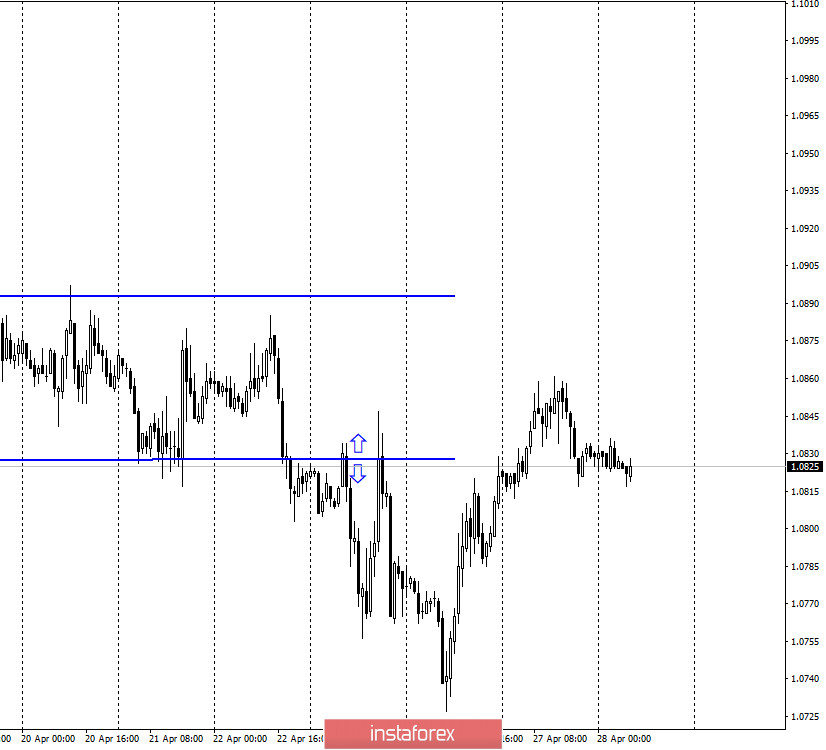

EUR/USD – 1H.

Hello, traders! The euro/dollar pair performed a reversal in favor of the US currency on April 27 and began a slow decline in quotes. There are no new graphical constructions on the hourly chart, so I recommend trading on a 4-hour chart at this time. There is nothing special to highlight from the news on the first day of the week. There were no important reports or other events scheduled for that day. Nevertheless, in America, Treasury Secretary Steven Mnuchin made a speech, which tried to reassure with words that the US economy will begin to recover in the coming months. According to Mnuchin, the huge amounts of dollars that have been invested in the economy will bear fruit. The Finance Minister also echoed Donald Trump and said that in the near future the economy "will be open". Thus, despite the ongoing epidemic (more than three million cases worldwide as of April 28, and 988,000 in America), many states can no longer sit in quarantine and are going to gradually weaken it.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair performed a reversal in favor of the US currency after the formation of a bearish divergence at the CCI indicator. Thus, without working out the downward trend line, the pair's quotes have a chance to resume falling in the direction of the corrective level of 0.0% (1.0638). Recently, the activity of traders has decreased slightly, but in the second half of this week, there will be a large number of different reports and events. So, I expect activity to increase this week. No indicator shows any new emerging divergences on April 28. Fixing the pair's exchange rate above the trend line will work in favor of the EU currency and significantly increase the probability of further growth in the direction of the corrective level of 38.2% (1.0964).

EUR/USD – Daily.

On the daily chart, the euro/dollar pair made a consolidation under the Fibo level of 23.6% (1.0840), as well as under the "narrowing triangle", which increases the probability of further fall of the pair in the direction of the corrective level of 0.0% (1.0637). Only fixing the quotes above the Fibo level of 23.6% will allow traders to count on some growth of the pair in the direction of the corrective level of 38.2% (1.0965).

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to expect an increase in quotes in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US currency and, possibly, a new long fall.

Overview of fundamentals:

On April 27, the European Union and America did not have a single important report or other economic event. Traders are waiting for the second half of the week, which is scheduled for a large number of reports, as well as meetings of the ECB and the Fed.

News calendar for the United States and the European Union:

On April 28, the calendar of economic events in the European Union and the United States does not contain any important reports and events.

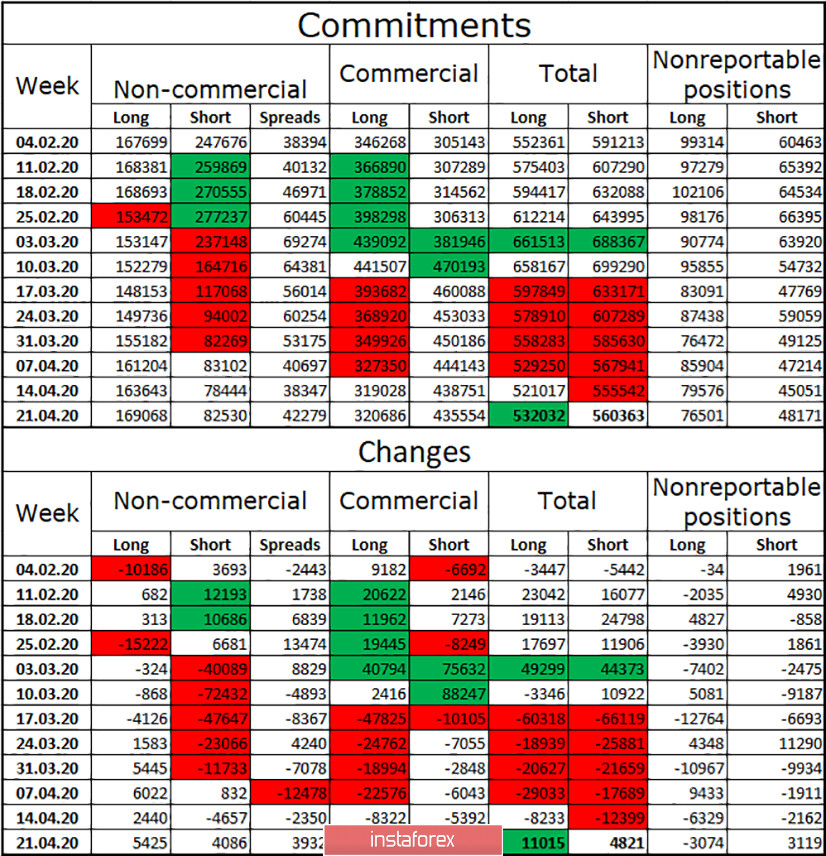

COT (Commitments of Traders) report:

A new COT report showed that during the reporting week, major players in the currency market again increased their contracts. The total number of long contracts increased by 11000, and short - by 5,000. The overall advantage remains in favor of short, 560,000 against 532,000 contracts. The advantage is not too strong. Over the past three months, every COT report has shown the advantage of bear traders. However, during this time, the euro not only fell, but also grew. Thus, I would say that the overall trend remains "bearish", that is, in the long term, I would expect further falls in quotes. But this does not mean that the Euro has no chance of growth at all. Speculators continue to believe in the euro currency since they have twice as many Long contracts in their hands as short ones.

EUR/USD forecast and recommendations for traders:

At this time, I recommend selling the euro currency with the goal of 1.0638, if the rebound from the trend line is performed on the 4-hour chart. The signal from the bearish divergence is also "bearish", but it is weaker than the rebound from the trend line. I recommend buying euros after fixing the quotes above the downtrend line on the 4-hour chart with the goal of 1.0964.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.