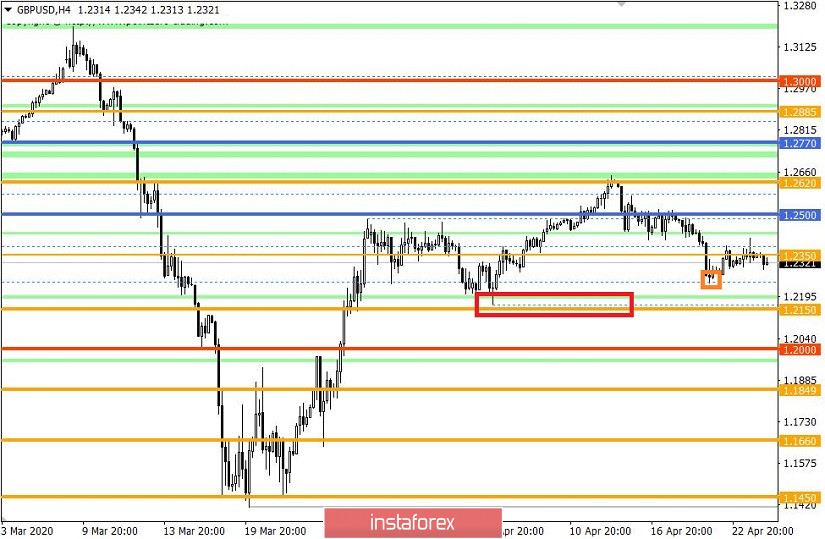

An impressive slowdown, which accelerated the move, was observed. Market participants focusing on the mirror level of 1.2350 formed a variable range with an amplitude of about 30-40 points. Since the downward mood remained and trading forces were regrouped, the growth of new volumes was affected. The slowdown was an excellent conclusion of the technical correction from the value of 1.2250. The last step, updating April 21's low (1.2246), remains. n impressive slowdown, which accelerated the move, was observed. Market participants focusing on the mirror level of 1.2350 formed a variable range with an amplitude of about 30-40 points. Since the downward mood remained and trading forces were regrouped, the growth of new volumes was affected. The slowdown was an excellent conclusion of the technical correction from the value of 1.2250. The last step, updating April 21's low (1.2246), remains.

Our analogy with the dynamics of the EUR / USD pair is gradually becoming apparent. The euro has already managed to update the local low, whereas the pound was still concentrating at the mirror level of 1.2350. Perhaps, it is time for the British currency to move now, by first pushing at the value of 1.2246, and then reaching the main level of 1.2150 during a wave of acceleration.

In the prospects of the GBP / USD pair's development, quotes may return to the values relative to the upward trend during March 20 to April 14. Thus, for a more distinct signal, reaching the area of 1.2150 is necessary.

Variable bursts of activity were observed yesterday. At the end of the daily candle, concentration at the mirror level became more significant, where the amplitude shrank to 20 points.

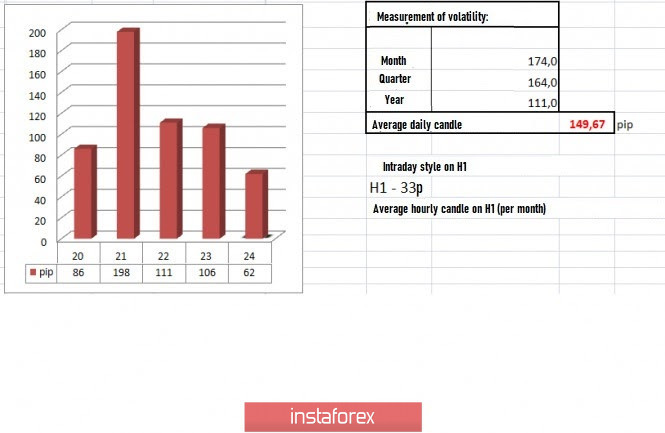

In terms of volatility, the same dynamics were seen on the indicator, as movement still courses at the same mirror level. Speculative mood also has not gone away.

Details of volatility: Monday - 165 points; Tuesday - 245 points; Wednesday - 172 points; Thursday - 358 points; Friday - 359 points; Monday - 144 points; Tuesday - 271 points; Wednesday - 676 points; Thursday - 354 points; Friday - 522 points; Monday - 267 points; Tuesday - 296 points; Wednesday - 333 points; Thursday - 452 points; Friday - 352 points; Monday - 148 points; Tuesday - 227 points; Wednesday - 108 points; Thursday - 126 points; Friday - 198 points; Monday - 116 points; Tuesday - 217 points; Wednesday - 131 points; Thursday - 122 points; Friday - 42 points; Monday - 87 points; Tuesday - 146 points; Wednesday - 193 points; Thursday - 119 points; Friday - 114 points; Monday - 86 points; Tuesday - 198 points; Wednesday - 111 points; Thursday - 106 points. The average daily indicator, relative to the dynamics of volatility,

As discussed in the previous review, traders focused on the mirror level of 1.2350, where main positions were never opened.

