Crypto Industry News:

Australian Finance Minister Jane Hume warns of the risk of missing out on the opportunities offered by cryptocurrencies. According to her, this is not a temporary fad, and further ignoring this market could expose Australia to losses.

Unlike the Reserve Bank of Australia (RBA), which last week issued a warning against investing money in cryptocurrencies, Jane Hume is aware that cryptocurrencies will stay with us for longer:

"As an industry, and as a government, we need to acknowledge this is not a fad. We should tread cautiously, but not fearfully ".

Hume also believes that there are areas related to financial services where past experience cannot be relied upon and new rules need to be developed.

"There are some areas of financial services where we can not learn from past experiences, and we have to forge our own trail."

Consequently, banks can no longer fight innovation as it will not transfer anything good.

A recent report clearly shows that Australians are very interested in cryptocurrencies. Almost every fifth respondent admitted that he had invested money in them.

Technical Market Outlook

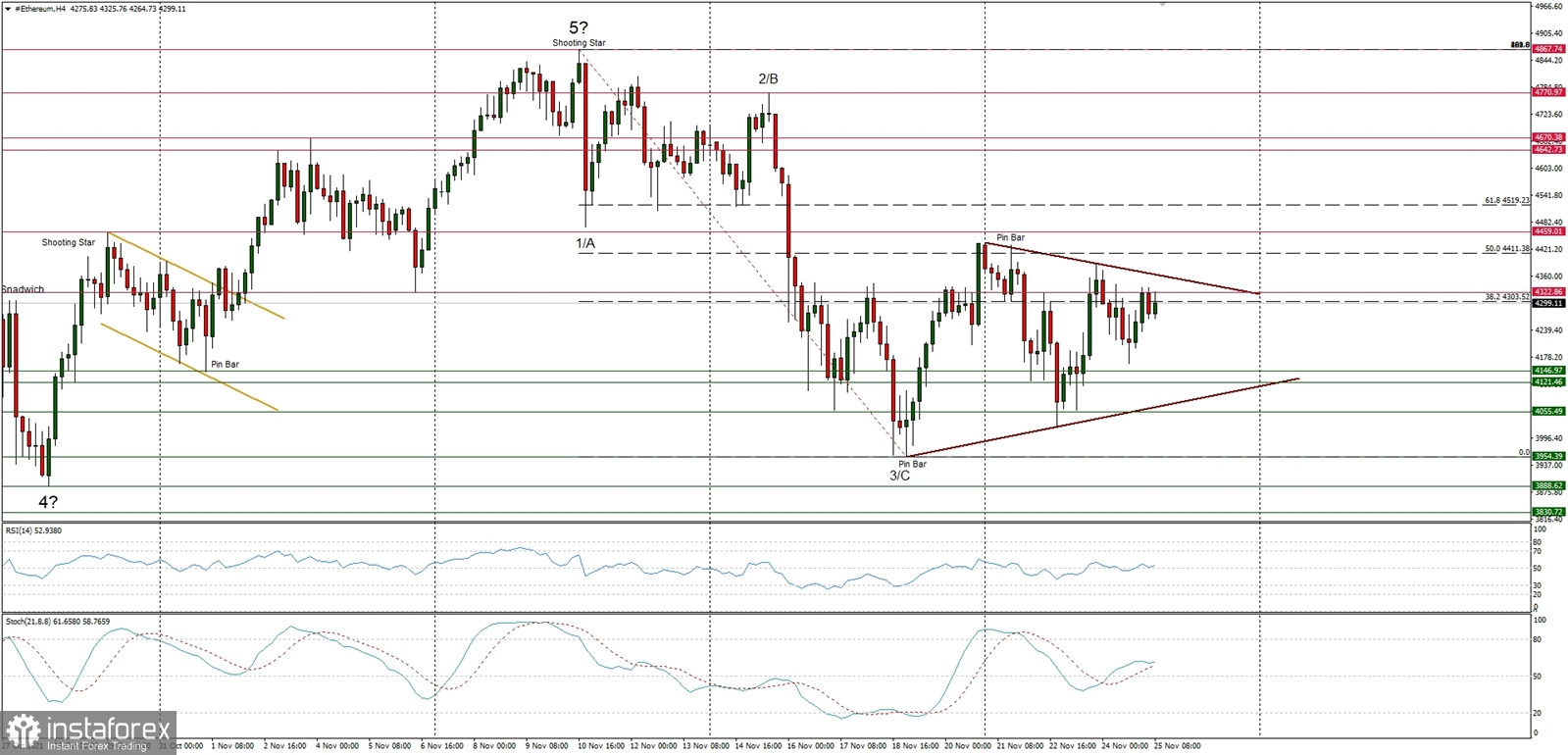

The ETH/USD pair keeps consolidating in a narrow range. The current price action indicates a possibility of a triangle price pattern in progress, so another down wave might occurs if there is a breakout from this pattern. In that case, the next target for bears is seen the level of $4,021. Any violation of this level would accelerate the down move towards the key short-term technical support seen at $3,954. Please notice, that the larger time frame trend remains up and there is no indication of the trend reversal yet.

Weekly Pivot Points:

WR3 - $5,566

WR2 - $5,159

WR1 - $4,752

Weekly Pivot - $4,357

WS1 - $3,938

WS2 - $3,564

WS3 - $3,134

Trading Outlook:

The next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,906. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.