Analysis of transactions in the EUR / USD pair

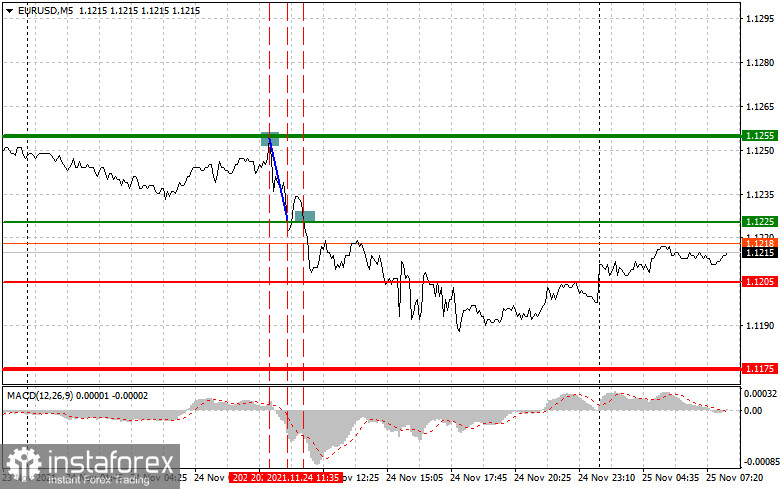

EUR / USD fell by 25 pips yesterday because traders took short positions amid a signal to sell that appeared at a time when the MACD line was at the overbought area. After that, another signal emerged, but this time the downward movement was limited because the MACD line was far away from zero. The signal to buy that followed was also unsuccessful even though the indicator already moved to the oversold area. Most likely, the reason was the weak data released by the Ifo.

Weak report on the indicator of the business environment, the assessment of the current situation and economic expectations from the German IFO led to the formation of pressure on the European currency, as the data turned out to be worse than economists' expectations. ECB executive board member Fabio Panetta's speech and inflation statements did not support the euro. Fabio Panetta in his speech was softer than his other colleagues, and most likely this position is taken by the majority of European politicians - who count on maintaining an extremely soft monetary policy for the foreseeable future. This puts pressure on the euro in the short term. The publication of the minutes of the Federal Reserve System supported the buyers of the US dollar, which led to its further strengthening against the euro.Euro declined yesterday amid weaker-than-anticipated data on the business climate, current situation and economic expectations in Germany. It was also pressured by the statements of ECB executive board member Fabio Panetta as it supports maintaining a soft monetary policy for the foreseeable future. The latest Fed minutes also raised demand for dollar, which accordingly escalated the bearish momentum in EUR / USD.

The observed decline may continue today if the GDP data and consumer climate in Germany come out weaker than the forecasts. ECB chief Christine Lagarde will also speak, and it could push euro lower if her statements remain dovish. In the afternoon, volatility and trading volume will decline sharply, all because of the closure of the US market in connection with the celebration of Thanksgiving Day.

For long positions:

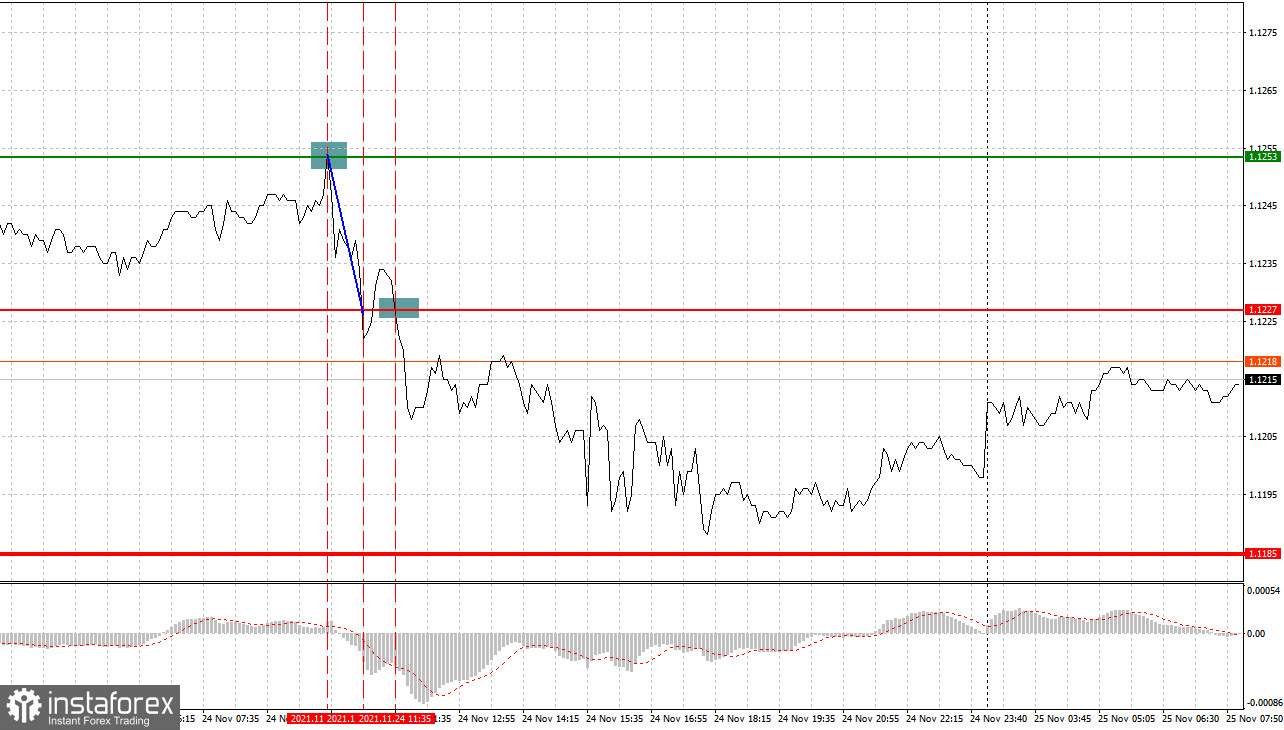

Buy euro when the quote reaches 1.1225 (green line on the chart) and take profit at the price of 1.1255. Demand will increase if the Euro area reports strong economic statistics and if the European Central Bank says hawkish statements on monetary policy.

Before buying, make sure that the MACD line is above zero, or is starting to rise from it. It is also possible to buy at 1.1205, but the MACD line should be in the oversold area, as only by that will the market reverse to 1.1225 and 1.1255.

For short positions:

Sell euro when the quote reaches 1.1205 (red line on the chart) and take profit at the price of 1.1175. Demand will decline if the situation with COVID-19 escalates. Weak data from Germany will also provoke a decrease in EUR / USD.

Before selling, make sure that the MACD line is below zero, or is starting to move down from it. Euro could also be sold at 1.1283, but the MACD line should be in the overbought area, as only by that will the market reverse to 1.1255 and 1.1216.

What's on the chart:

The thin green line is the key level at which you can place long positions in the EUR/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.