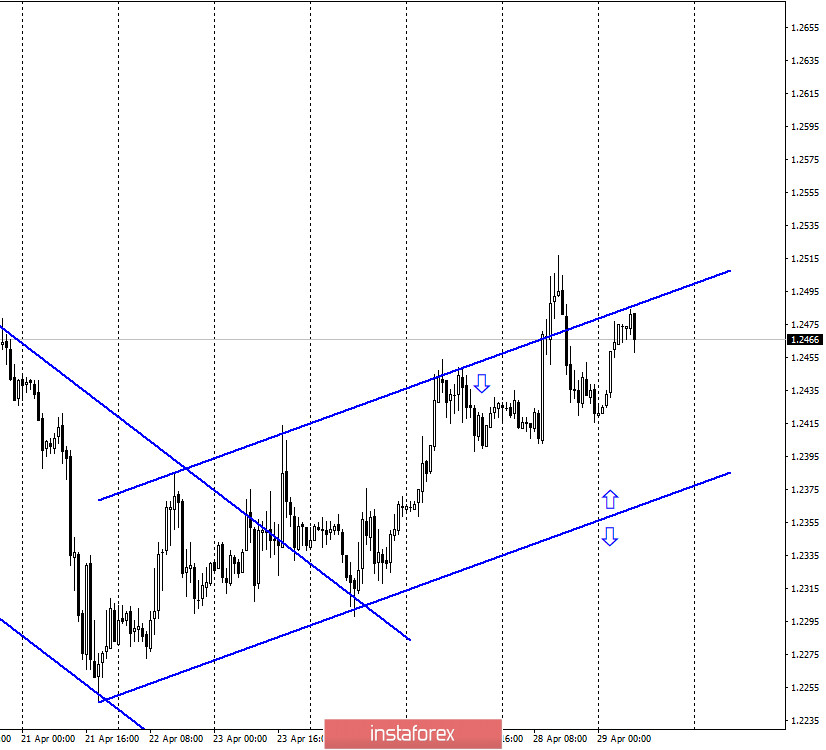

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair continues the growth within the upward trend corridor, which defines the mood of traders as "bullish". There are no prerequisites for the pair to exit through the lower border, and nothing will change through the upper one. The mood will still remain "bullish", however, it will only get stronger. At the same time, there are no signals on the hourly chart at the moment. I do not believe that the rebound from the upper line of the corridor can cause a fall to its lower border in the current conditions. Everything is going, on the contrary, to the fact that another ascending corridor will be built with a higher angle of inclination. There is still little news in the UK. Boris Johnson has returned to his duties but has yet to make any major decisions. In the near future, the government of the country should resolve the issue of easing the quarantine measures, but Johnson himself on the first day of leaving the hospital urged British citizens not to rush this.

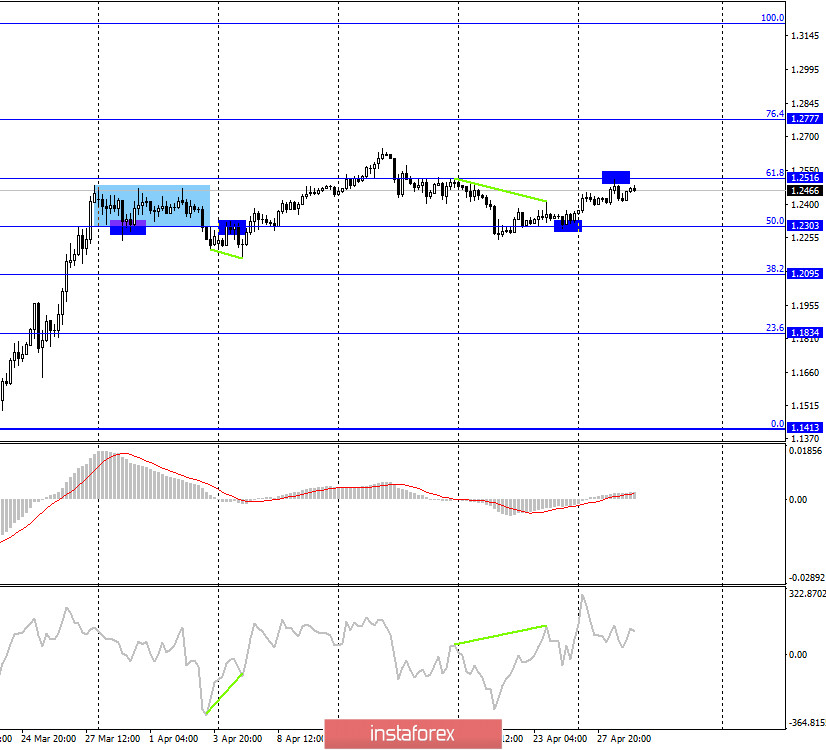

GBP/USD – 4H.

On the 4-hour chart, the pound/dollar pair rebounded from the corrective level of 61.8% (1.2516), a reversal in favor of the US currency and a slight fall. However, at this moment, the pair's quotes have already made a return to this Fibo level. Thus, a new rebound from the level of 61.8% will again allow traders to count on a reversal in favor of the US currency and a slight fall in the direction of the corrective level of 50.0% (1.2303). Today, the divergence is not observed in any indicator. Fixing the exchange rate above the Fibo level of 61.8% will work in favor of continuing growth towards the next corrective level of 76.4% (1.2777).

