Let's be honest, the market is paying less and less attention to the coronavirus epidemic. Even disappointing statistics, which showed that the United States overcame the mark of 1 million confirmed cases of coronavirus infection, did not make any impression on the market. And this is not only because of the market's tiredness from this entire epidemic. For the most part, this is due to the fact that it seems like you can exhale and take a breath. One by one, the countries of the world either are already starting to remove restrictive measures, or they are announcing the start date of the softening of the restricted quarantine regime. That is, the peak of the epidemic has passed, and now it's time to think about how to get out of the economic pit. However, first you need to understand the scale of the disaster. This is not possible without macroeconomic statistics.

But as usual, the market ignores insignificant macroeconomic data from its point of view. The market simply stood still during almost the entire European session, although some statistics were published. For example, in Spain, the unemployment rate rose from 13.8% to 14.4%. Growth is quite substantial. However, this does not look so impressive against the background of the general level of unemployment. Frankly, unemployment data in Spain never really bothered market participants, therefore, you should pay attention to what is happening on the debt market separately. After all, the yield of many European debt securities continues to grow, and therefore the trend for strengthening the dollar is still maintained. So, an interesting thing happened with 6-month Italian bonds, whose yield jumped from 0.055% to 0.227%. The growth is truly impressive. Now, let's add to this the fact that even when the yield on Italian debt securities was negative, the Italian government did not hide that it had almost no ability to service the national debt. It is easy to guess that the growth in yields puts Italy on the verge of default. And Italy is not alone in this situation. This is a priority issue that the European Union will need to address.

Unemployment Rate (Spain):

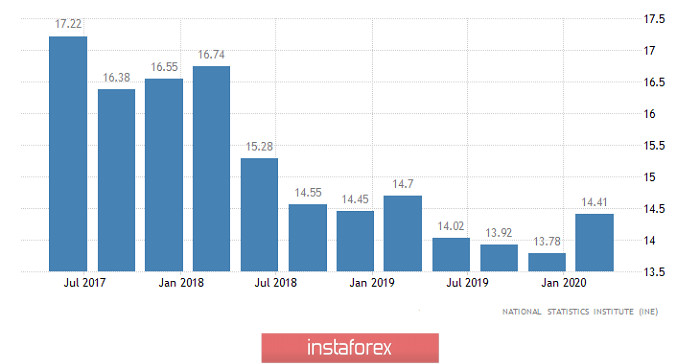

However, the dollar began to lose its position in relation to the pound and the single European currency even before the opening of the American session. This is due to the fact that they expected growth in wholesale inventories by 1.0%. The logic is that in conditions of a catastrophic drop in consumer demand, overstocking of warehouses threatens a very late start to the recovery of industry. While the warehouses are full, no one will place new production orders, which means that the decline in industrial production will last longer than in other industries. However, the worst thing is that this particular situation threatens an extremely prolonged way out of the crisis. But it turned out that wholesale inventories decreased by 1.0%, and after that, the dollar fully recovered all its losses. The decline in stocks is most likely caused by that before the introduction of the restricted quarantine regime, the Americans swept everything. But retail chains, realizing that consumer activity is about to drop to almost zero, did not place new orders. So the warehouses began to empty. And obviously, this is all extremely interesting, but the most interesting thing happened on the debt market, as the yield of just longer securities began to significantly decline again. In particular, the yield on 7-year US bonds fell from 0.680% to 0.525%. In other words, large investors behave as if they had no doubt that the way out of the crisis would be extremely protracted. S & P / CaseShiller data on housing prices did not interest anyone at all, since they reflect the dynamics of prices for February. Although their growth rate accelerated from 3.1% to 3.5%.

