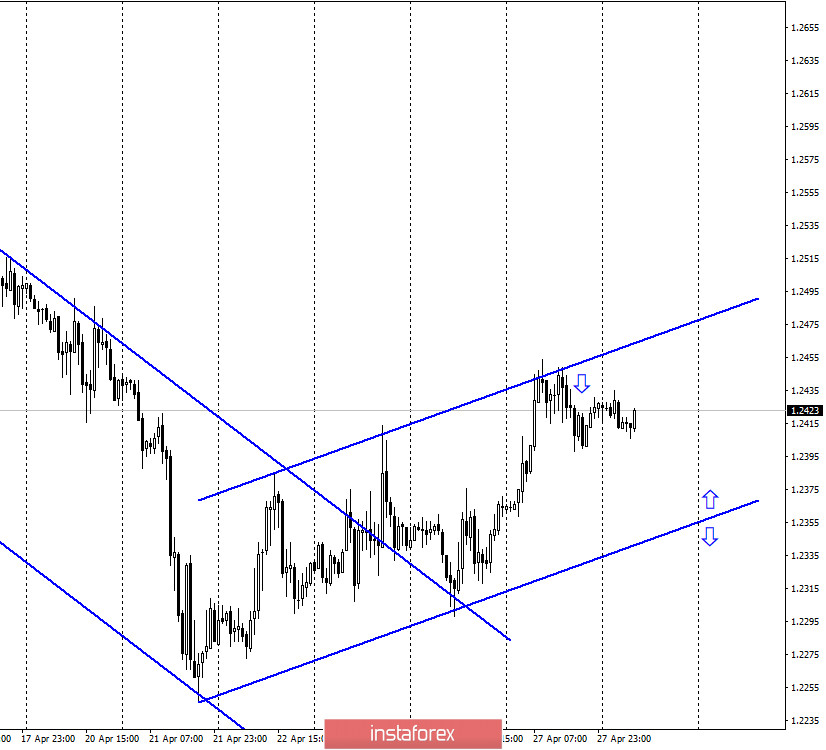

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair performed a reversal in favor of the US currency near the upper line of the upward trend corridor. Thus, on April 28, the process of falling in the direction of the lower line of the corridor began. The general mood of traders remains "bullish" and is supported by the trend corridor. There was also no economic news in the UK on Monday. But representatives of the health sector reported that over the past day, the least number of deaths from coronavirus was recorded over the past month. Also yesterday, for the first time since his illness, Boris Johnson addressed the nation, who said that the peak of the epidemic is probably over, but it is too early to remove the quarantine and celebrate the victory. The UK government will soon begin to consider the possibility of easing the quarantine measures, but there is no official information about this yet.

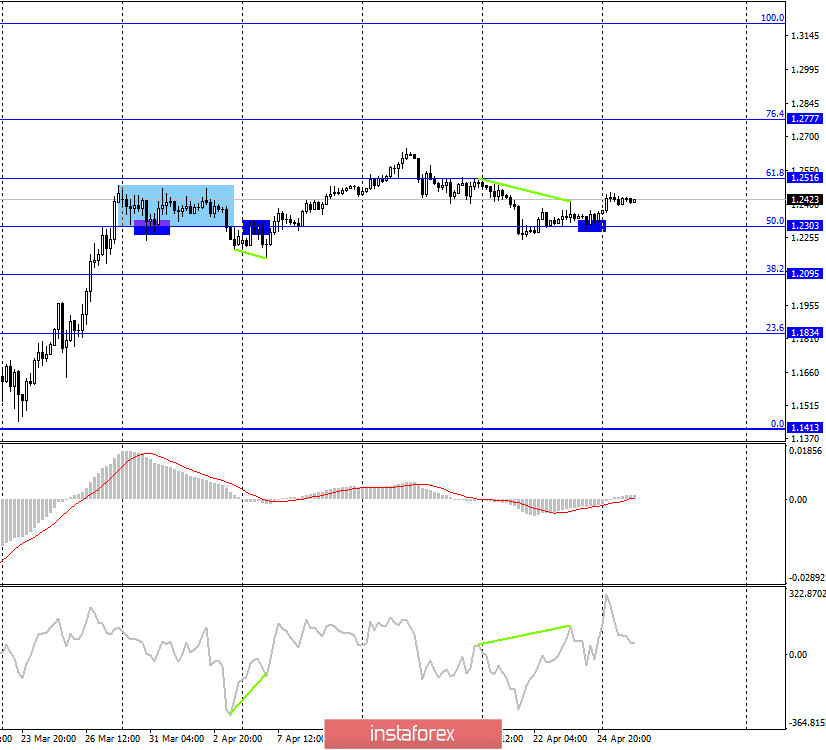

GBP/USD – 4H.

On the 4-hour chart, the pound/dollar pair, after rebounding from the corrective level of 50.0% (1.2303), performed a reversal in favor of the British currency and began the growth process in the direction of the corrective level of 61.8% (1.2516). Thus, the readings of the two most lower charts coincide and indicate a "bullish" mood of traders. The rebound of the pair's exchange rate from the Fibo level of 61.8% will allow traders to expect a reversal in favor of the US currency and a slight fall in the direction of the Fibo level of 50.0%. Fixing the quotes above the level of 61.8% will increase the probability of further growth towards the next corrective level of 76.4% (1.2777). No new divergences are currently being observed in any indicator.

