To open long positions on GBPUSD, you need:

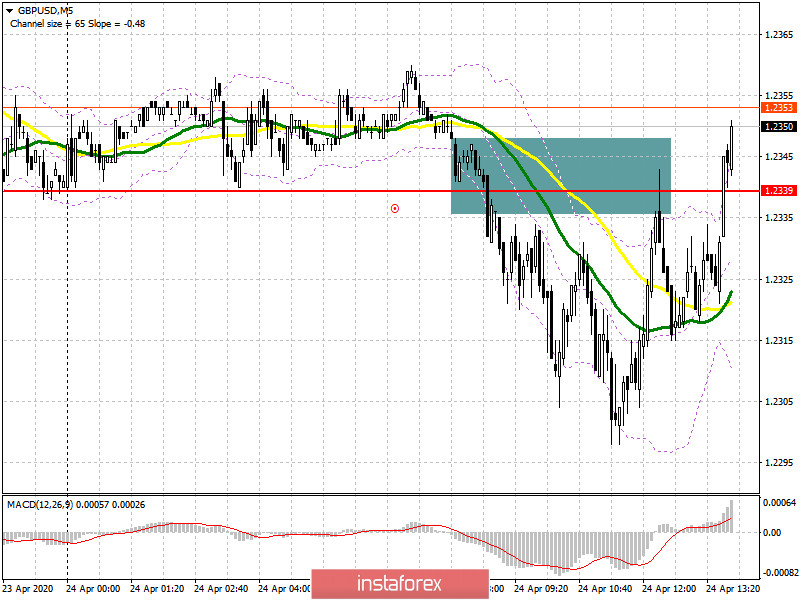

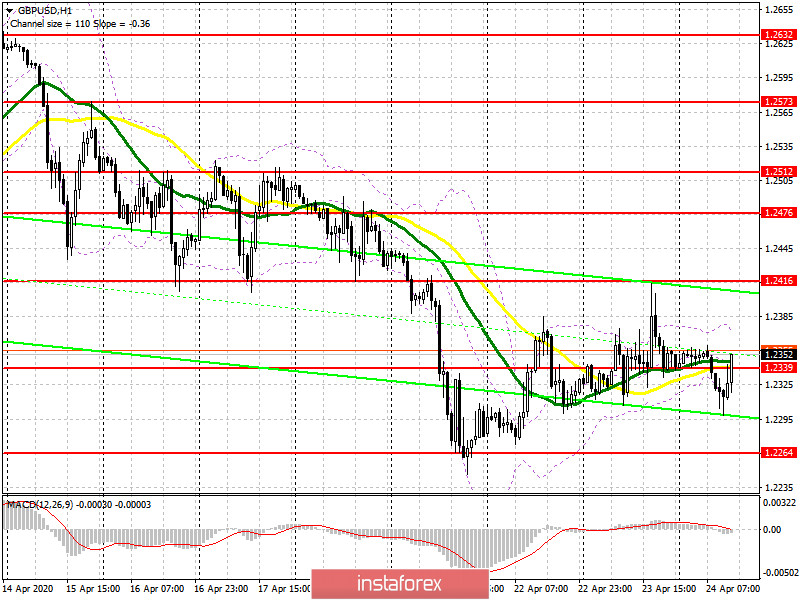

The report on retail sales in the UK was ignored by traders, although the bears tried to resume the downward trend, fixing below the level of 1.2339 in the first half of the day, which is clearly visible on the 5-minute chart. Even with the second test of this resistance from the bottom up, sellers acted actively, intending to update the minimum of 1.2264, but the market did not go below the lows of yesterday. At the moment, the bulls have regained the level of 1.2339, and while trading will be above this range, we can expect the upward correction to continue to the resistance area of 1.2416 and then test the maximum of 1.2476, where I recommend taking the prof. In the scenario of a repeated return of GBP/USD under the support of 1.2339, it is best to look at long positions only for a rebound from the weekly low in the area of 1.2264, and then, counting on the upward correction of 30-40 points within the day.

To open short positions on GBPUSD, you need:

Sellers tried several times to resume the bearish trend below the level of 1.2339, taking advantage of a poor report on retail sales in the UK, which saw a decline of more than 5.0%. However, it was not possible to achieve a major fall in the pound again, which calls into question the strength of the bearish trend formed since mid-April this year. In the second half of the day, it is best to consider new short positions only after the bears once again push the pair under the support of 1.2339, and consolidate below it. Only then can we expect a repeated decline in GBP/USD to the area of the minimum of 1.2264 and a larger fall of the pair to the support of 1.2173, where I recommend fixing the profits. In the GBP/USD growth scenario, you can return to short positions after testing the maximum of 1.2416, or even higher, from the major resistance of 1.2476, counting on correction of 30-40 points within the day.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily averages, which indicates market uncertainty with the future direction.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break in the lower border of the indicator around 1.2320 will increase the pressure on the pair. A break of the upper limit in the area of 1.2372 will lead to a larger upward correction.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20