Hello, dear colleagues!

Today's review of the main currency pair of the Forex market will start with macroeconomic statistics, which will not be so much. No reports from the Eurozone are scheduled for today. The United States will publish several data that may arouse interest from investors. First of all, traders should pay attention to the consumer confidence indicator, which will be published at 15:00 (London time). A little earlier, at 14:00 (London time), the S&P house price index will be released. According to analysts, consumer confidence will fall to 88, while the previous figure was 120. I think this is not surprising or unexpected, because the negative consequences of the COVID-19 epidemic cannot but affect the world's leading economy.

The events of the next two days will be much more important and significant. Let me remind you that on Wednesday evening, the US Federal Reserve (FRS) will publish its decision on interest rates, and a little later there will be a press conference of the head of the Federal Reserve Jerome Powell. A day later, the European Central Bank (ECB) will inform market participants of its decision on interest rates, and ECB President Christine Lagarde will hold a press conference. Before these events, preliminary data on the US and Eurozone GDP for the first quarter will be released. Let's talk about this in more detail on the release day.

It seems that the main events for EUR/USD will be the decisions of the world's two largest central banks and the comments of their leaders. But it is difficult to guess how strong will be the reaction of market participants. First, for more than a month, investors have been paying little attention even to important statistics and comments from monetary officials of various ranks. Second, both the Fed and the ECB have already announced their programs to stimulate and support the economy, so it is unlikely that they will be able to surprise the markets. Unless some additional measures will be announced to counteract the negative consequences of the coronavirus epidemic.

By the way, despite the fact that the number of infected with COVID-19 in the world has exceeded 3 (three) million people, many countries are removing restrictions related to quarantine measures, or are considering such a possibility. Everything is clear and understandable, everyone wants to return to normal full-fledged life as soon as possible, and the economies of virtually all states are suffering huge losses. This is especially true for countries whose budget is heavily dependent on tourism and hotel business. There's just trouble here! Few tour and airline operators will be able to withstand and recover from the devastating effects of the pandemic.

Meanwhile, US President Donald Trump continues to blame all the troubles on China, which allegedly hid information about COVID-19 and now has to pay a huge compensation for the spread and consequences of the epidemic. The question is complex and far from clear. Most likely, such statements by Trump are intended to shift responsibility and raise their rating in the run-up to the next US presidential election. Anyway, it's time to move on to the technical analysis of the euro/dollar currency pair.

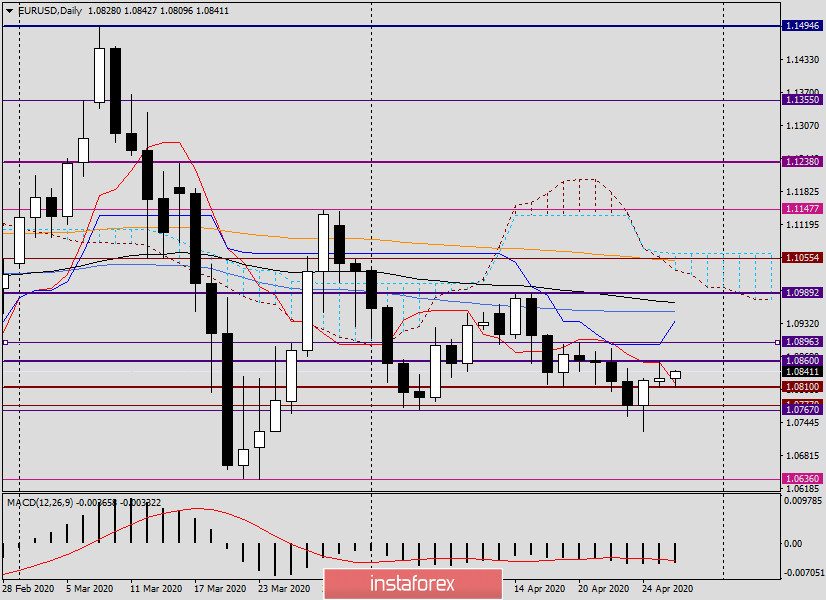

Daily

As expected the day before, the euro bulls made attempts to continue the rate rise but met strong resistance on the Tenkan line of the Ichimoku indicator, which did not let the pair above the strong technical level of 1.0860.

At the same time, the support at 1.0810 held and was not broken. Thus, at the end of this review, the euro/dollar is trading in the range of 1.0860-1.0810. It would be reasonable to assume that an exit from this range in one of the sides will indicate the subsequent direction of the price, but in the run-up to the main events of this week, this is not quite correct. I believe that the decisions and comments of the Fed and ECB will make adjustments to the price dynamics of the main currency pair of the Forex market.

Now the euro/dollar is slightly stronger and will most likely re-test the strength of sellers' resistance at 1.0860. If this level can be overcome, the next goal of players to increase the rate will be 1.0896, where the maximum trading values were shown on April 20.

Conclusions and trading recommendations for EUR/USD:

I continue to consider the ascending scenario as the main one and suggest considering purchases with small goals after a true breakout of 1.0860 or after a pullback to the area of 1.0827-1.0812.

On the other hand, do not underestimate the strength of resistance in the price zone of 1.0860-10870. If there are reversal patterns of candle analysis on 4-hour and (or) hourly timeframes that indicate the probability of a decline, you can try to sell. The nearest targets for purchases are 1.0900. It is better to fix sales in the area of 1.0815-1.0800.

Good luck!