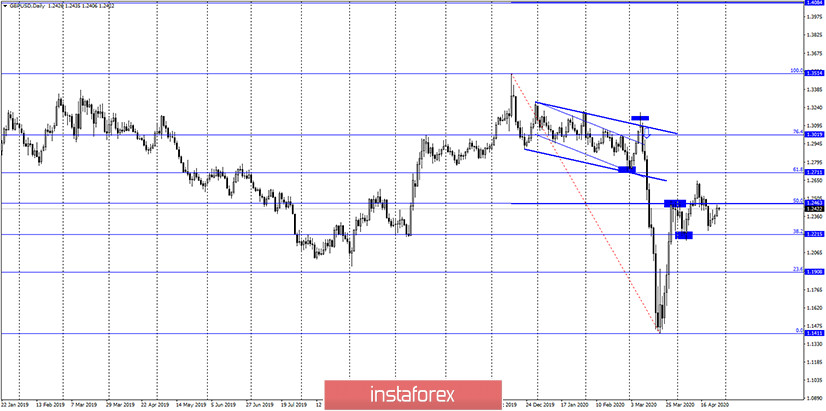

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a reversal in favor of the English currency and returned to the corrective level of 50.0% (1.2463). The rebound of quotes from this level will work in favor of the US dollar and resume the fall in the direction of the corrective level of 38.2% (1.2215).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the top two trend lines, but in the long term.

Overview of fundamentals:

There were no reports or economic news in the UK or America on Monday. Thus, traders are waiting for the second half of the week, when there will be quite a lot of different important economic reports in America, as well as a meeting of the Fed and a press conference with its Chairman Jerome Powell.

News calendar for the US and UK:

Today, April 28, the UK and US news calendars again do not contain any important information.

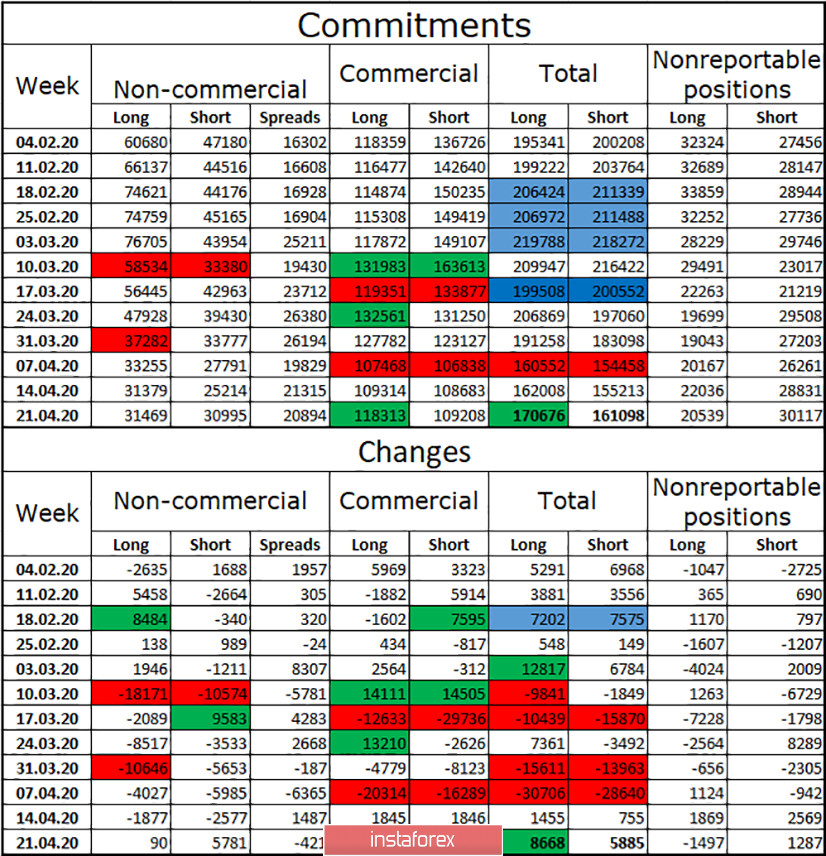

COT (Commitments of Traders) report:

A new COT report showed an overall increase in the number of long and short contracts. This means that interest in the British among major market players is beginning to grow slowly. However, overall trading volumes remain fairly low. During the reporting week, the total number of longs increased by 8,668 contracts, and shorts - by 5,885. The overall advantage also remains for long, and it is also minimal - 170,000 against 161,000. A larger number of longs are also focused on the hands of a separate group of hedgers. But for a group of speculators, equality is almost complete – 31,000 short and long. Thus, since it is generally assumed that speculators drive the market, this judgment is now untenable. Speculators last week increased just short contracts, which was not enough to resume the downward trend.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound today with a target of 1.2303 if the rebound from the corrective level of 61.8% on the 4-hour chart is completed. I do not recommend buying the pound yet since the quotes have already performed an increase to the upper line of the corridor on the hourly chart and have now begun to fall.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.