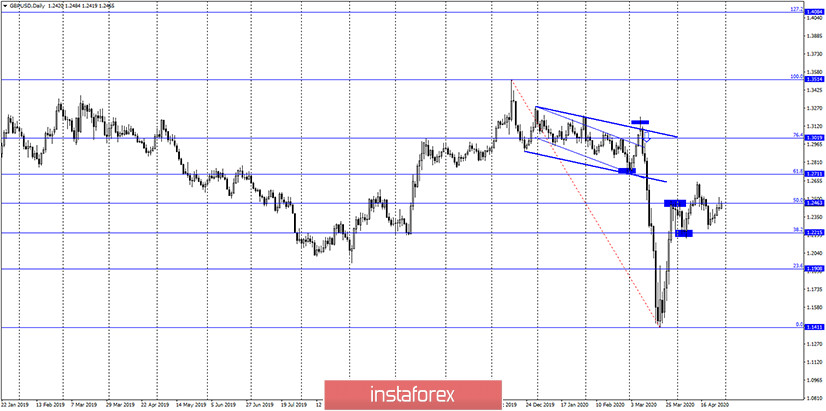

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a reversal in favor of the English currency and returned to the corrective level of 50.0% (1.2463). The rebound of quotes from this level will work in favor of the US dollar and resume the fall in the direction of the corrective level of 38.2% (1.2215).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the top two trend lines, but in the long term.

Overview of fundamentals:

There were no reports or economic news in the UK or America again on Tuesday. Thus, traders continue to wait for the US events and news of this week.

News calendar for the US and UK:

US - change in GDP for the quarter (14:30 GMT).

US - FOMC decision on the main interest rate (20:00 GMT).

US - accompanying FOMC statement (20:00 GMT).

US - FOMC press conference (20-30 GMT).

Today, April 28, the UK news calendar again does not contain any important information. But there will be a lot of important news and messages in America. The report on GDP, which may be reduced by more than 4%, and subsequent decisions and statements of the FOMC may cause a reaction of traders.

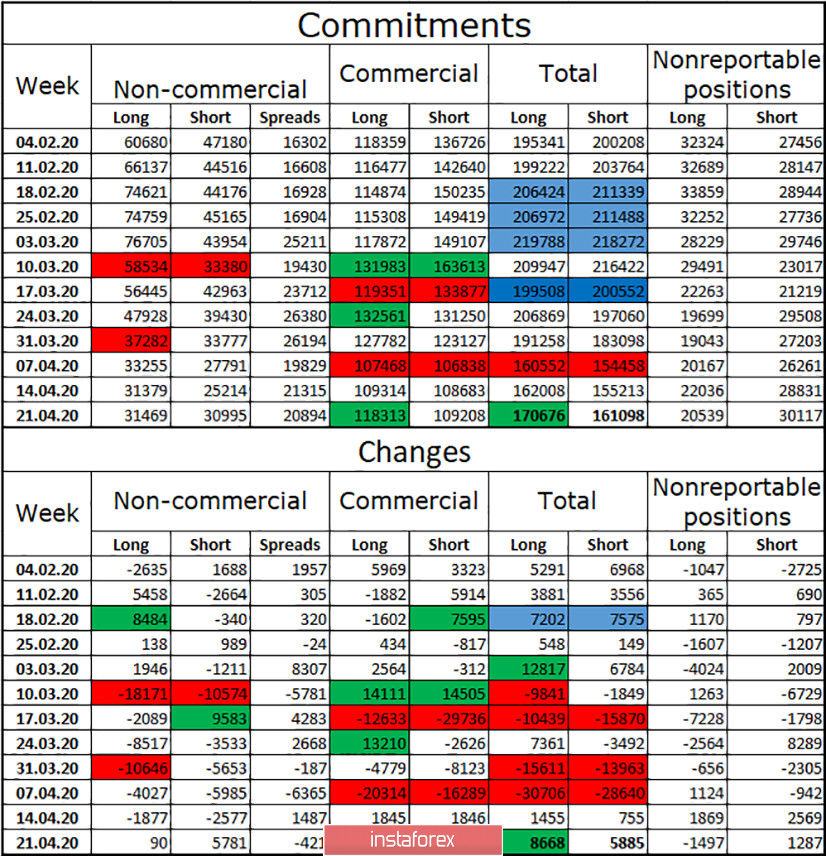

COT (Commitments of Traders) report:

A new COT report showed an overall increase in the number of long and short contracts. This means that interest in the British among major market players is beginning to grow slowly. However, overall trading volumes remain fairly low. During the reporting week, the total number of longs increased by 8,668 contracts, and shorts - by 5,885. The overall advantage also remains for long positions, and it is also minimal - 170,000 against 161,000. For a group of speculators, equality is almost complete - 31,000 short and long. However, I would like to note that since the report for March 31, when the number of long and short contracts in the hands of the "Non-commercial" group has almost leveled off, all trades in the British currency are mostly held between the level of 1.2303 and 1.2516, that is, in a side corridor.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound today with a target of 1.2303 if the rebound from the corrective level 61.8% on the 4-hour chart is completed. I recommend buying the pound after closing above the Fibo level of 1.2516 with a target of 1.2777.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.