To open long positions on EURUSD, you need:

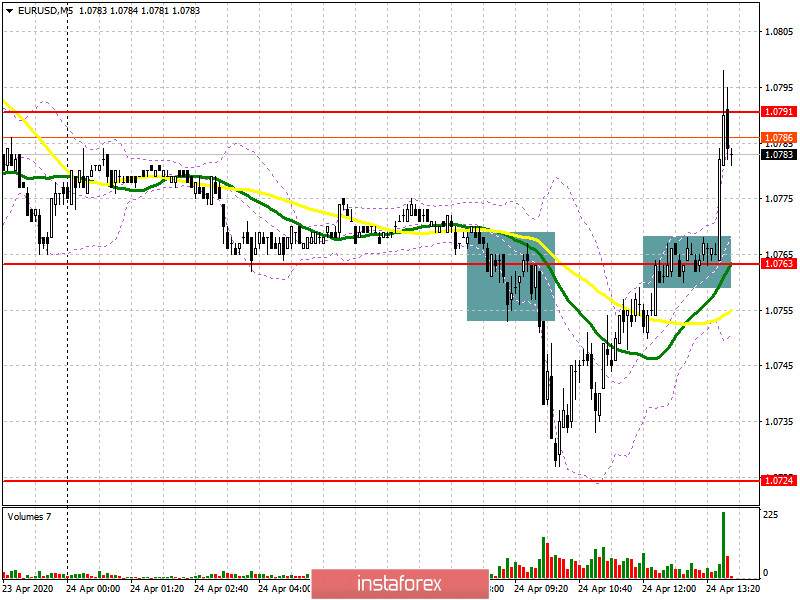

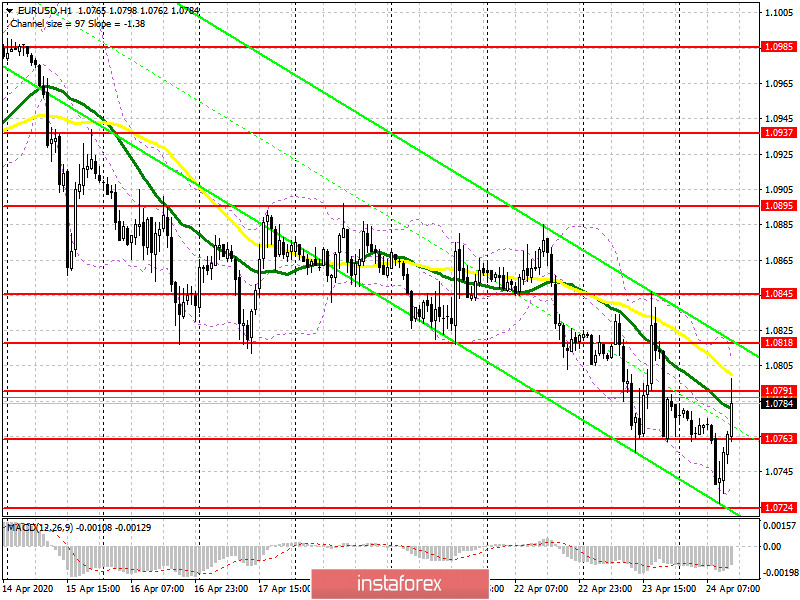

A breakdown of the support of 1.0763 and consolidation below this range, which is clearly visible on the 5-minute chart, led to a decrease in the European currency, which I paid attention to in the morning forecast, and where I recommended opening short positions. Unfortunately, the bears did not reach their target around 1.0718 and left the market after a weak report on the state of the German economy, which continues to decline at a very rapid pace. The current growth of the euro can be attributed to profit-taking at the end of the week after the analysis of the final EU summit. At the moment, the bulls have returned to the level of 1.0763, from where purchases continued in larger volumes, which is also clearly visible on the 5-minute chart. The current task of the bulls will be a breakthrough and consolidation above the resistance of 1.0791, the first test that has already taken place, which will only increase demand for EUR/USD and will update the highs of 1.0818 and 1.0845, where I recommend taking the profit. Another false breakout formation in the support area of 1.0763 will also be a signal to open long positions. If there is no activity at this level, it is best to postpone long positions immediately to rebound from this week's low around 1.0725.

To open short positions on EURUSD, you need:

Sellers coped well with the morning task and continued to fall the euro, which I discussed in detail in my review. However, the rapid market reversal has already led to a resistance test of 1.0791, where new active sales are visible. Before opening short positions from this level, it is best to wait for the formation of a false breakout. If there is no active downward movement from this resistance, I recommend waiting for the update of the larger levels of 1.0818 and 1.0845 and opening short positions from there immediately for a rebound in the expectation of an intraday correction of 30-40 points. An equally important task for sellers will be to return EUR/USD to the support of 1.0763, which will again increase pressure on the euro and lead to an update of the weekly low in the area of 1.0724, as well as maintain the downward trend.

Signals of indicators:

Moving averages

Trading is below the 30 and 50 daily moving averages, which indicates a further fall in the euro.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of an upward correction, the upper limit of the indicator around 1.0805 will act as a resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20