Wholesale Stocks (United States):

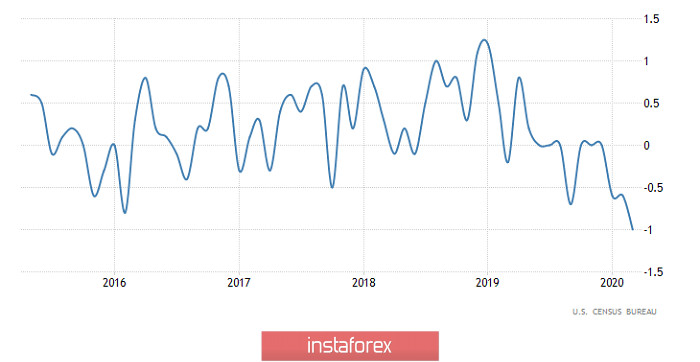

Spain has already managed to report on retail sales for March. Honestly, it would be better if the descendants of the conquistadors did not do this. If the retail sales growth rate was 1.8% in April, and they were supposed to show a decline of 3.0% in March, then in fact it turned out that they declined by 14.1%. So we have received confirmation once again that the scale of the economic downward turn will be much larger than originally imagined by anyone. Italy still has to report on producer prices, the decline of which may accelerate from -2.6% to -3.7%. Thus, deflation is becoming an increasingly realistic option for further developments in Europe. By the way, they expect a slowdown in inflation from 1.4% to 0.7% in Germany. Therefore, talking about deflation does not belong to the category of feverish delirium. But generally, lending growth rates in Europe may slow down significantly. Thus, the growth rate of consumer lending should slow down from 3.8% to 3.0%. As for corporate lending, it is expected to slow down from 3.0% to 2.2%.

Inflation (Germany):

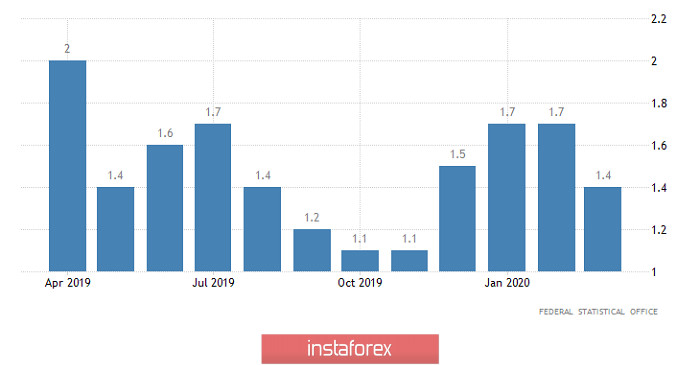

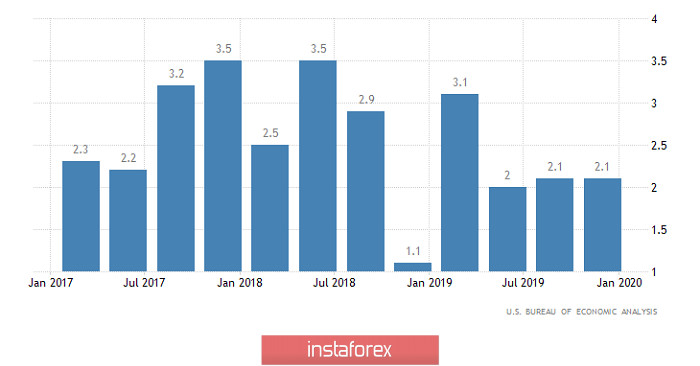

But the most interesting thing will happen on the other side of the Atlantic, and this is not a meeting of the Federal Committee for Open Market Operations. Everything is clear with it so there will be no changes. During two emergency meetings, the refinancing rate has already been lowered at a record pace. So for now, the Federal Reserve is playing the bystander. Like, everything is already done in advance and you just need to wait for the results. Much more interesting is what the first estimate of GDP for the first quarter will show. However, they don't expect anything good from it. Although restrictive measures began to be introduced only in mid-March, that is, at the very end of the quarter, GDP may decline by 4.6%. Not only does this mean that the decline will be even greater in the second quarter, it is also because the problems themselves in the economy appeared long before the coronavirus epidemic. In short, the situation is not very pleasing.

GDP growth rate (United States):

Given that the market is increasingly focusing on macroeconomic statistics, the growth of the single European currency in the direction of 1.0950 is considered. However, do not forget that the general trend towards the strengthening of the dollar is still preserved. Thus, the strengthening of the single European currency will be temporary.

The pound can grow even above the level of 1.2525 exactly for the same reasons. We can say that even a path is being planned in the direction of 1.2625, however, the pound is clearly not going to get there.