The British pound stopped falling against the US dollar amid drop in inflation data. The double decline in the eurozone's consumer confidence data, meanwhile, lowered the European currency, before the important EU summit. The ECB surprised Italy and Spain with its announcement that it will accept "junk" bonds as collateral.

Credit ratings of Italian and Spanish bonds may be revised if debt obligations of Italy and Spain continue to rise. According to some experts, investment rating is not as influential at the moment, however, the ECB decided to be proactive, saying that they are ready to purchase bonds even with a low rating. Although the decision was mainly made for simplified access of ECB money to eurozone banks amid the pandemic, the regulator inserted one caveat - bonds whose ratings were investment as of April 7 will be considered as collateral. Higher premium and risk discounts are not excluded. Such rules will be valid until September 2021.

Today, much will depend on the online EU summit, which will discuss the eurozone's problems regarding the pandemic, particularly on the issue of pan-European bonds and the European Commission's proposal to increase the EU budget for 2021-2022. Unfortunately, disagreement persists between the EU countries on these issues, which keeps pressure on the European currency.

Meanwhile, a sharp drop in the eurozone's consumer confidence index was reported yesterday. According to the European Commission, the index fell from -11.6 points to -22.7 points, the lowest value observed since March 2009.

US Secretary of Treasury Steven Mnuchin announced yesterday that most of the US economy will be open in summer. According to him, US spending does not matter at the moment, so the Fed and the government should spend as much as needed to overcome the coronavirus.

As for the technical picture of the EUR / USD pair, the bears reached the lower border of the 1.0815 channel, but serious pressure after the fourth test of the level has not yet been observed. Traders may be waiting for the reports in the US and the EU services and manufacturing sectors, as well as the outcome of the EU summit. If the euro receives support, then a break in the middle of the 1.0855 channel will strengthen the demand for risky assets, which may lead to a larger upward move of the pair to the areas of 1.0940 and 1.1040. But if authorities failed to agree at the summit, pressure on the trading instrument will return, and nothing good can be expected from the PMI indices. Breaking through 1.0815 will increase pressure on EUR / USD, and will open the way to annual lows in the areas of 1.0770 and 1.0710.

GBP / USD

Yesterday's UK inflation report supported by the British pound temporarily, however, the bulls failed to form a larger upward correction, since economic prospects remain unclear, and the Bank of England is in no hurry to provide new assistance.

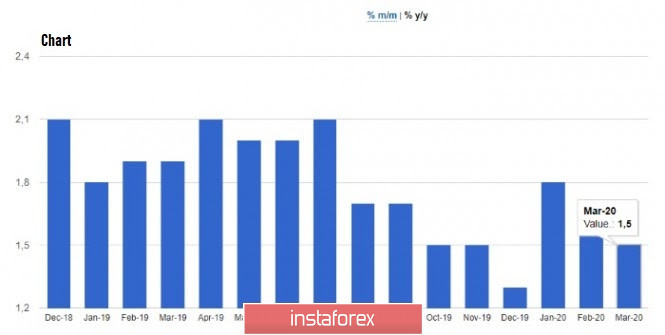

According to a report by the National Bureau of Statistics, UK's annual consumer price inflation fell to 1.5% in March, slightly worse from the 1.6% forecast. Forecasts for the second half of the year were also negative given the pound's rapid decline in March. According to some economists, inflation may slow down to 0.5% due to extremely low energy prices and sluggish demand amid falling employment.

Lending in the UK public sector is projected to grow by 220 billion pounds, or about 10% of UK GDP, which is expected to decline by 6.5% at the end of 2020. The Office for Budget Responsibility will publish its report on 2020-2021 state revenues and expenditures today, from which we can clearly see all the figures.

As for the current technical picture of the GBP / USD pair, in the short-term, much will depend on activity reports in the UK's services and manufacturing sector. If the indicators turn out worse than economists' forecasts, the pressure on the trading instrument will return, and the break of the support of 1.2300 will bring the pound down to the lows of 1.2240 and 1.2170. Growth will be limited by yesterday's high in the area of 1.2380, a break of which will open a direct road to the area of 1.2440.