Technical analysis recommendations for EUR / USD and GBP / USD on April 22

Economic calendar (Universal time)

Data on US crude oil reserves will come out (15:30).

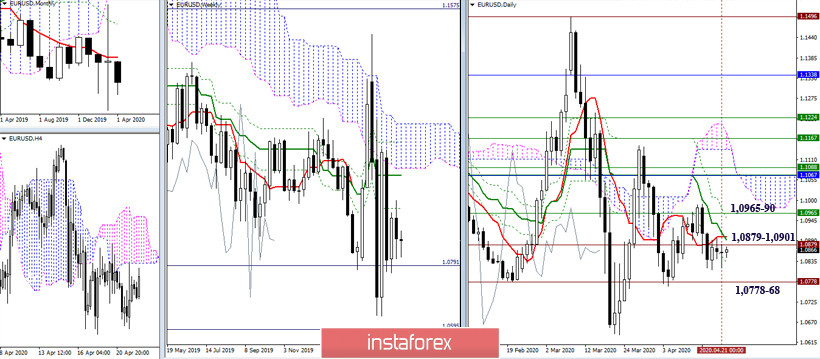

EUR / USD

No significant changes are recorded and uncertainty still prevails. The pair remains to be in the zone of influence of several levels, joining forces in the area of 1.0879 - 1.0901 (daily cross + historical level). Consolidation above can strengthen bullish moods and expectations, opening the way to new perspectives, such as 1.0965-90 (daily and weekly Fibo + maximum extremes). Downward move will resume if the market mood is bearish and last week's low is updated (1.0812). The overriding task in this direction is overcoming the support level of 1.0778-68 (historical level + minimum extremum).

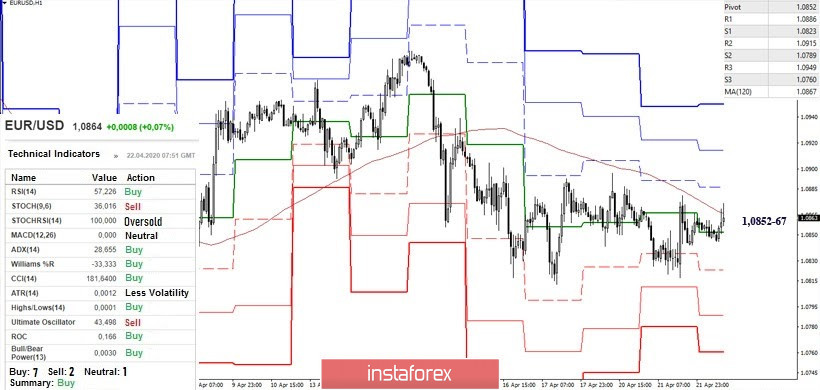

Downgrade players still do not realize the existing advantage. As a result, the opponents at the lower timeframes are currently trying to change the situation in their favor. Upward players gained support from most of the analyzed indicators and are now fighting for the key levels of 1.0852 (central Pivot level) and 1.0867 (weekly long-term trend). Rebound formation and subsequent update of the lows, led by 1.0812, may finally inspire players to increase. Support for classic Pivot levels are located today at 1.0823 - 1.0789 - 1.0760. Consolidation above the weekly long-term trend (1.0867) and reversal of the moving averages will give upward players on H1 an advantage.

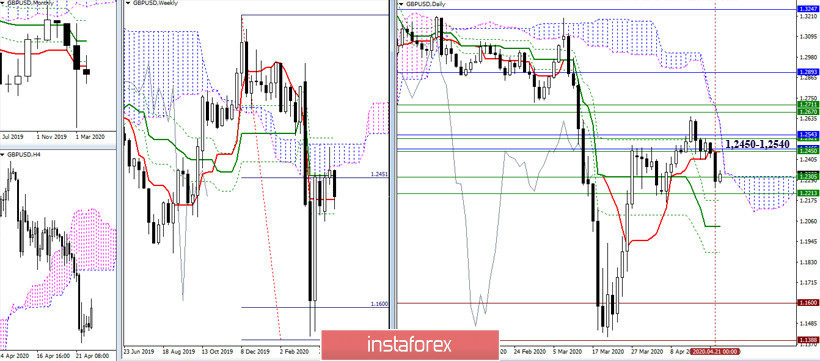

GBP / USD

Daily close at important levels (1.2450-1.2540) led to bearish activity and continued decline. Support is currently scattered and quite fragmented, so it is difficult to single out the most promising level. Everyone has a chance to slow down or stop the decline - 1.2305 (weekly Tenkan) - 1.2213-1.2175 (weekly Fibo + daily Fibo) - 1.2029 (daily Kijun) - 1.1883 (daily Fibo)

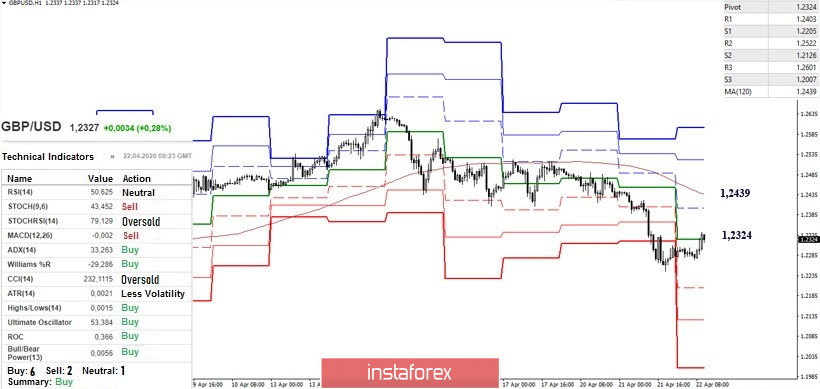

The pair is now in the correction zone on H1 and is testing the first important resistance - the central Pivot level (1.2324). The rebound and trend recovery will return relevance to the support of the classic Pivot levels (1.2205 - 1.2126 - 1.2007). Consolidation above the level (1.2324) will further develop the upward correction, where the main reference point of which will be the weekly long-term trend (1.2439).

Ichimoku cloud (9.26.52), Pivot Points (classic), Moving Average (120)