Hello!

In this review, we will conduct the most detailed technical analysis of the USD/CAD currency pair and try to find current trading ideas for this instrument. Since this pair is considered once a week, we will start with the corresponding timeframe for completeness.

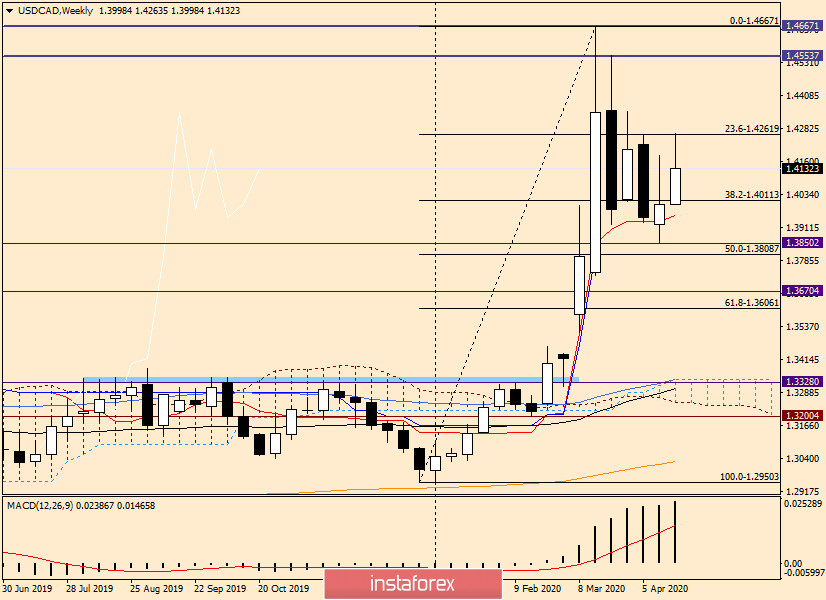

Weekly

As we can see, a bullish candle with a particularly long upper shadow formed last week, which could cast doubt on the ability of the players to continue moving in the north direction.

However, at the time of writing, the USD/CAD pair is showing quite good growth. The pair has already been at 1.4263, but failed to hold there, after which it bounced down and is now trading near 1.4133.

Despite the fact that the previous highs at 1.4181 have already been updated, much in the future direction of the quote will depend on the candle model that will appear at the end of these weekly trades. A bearish pattern will confirm the inability of the bulls to continue growing and give a signal to open sales. If the current week closes above 1.4181, and even more so above the level of 1.4200, there will be confidence in the further strengthening of the USD/CAD, which will give grounds to consider purchases. The weekly resistance is at 1.4263, and support is marked at 1.3955 and 1.3850.

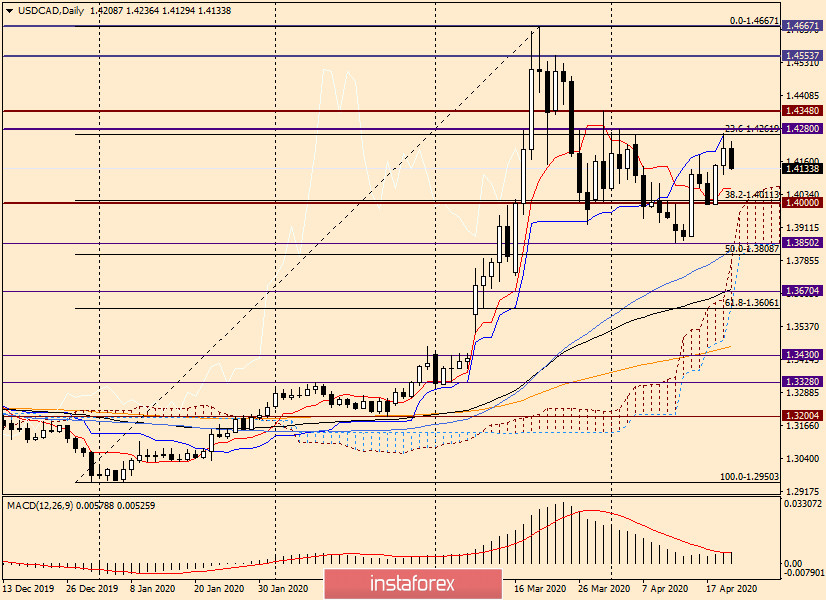

Daily

What a misfortune! The growth that started was stopped by the Kijun line of the Ichimoku indicator and the 23.6 Fibo level from 1.2950-1.4667. After that, it rebounded noticeably and today, at the time of writing, it shows a downward trend. If the decline continues, its next target will be the Tenkan line, which runs at 1.4060. By the way, this is a fairly strong technical level, so you can expect a rebound or reversal of the quote in the opposite direction. A more distant target for sellers will be the important psychological level of 1.4000, near which the trading lows were shown on April 17 and 20. The daily resistance zone can be considered 1.4236-1.4263.

H4

After the appearance of the last big black candle, bearish sentiment for USD/CAD increased, which confirms the current decline in the exchange rate. If the downward trend continues, the "Canadian" will fall to the levels of 1.4080 and 1.4050, from where I recommend trying to buy the pair. We are looking for lower and more attractive prices for opening long positions after the decline to the levels of 1.4000 and 1.3970.

Now regarding sales. Aggressive and risky, you can try to sell from the current price of 1.4131. It is less risky to wait for a rebound to the level of 1.4160 and sell the pair from there. I recommend considering higher and more favorable prices for opening short positions after the quote rises to the area of 1.4180-1.4220.

In conclusion, I would like to note that the situation is ambiguous and it is likely that today's auction will be significantly influenced by data from Canada on consumer prices, as well as the index of prices for new housing. Let me remind you that these reports will be published at 13:30 (London time). However, whether market participants will react to them or not remains a mystery in the current conditions.

Good luck!