Even though the European economy is falling into a catastrophe, this fact can not force the eurozone countries to come to a compromise on the issue of finding a solution to the current situation. Italy and Spain insist on issuing pan-European debt securities instead of national ones. In turn, Germany and the Netherlands offer them cheap loans. As a result, there were no specifics about how and to what extent the economy will be stimulated. Moreover, the position of Italy and Spain is quite understandable, since, despite the negative rates of return on their public debt, they are no longer able to service their public debt. So the new loans will not solve anything, but it will only postpone this issue for later. At the same time, the problem will just grow, which will further exacerbate economic problems. Germany does not want to take responsibility for the financial situation of all the eurozone countries. Moreover, direct loans give Germany the ability to control their use, and impose additional conditions on the borrower countries to guarantee their repayment. If we issue pan-European bonds, each country will be able to do whatever it wants with them. This means that financial carelessness in one country will automatically affect the ability of all others to raise much-needed funds. This is why the grand plan of economic assistance worth two trillion euros remains a plan, since it is completely unclear how it will be funded.

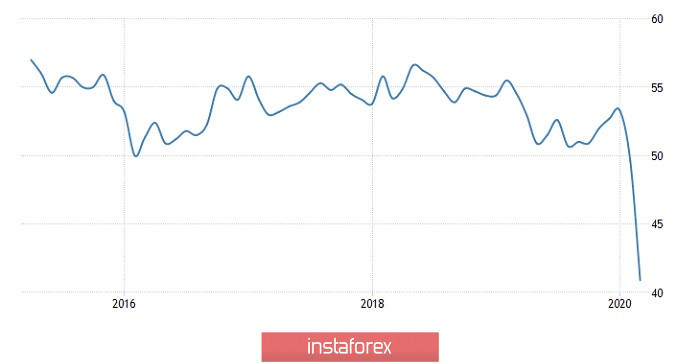

Preliminary data on business activity indices in Europe and in the United States will be released today. Moreover, they are both expected to fall. The index of business activity in the service sector could drop from 26.4 to 23.0, while the industrial index from 44.5 to 39.0. As a result, the composite business activity index could decline from 29.7 to 24.0. So the situation in the European economy is only getting worse, and the inability of the eurozone countries to compromise in such difficult times only aggravates the situation.

Composite Business Activity Index (Europe):

The situation is not any better in the United States. The index of business activity in the services sector could fall from 39.8 to 32.2, while the production index from 48.5 to 37.6. As a result, the composite index of business activity will decrease from 40.9 to 34.2. The only difference from Europe is that the index values are slightly higher. And this is a serious argument in favor of the dollar in current conditions. In addition, regular data on applications for unemployment benefits will be released today, which is expected to show that the labor market's situation is deteriorating further. The number of initial applications for unemployment benefits should once again decrease and amount to 4,545 thousand, which is still a huge number. But the number of repeated applications should continue to increase and it could even reach 13,000 thousand. That is, a new anti-record. However, oddly enough, these data have no effect on the dollar, but rather, it contributes to its growth. And the principle is quite simple - if everything is so bad in the United States, then in other countries things are even worse.

Composite Business Activity Index (United States):

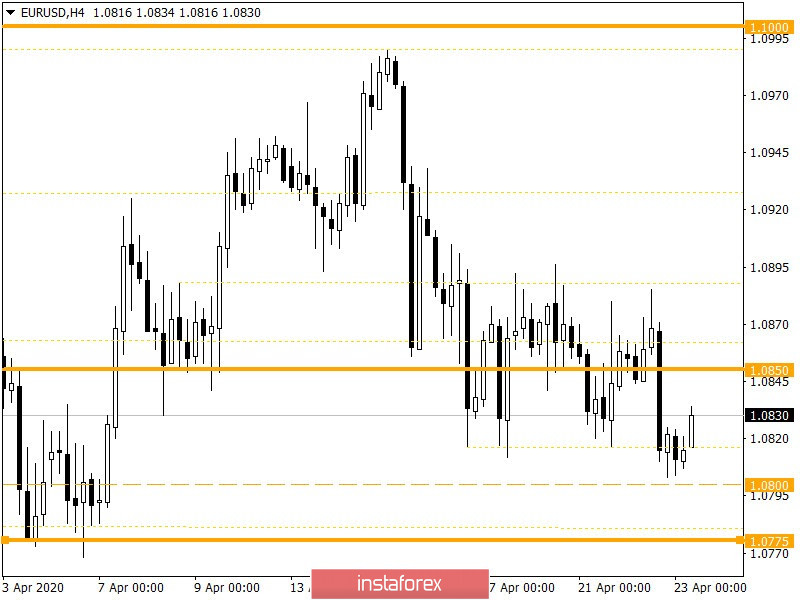

From the point of view of technical analysis, we see a local breakout of the lower boundary of the variable flat of 1.0810/1.0890, where the quote managed to go down to the value of 1.0803. In fact, there was a signal to violate the structure of the side channel, which subsequently can play into the hands of sellers, since the lower border is no longer considered a priority.

In terms of a general review of the trading chart, the daily period, the prevailing downward interest is visible, where inertial oscillations in the form of a Zigzag-shaped pattern were successively formed.

We can assume that the downward mood will continue in the market, where the main point of support will be the area where trade forces interact at 1.0775, but before directing its positions in the downward direction, you can not rule out a local rebound towards the mirror level of 1.0850.

We specify all of the above into trading signals:

- We consider the buy positions in terms of a pullback towards 1.0850.

- We consider selling positions lower than 1.0800, with the prospect of a move to 1.0775.

From the point of view of a comprehensive indicator analysis, we see a predominant downward interest in hourly and daily periods. Minute intervals focus on the pullback.