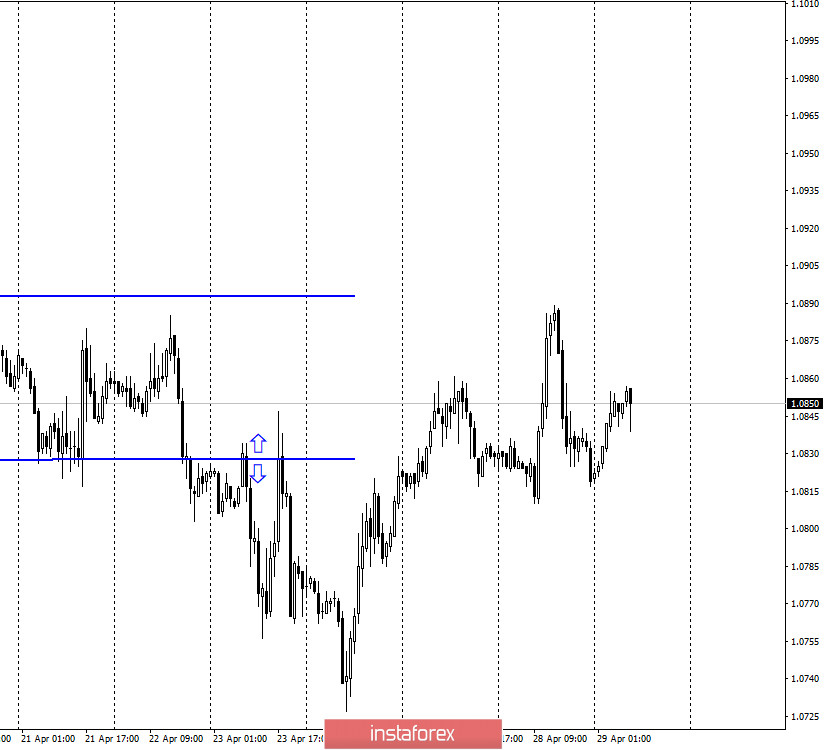

EUR/USD – 1H.

Hello, traders! The euro/dollar pair performed two reversals on the hourly chart on April 28. First, in favor of the US currency with a slight fall, then in favor of the euro with the resumption of the growth. Most traders are now in a bullish mood. However, it is not possible to build any graphical constructions in the form of trend lines or a trend corridor on the hourly chart now. Thus, we conduct analysis and forecasting on 4-hour and older charts. There is nothing to highlight from the economic news of the past day. However, the media received several reports that deserve attention. First, in many EU countries, starting from May 1, the quarantine is relaxed. Second, Donald Trump intends to do the same with America. Third, Germany and the United States became the first countries in the world to express or are about to express financial claims against China for the spread of coronavirus. Thus, despite the fact that the number of cases in America has exceeded 1 million, the situation in the European Union is no better, and there is still no vaccine, countries are beginning to come out of quarantine, betting on economic recovery.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair performed a reversal in favor of the euro and worked twice over the last day on the downward trend line, which now acts as the last bastion of hope for bear traders. A new rebound of the pair's quotes from this line will work in favor of the US dollar and resume the fall in the direction of the corrective level of 0.0% (1.0638). However, over the past few days, the bears have failed to show their interest in the pair's new sales. Thus, without lying, we can say that today, when GDP is released in America and the Fed meeting takes place, the fate of the euro currency will be decided. Fixing the pair's rate above the trend line will allow traders to expect continued growth in the direction of the corrective level of 38.2% (1.0964).

EUR/USD – Daily.

On the daily chart, the euro/dollar pair made a consolidation under the Fibo level of 23.6% (1.0840), as well as under the "narrowing triangle", which still allows us to count on a drop in quotes in the direction of the corrective level of 0.0% (1.0637). Only fixing the quotes above the Fibo level of 23.6% will allow traders to expect some growth of the pair in the direction of the corrective level of 38.2% (1.0965).

