Weak economic data released by the US on Friday once again justified fears of economists that the US GDP may contract by more than 5.0% by the end of this year. However, analysts argue that this scenario is rather positive since it is not known yet how long the coronavirus pandemic will affect the economy.

The report released on Friday by the US Department of Commerce showed a decline in demand for durable goods in March this year. The bigger-than-expected drop was due to a sharp decrease in demand for transport orders. Thus, new orders for durable goods in March 2020 fell by 14.4% compared to the previous month, while economists expected a 12% fall. As mentioned before, the decline was mostly due to the sharp collapse of the transport equipment that plunged by 41% in March. Excluding the transport equipment, new orders dipped by only 0.2%. Such a drastic decrease occurred due to the bankruptcy of a number of companies in the United States caused by the spread of the coronavirus.

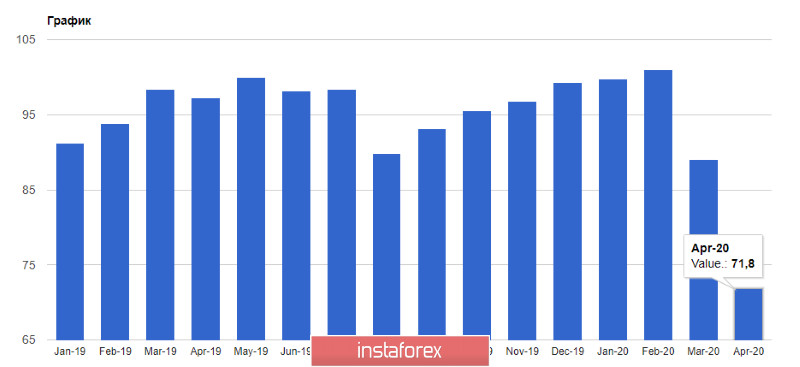

A report from the University of Michigan unveiled on Friday also showed that the outlook for the US economy has deteriorated according to its citizens. The data revealed that the consumer sentiment index in April 2020 crashed to 71.8 points from 89.1 points in March, while economists expected the index to come in at 67 points. Nevertheless, taking a closer look at the composite indicators of the index, which reflect the current assessment and prospects of the economy, some positive figures can be also seen. The expectations index shed only 9.6 points in April to 70.1 points, while the consumer sentiment index shrank by 29.4 points to 74.3 points. This difference indicates that households expect a sharp economic recovery after the ease of the coronavirus pandemic in the summer.

Traders were disappointed by the report published by the Fed of Kansas City, which showed the reduction in the service sector as the main sectors of the economy are locked down due to the coronavirus epidemic. A report from the Federal Reserve Bank of Kansas City indicated that the composite index fell to -58 points in April from -16 points in March.

This weekend US Treasury Secretary said that the economic activity in the US would be resumed after the quarantine, and this would happen presumably in May-June this year. By July, the US expects to see the first signs of its recovery after the pandemic. According to Steven Mnuchin, an impressive increase will occur in August and September because of the stimulus measures.

However, traders remain cautious due to the forecasts made by the Congressional Budget Office last week. The report unveiled that the US economy would shrink by 5.6% in 2020. This is one of the most optimistic scenarios. The US economy will be able to reach the pre-crisis indicators only by the end of 2021.

This week, the US Federal Reserve and the European Central Bank will hold their meetings. The Fes is most likely to remain the key rate unchanged, while the ECB may lower the interest rate to -0.7% from the current level of -0.5%. The ECB may also increase the number of reserves of commercial banks that are not subject to negative rates.

Against this background, the current rally of the single currency may be halted. Additionally, the demand for risky assets will remain low.