Like many other major world currencies, yesterday the ruble was stuck in the same range. Its intraday fluctuations were insignificant. Nevertheless, it is hardly surprising taking into account the latest events. Some economists thought that the market would be stirred by the news on a decline in oil prices below the $ 20 per barrel mark. However, the lack of response to this event indicates that traders are anticipating soon recovery in oil prices. Besides, the turmoil in the oil market cannot last forever. Additionally, more and more market participants assume that Saudi Arabia and Russia are benefiting from the current situation. Just over the weekend, major American business magazines published rough calculations showing that Russia can withstand the current level of oil prices for at least two years. Yet, many economists assume that Russia will be able to cope with the low oil prices for far more years. This statement is debatable, but there is a grain of truth in it. Investors prefer to take a wait-and-see approach amid market uncertainty.

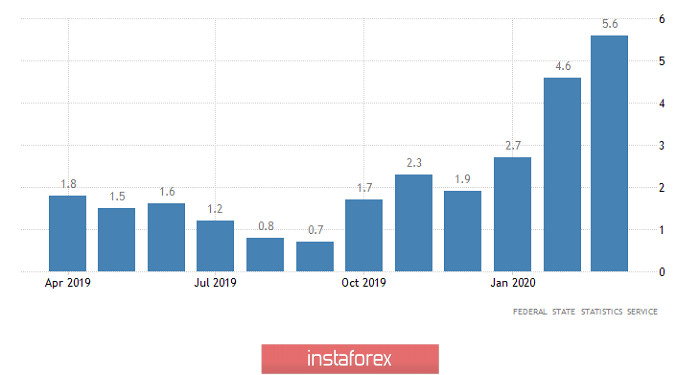

What is more, traders were surprised by yesterday's macroeconomic statistics, which were very different from other countries. For example, retail sales growth accelerated from 4.6% to 5.6% in March. Although economists expected them to slow down to 2.2%. The real wage growth fell from 6.5% to 5.7% instead of 5.1%. As seen, the recent data is rather positive. However, there is an explanation. However, the data issued on wages was for February. As for the retail sales, the restrictive measures and self-isolation regime were introduced only in April. By the end of March, everyone was well aware that all this was inevitable. Many employers allowed their employees to work from home. This triggered a wave of a panic, and at the end of March, people frantically bought food and necessities. The consumer boom in the stores and supermarkets reached such a level when there was a shortage of some goods. This is why a sharp decrease in the retail sales may be seen only in macrocosmic statistics for April.

Retail sales (Russia):

Today, the ruble stays still. Most likely, this will last for the entire day. Investors are awaiting the upcoming meetings of the Fed and the European Central Bank. The regulators may announce the introduction of additional stimulus measures, including lowering interest rates. Hence, traders prefer sitting on the sidelines. So, investors are anticipating the results of the meetings of the two largest central banks in the world. This is why there will be no market moving events until these meetings. The US dollar is most likely to remain just below the level of 75.00 against the ruble.