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to expect an increase in quotes in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US currency and, possibly, a new long fall.

Overview of fundamentals:

On April 28, the European Union and America did not have a single important report or other economic events. Traders continue to wait for the second half of the week, which is scheduled for a large number of reports.

News calendar for the United States and the European Union:

Germany - consumer price index (14:00 GMT).

US - change in GDP for the quarter (14:30 GMT).

US - FOMC decision on the main interest rate (20:00 GMT).

US - accompanying FOMC statement (20:00 GMT).

US - FOMC press conference (20:30 GMT).

On April 29, the calendar of US economic events contains a report on GDP and the results of the meeting of the monetary committee of the Federal Reserve. Decisions will be announced, as well as forecasts and policy direction.

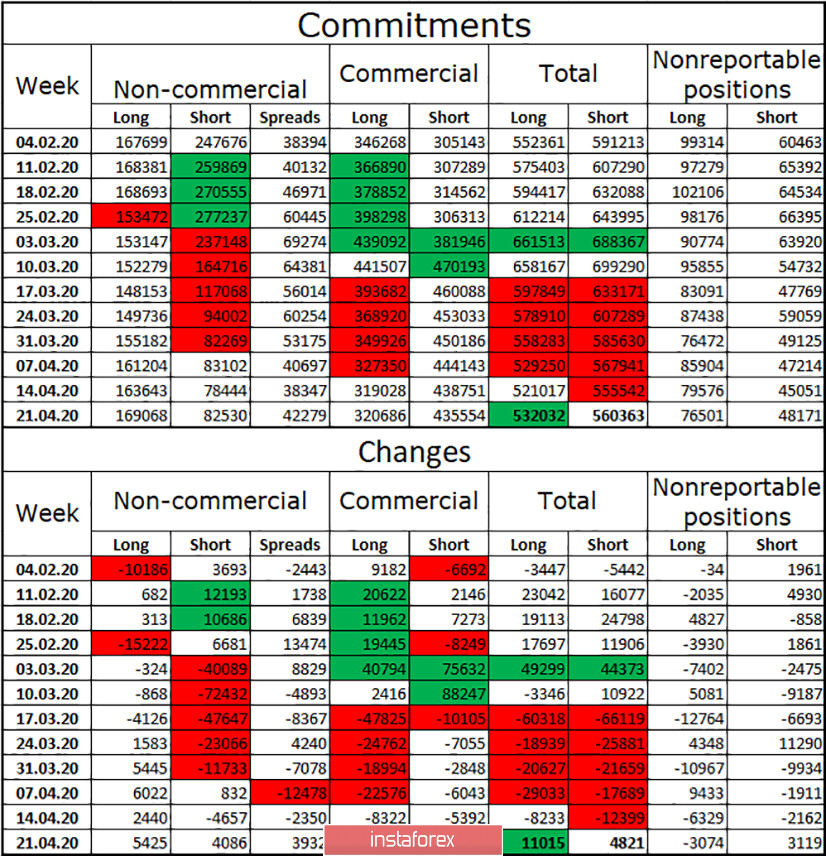

COT (Commitments of Traders) report:

The latest COT report showed that during the reporting week, major players in the currency market again increased their contracts. The total number of long contracts increased by 11,000, and short - by 5,000. The overall advantage remains in favor of short - 560,000 against 532,000 contracts. The advantage is not too strong. Over the past three months, every COT report has shown the advantage of bear traders. However, during this time, the euro not only fell but also grew. Thus, the overall trend remains "bearish", that is, in the long term, I would expect a further fall in quotes. However, there is still a graphic picture that may show a signal to buy. Speculators continue to believe in the euro since they have twice as many long contracts in their hands as short ones.

Forecast for EUR/USD and recommendations to traders:

At this time, I recommend selling the euro with the goal of 1.0638, if there is another rebound from the trend line on the 4-hour chart. I recommend buying euros after fixing the quotes above the downward trend line on the 4-hour chart with the goal of 1.0964.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.