Weak economic reports in the US disappointed the buyers of risky assets. Fed's meeting today, which promises no alteration, may strengthen dollar's position against euro and pound.

Yesterday's macroeconomic statistics once again demonstrated the horrific consequences of the pandemic. According to INSEE, consumer sentiment in France worsened in April this year, as the indicator decreased to 95 points due to the outbreak. Economists expected the index to be 87 in April.

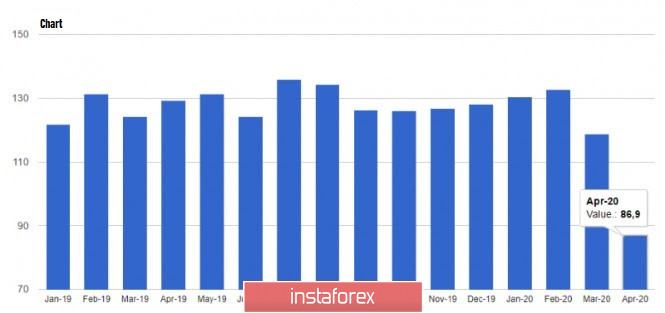

Similar pressure was seen in the US consumer confidence, which fell to 86.9 points in April, according to the Conference Board report. This does not seem to be the end of the deterioration, as aggravation of the pandemic will continue to affect the indicator. To date, coronavirus infection in the US already exceeded 1 million. Economic recovery is far from seen as well.

Many expect the economy to open in May this year, but re-outbreak concerns make such forecasts unrealistic.

S&P CoreLogic Case-Shiller reported an increase in US home prices in February, but the pandemic threatens a decline in the rate this spring season. A 4.2% annual gain was recorded in the February data, better than the previous month's 3.9%. Sales, meanwhile, were pulled down by buyers and sellers' refusal to deal, which plunged the index by 8.5% in March. If it continues, future prices will be affected, forcing them to decline from the highs reached.

Manufacturing activity in the Central Atlantic region plummeted, but did not surprise anyone. The Richmond Fed report revealed that the composite production index fell to -53 in April, much worse than the previous month's value of 2. All three components of the index fell at once.

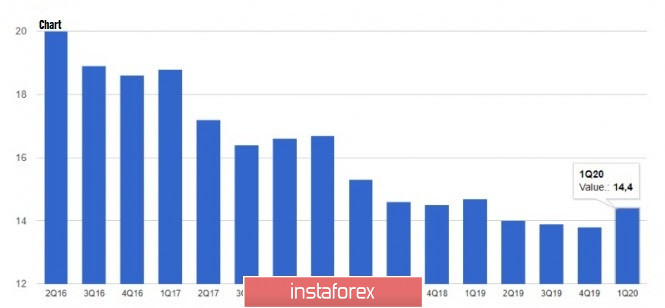

Economists published several forecasts related to Spain and Germany yesterday. Unemployment rate in Spain is expected to jump to 14.4% in the 1st quarter of this year, and exceed 20% in the 2nd quarter, provided that quarantine restrictions are lifted in May. If not, the situation will only get worse.

Moody's revised down its economic outlook in Spain yesterday. The change was due to a decline in the tourism sector, which suffered because of isolation measures. Thus, Spain GDP is forecast to dip to about 8% in 2020.

Meanwhile, Germany's IFO forecast the country GDP to fall by more than 16%, due to quarantine. This, German GDP will most likely collapse by 1.9% in the 1st quarter, more than 12.0% in the 2nd quarter, and by 6.6% year on year.

In this regard, the ECB and the finance ministers must make a lot of efforts to prevent the further plunge of eurozone economies. Expansion of the asset purchase program this week is unlikely, but will definitely happen later this year. More detailed assessment on the recession, as well as the coronavirus situation, will be taken.

Today's Fed meeting promises no alteration in the monetary policy, leaving rates unchanged at zero. Discussions will most likely be directed to fiscal decisions.

As for the technical picture of the EUR / USD pair, demand for risky assets remain low, and will most likely remain so unless the Fed comes up with new measures to support the economy. Bears will continue to defend the resistance level of 1.0890, from which a break of the 1.0815 support will increase pressure on the trading instrument and lead to a larger sell-off in the area of lows at 1.0780 and 1.0750. Break through 1.0890 will trigger bullish mood to risky assets, which may push quotes to the area of 1.0940 and 1.0990 resistances.