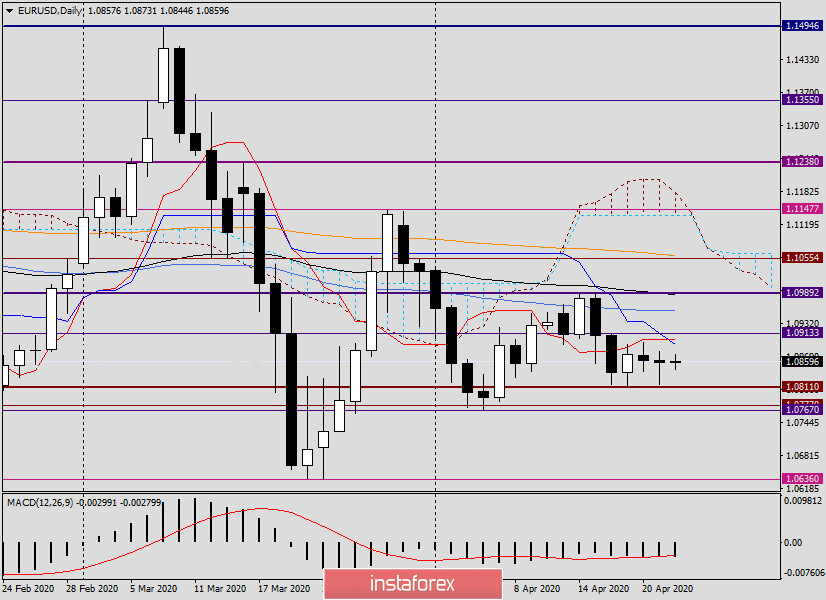

Daily

If we go to the technical picture for the EUR/USD pair, the situation here still remains uncertain. Yesterday's attempts by the bears to push through the key support zone near the important level of 1.0800 were not successful. As early as 1.0816, the exchange rate started to recover, and as a result, a Doji candle with a much longer lower shadow was formed. Usually, these candles show the market's reluctance to decline, after which there is a growth or attempts.

At the end of this article, the euro/dollar is actually slightly stronger. If the growth continues, the nearest resistance will be the Kijun and Tenkan lines of the Ichimoku indicator, which are located in the extremely important price zone of 1.0890-1.0900. If this zone can be overcome, the next targets of the euro bulls will be 1.0955 and 1.0985.

A break of the support of 1.0811 and a close below 1.0800 will indicate a bearish scenario, with the nearest targets being 1.0777-1.0767 and possibly the support level of 1.0636.

Regarding trading ideas, I still consider selling EUR/USD to be the most relevant and recommend opening short positions after short-term rises to 1.0874, 1.10892, 1.0903 and 1.0917.

However, purchases in the current situation have a chance of success. Those who wish can try to buy a pair at the current price of 1.0857. It is less risky to wait for a decline in the price zone of 1.0840-1.0820 and then consider buying from there.

In conclusion, I would like to draw your attention to the fact that in the current uncertainty, it is better to wait for confirmation signals on smaller timeframes before opening positions.

Good luck with trading!