Good day, dear traders!

Yesterday, data on the UK labor market were published, which turned out to be very mixed. The unemployment rate in February rose from 3.9% to 4.0%, which is extremely insignificant in the context of the ongoing COVID-19 epidemic. At the same time, it is worth noting that the number of applications for unemployment benefits came out much lower than the forecast values of 175,000 and amounted to only 12,200. However, it is worth noting that the data for February has not yet fully reflected the consequences of the rampant pandemic around the world, and the next report on the British labor market may be much more depressing.

Today, a large block of macroeconomic statistics has already been received from the UK. The consumer price index, which came out within expectations, should have attracted particular attention from market participants. However, there was no noticeable reaction from investors to the data from the UK, despite the fact that less significant releases exceeded the forecast values. As has been repeatedly noted, fundamental factors are not in favor of traders now, and this "now" has been going on for about a month.

I would venture to assume that market participants are more concerned about the consequences of coronavirus for the economies of developed countries, as well as for the global economy as a whole. The vast majority of investors are trying to calculate the probability of a global financial and economic crisis, the scale of which will surpass the analog of 2008-2009. In this regard, investors evaluate the measures taken by the leading developed countries and the degree of their support for the economy.

Against this background, the beginning of the second round of Brexit negotiations between the UK and the European Union, which may adjust the timing of the transition period, remains in the shadows. In particular, Scotland insists on this, which, as you know, is not eager to leave the European Union and even threatens London with holding its own referendum on this issue. I do not think that the second round of negotiations will yield any important or significant results. With a high probability, there will be a postponement to a later date. At the moment, no one knows exactly what losses for the economy will end the epic COVID-19. And for this, I suggest that we proceed to the technical analysis of the pound/dollar currency pair.

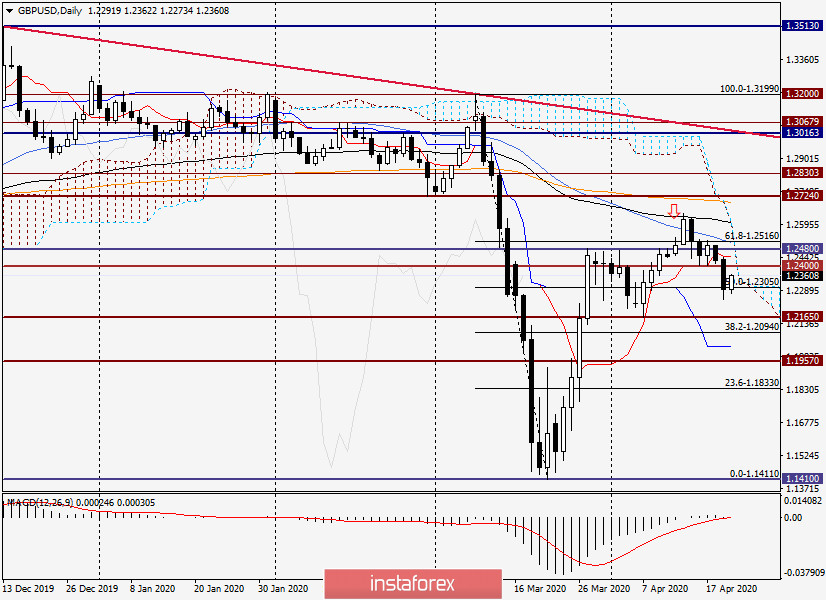

Daily

Despite the ambiguous labor statistics received yesterday from the United Kingdom, the pair has significantly declined. Following the results of yesterday's trading, a large black (bearish) candle appeared with the closing price at 1.2294, that is, below the important technical level of 1.2300. Can we assume that this mark is truly broken? I suppose not. It's a little early.

However, if we recall the previous review of GBP/USD and look again at the last weekly candle, the most likely direction for the pound remains the south. This is what is happening so far, the pair shows a downward trend, which is most likely inclined to continue. Well, let's see what options you can find to open short positions on the British pound.

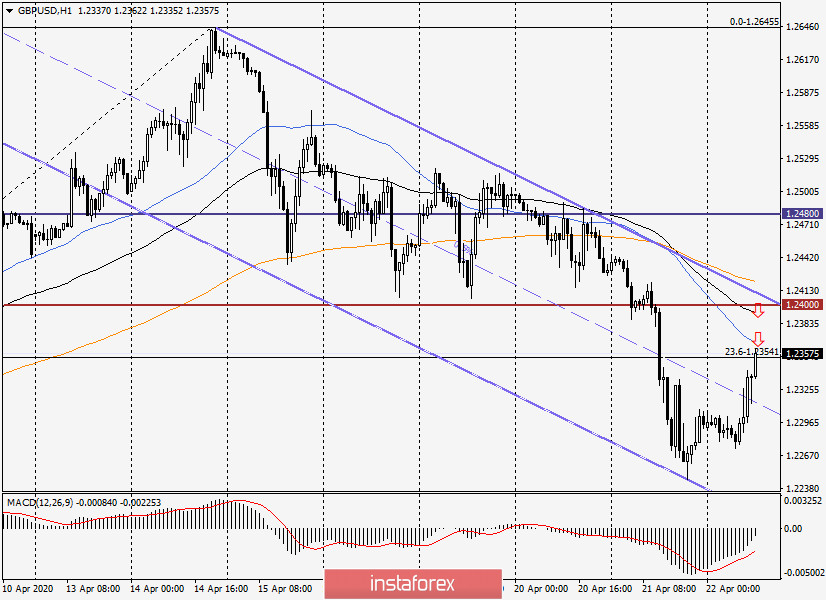

H1

I built a descending channel with parameters on the hourly chart: 1.2645-1.2485 (resistance line) and 1.2246 (support line). As you can see, the pair is currently trading above the average line of this channel and may well rise to the resistance line. If it goes up 50 simple moving average, which is at the level of 1.2368.

Conclusion and recommendations on GBP/USD:

As previously expected, the main trading idea for the pair remains sales, which are better to open after the rate rises to the price zones of 1.2350-1.2370 and 1.2390-1.2420. Those who want to buy can offer to do this on a rollback to the middle line of the channel, but I consider this positioning riskier. Given the complex and largely uncertain situation associated with the spread of coronavirus, it is better to see confirmation signals before opening positions.

Good luck!