US stock indices closed the week on a positive note, primarily due to the growth of shares of technology companies. Asian stock exchanges are also trading in the green zone on Monday morning. Generally, the mood remains positive due to the slowdown in the spread of coronavirus.

The Congressional Budget Committee has presented preliminary forecasts for key economic indicators until the end of 2021. According to the NEA, real GDP will decline by 12% in the 2nd quarter, the unemployment rate will be 14%, the national debt will reach 101% of GDP at the end of fiscal 2020, but most importantly, the federal budget deficit is projected at $ 3.7 trillion.

The number of initial applications for unemployment has increased again, this time by 4.427 million, and the total volume of applications for 4 weeks exceeded 26 million.

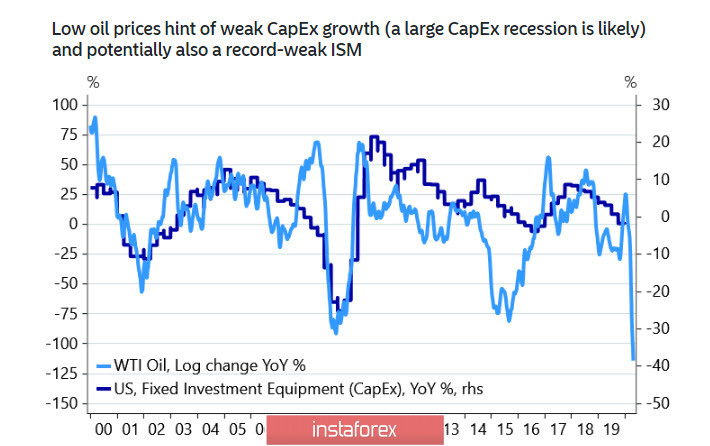

On the other hand, the US economy is sinking into a deep depression, and if the United States is plunged into depression, then most other world economies will follow. The current oil prices indicate a record decline in investment, and a sharp increase in unemployment and a decrease in orders for durable goods will also lead to a record drop in ISM.

This current week will pass under the sign of expectation – the Fed and the ECB will meet on Wednesday and Thursday. Former FOMC member Kocherlakota justifies the need for negative interest rates, and if the Fed takes this step, the next logical step would be the Japanese way of eternal QE, when the government debt issued by the government is immediately bought by the Central Bank without any prospects to break this vicious circle.

According to the CFTC Friday report, the dynamics of speculators is not high, the total short position in the dollar has additionally decreased by 0.124 billion, while the positive signals about a slowdown in the spread of coronavirus increase the chances of a resumption of global economic growth starting from the 3rd quarter. Therefore, the dollar will remain under pressure against most currencies G10.

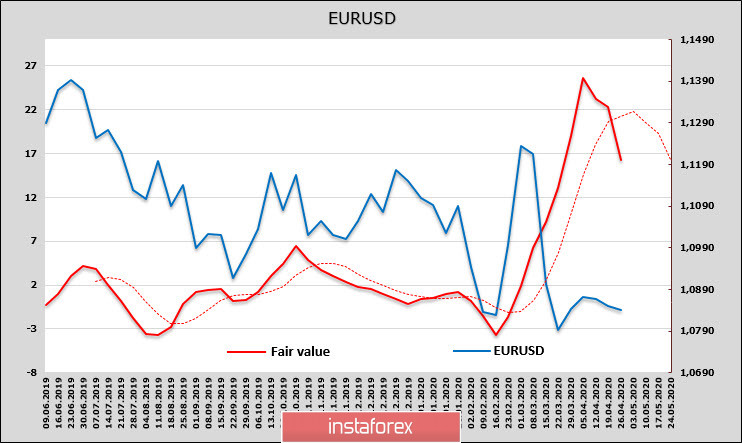

EUR/USD

Despite the fact that the cumulative long position in the euro, as follows from the CFTC report, has slightly decreased, the bullish advantage remains significant. The estimated fair price is at 1.12, so the chances of resuming growth remain high.

Support located at 1.0760 / 80 resisted, short-term impulse is up, the nearest resistance is at 1.0870 / 90 and 1.0990. The probability of euro growth will increase as the ECB meeting on Thursday approaches, as ECB officials do not give clear signals about the expected additional measures to support the eurozone economies, which indirectly indicates a lack of consensus.

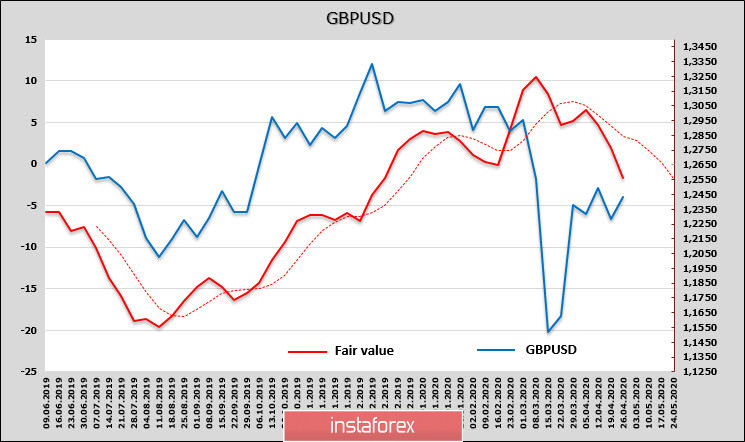

GBP/USD

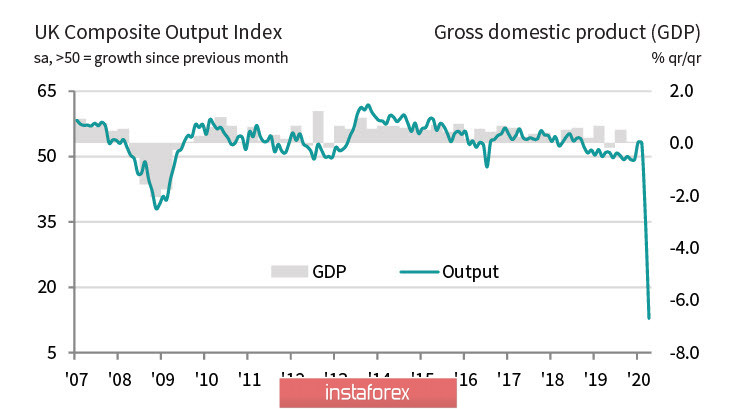

UK business activity indexes showed the largest decline in the entire period of observation. PMI in production declined from 47.8 to 32.9p, while from 34.5p to 12.3p in the services sector. As a result, a decline in GDP by 7% in the 2nd quarter is expected. The fall of the PMI index exceeded the lows of 2008 and, obviously, indicates the probability of a much deeper recession than 12 years ago.

In fact, the decline in GDP may be even deeper than 7%, since PMI studies do not consider the self-employed and the retail sector, whose problems are even deeper. CBI reports a 56% decline in production orders in April, and this is from the already low base in March. Meanwhile, retail sales fell 5.1% in March and CBI expects a 40% fall in April. Gfk's consumer confidence index also fell from -9p. up to -34p. All this is accompanied by a massive loss of jobs.

The CFTC report for the pound was negative, the total position became bearis and the total volume of contracts decreased by 0.361 billion.

The spot price is almost equal to the estimated price, but the direction of the latter is steadily down, so the resistance zone of 1.2450 / 70 can stop short-term growth and the pound will resume decline. The pound may pull back to the lower boundary of the horizontal range of 1.2150, which is the most likely scenario for the coming week on Monday morning.