Traders are counting on the resumption of the downward move. Consolidation below 1.2300 will open the way to the values of 1.2250 and 1.2150.

In the daily chart, the upward tact on March 20 to April 14 formed a significant slowdown, which can be described as a possible change in trading interest.

In terms of macroeconomics, Britain's business activity indices came out much worse than forecasts. Business activity in the service sector fell from 34.5 to 12.3, and the production index fell from 47.8 to 32.9. As a result, the composite index fell from 36.0 to 12.9.

Market reaction did not play out much.

A similar PMI in the US came out in the afternoon. The service sector in the US recorded a decrease from 39.8 to 27.0, while the manufacturing sector recorded a decrease from 48.5 to 36.9. Applications for unemployment benefits also came out, which were much more terrible - new applications were 4,427,000, while repeated applications were 15,976,000.

Market reaction at this time took hold of the US dollar, but only locally.

Meanwhile, British Prime Minister Boris Johnson was reported to have recovered from the coronavirus and intends to return to work on Monday, April 27th.

However, despite the captain's return, problems still remain. According to Bank of England representative Gertjan Vlieghe, Britain will face the biggest economic downturn in centuries due to the pandemic.

"Judging by the early signs and experiences of other countries affected earlier than the UK, it seems that we are experiencing the strongest and fastest economic downturn in the last century, and possibly several centuries," said Vlieghe.

Recovery process may be delayed and turn out to be U-shaped rather than V-shaped, Vlieghe also noted.

Britain's retail sales in March decline by 5.8%, which inspired fear among investors.

March's data on the volume of orders for durable goods in the US will be published in the afternoon, where an impressive decline of -11.9% is expected.

The upcoming trading week awaits the meetings of the Fed and the ECB, as well as the preliminary data on US GDP.

The most significant events are displayed below (Universal time):

Tuesday, April 28

USA 14:00 - S&P / CS composite housing price index (YoY) (Feb)

Wednesday, April 29

USA 13:30 - preliminary data on GDP (Q1)

USA 19:00 - Fed meeting

USA 19:30 - Fed press conference

Thursday, April 30

EU 12:45 - ECB meeting

USA 13:30 - Weekly report on applications for unemployment benefits

Friday, May 1

Germany / France / Italy / Spain / Switzerland - day off (Labor Day)

Great Britain 9:30 - Manufacturing PMI (Apr)

USA 15:00 - ISM Manufacturing PMI

Further development

A local surge in activity caused by the concentration of trading forces at the mirror level of 1.2350 was observed during the Asian session. As a result, the level of 1.2300 was hit by shadows during the H1 period. Consolidation may not have happened but activity does not end there. Downward mood is still active, and the picture may soon change.

Speculative positions also remain, relative to the market move. However, medium-term deals may soon emerge.

Consolidation attempts at the value of 1.2300 were also present. Soon, we will be pulled towards 1.2250.

Bearish mood will continue to persist. Local positions to be considered in case of a repeated break of 1.2300 down, with a prospect move to April 21's low - 1.2246. The next main move will be after the consolidation below 1.2240, where going towards the support of 1.2150 will be attempted.

Based on the above information, we came up with these trading recommendations:

- Open shorts below 1.2300, towards 1.2250. Consolidation will push the pair to the main level of 1.2150.

- Alternatively, buy longs if the price consolidates above 1.2360, towards 1.2380.

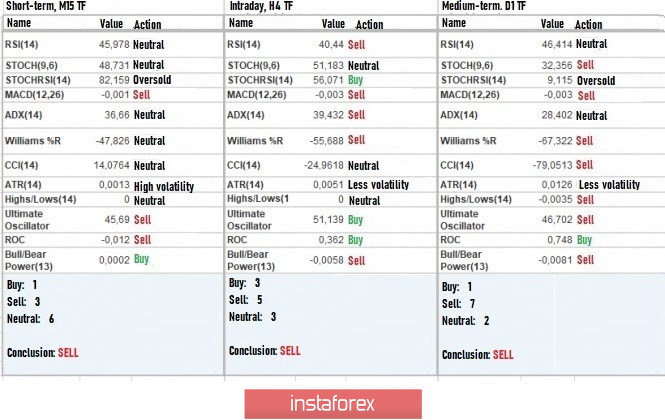

Indicator analysis

The hourly and daily periods indicate a bearish mood, which reflects general interest. The same can be seen on the minute intervals.

Volatility per week / Measurement of volatility: Month; Quarter year

The volatility measurement reflects the average daily fluctuation, calculated by Month / Quarter / Year.

(April 24 was built, taking into account the time of publication of the article)

Current volatility is 67 points, which is 58% lower than the daily average. Acceleration may still occur even while maintaining a downward measure.

Key levels

Resistance zones: 1.2350 **; 1.2500; 1.2620; 1.2725 *; 1.2770 **; 1.2885 *; 1.3000; 1.3170 **; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support Areas: 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411); 1.1300; 1,1000; 1,0800; 1,0500; 1,0000.

* Periodic level

** Range Level

*** Psychological level

**** The article is built based on the principle of conducting a transaction, with daily adjustment