How long will the Fed keep rates at minimum values?

Greetings, dear colleagues!

Before proceeding to the technical analysis of the main currency pair of the Forex market, let me once again remind you of the most important event of today, and possibly of the entire current week.

In the evening, at 19:00 (London time), it will be known about the decision of the US Federal Reserve System (FRS) on interest rates. After that, at 19:30 (London time), a press conference will be held by Fed Chairman Jerome Powell. We will also find out the updated economic forecasts of the Open Market Committee (FOMC), and how the votes of FOMC representatives were distributed when voting on the rate.

Most likely, the main interest rate in the US will not change and will remain within 0.25%. Much more interesting for market participants will be the new forecasts for the world's largest economy, as well as the rhetoric of the speech of the head of the Federal Reserve. It would be naive to assume that economic forecasts will be optimistic in the current situation. And Jerome Powell's speech will probably be devoted to the threats of COVID-19 to the US economy. As for measures to maintain economic activity, I believe that the US Central Bank has taken all the necessary actions at the moment. As Powell has already said, the QE program will not have restrictions in the form of a specific amount. In addition to the latest economic forecasts, it is impossible to completely rule out a rate cut to zero. Of course, in light of the last two emergency and very significant cuts in the refinancing rate, such a step is unlikely. It will be more realistic to announce any additional measures to support the economy or adjust those already taken. As for the rhetoric of the head of the Fed, some doubt that it will be sustained in "dovish" tones. Another question that worries market participants: how long will the Fed keep rates at the current minimum values? I think that we will not get a clear answer to it. Most likely, Powell will say that everything will depend on how much damage COVID-19 will be caused to the economy, and how soon it (the economy) will be able to recover from it.

Before the Fed, at 13:30 (London time), preliminary data on US GDP for the first quarter will be published. Naturally, in a pandemic where the United States still leads in the number of infected and dead, the forecasts are far from optimistic and are reduced to minus 4%.

I wonder how investors will react to this important information this time and whether the market will win it back. In the meantime, let's see how yesterday's trading ended, and try to predict the course and results of today's session.

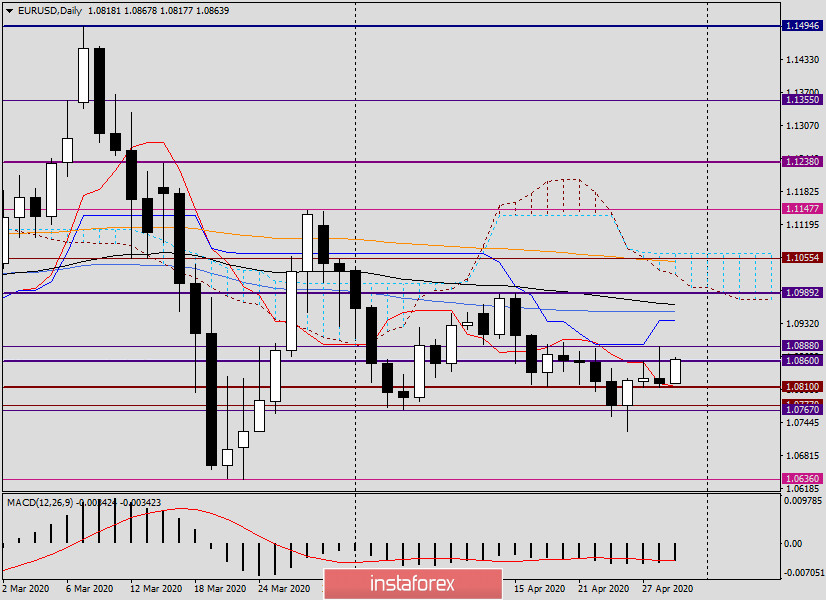

Daily

As you can see, yesterday's attempts of the euro bulls to resume the rise of the exchange rate and break through the strong resistance of sellers at 1.0860 again failed. However, no one is going to give up. Players on the increase are full of enthusiasm, and at the time of completion of the article, they again make attempts to raise the quote.

Taking into account yesterday's highs, we will designate the resistance zone as 1.0860-1.0888. Closing above yesterday's maximum values, or even better above 1.0900, will indicate the superiority of the bulls over their opponents and give reason to expect further strengthening of the exchange rate.

The support is still active near 1.0810, and the Tenkan line of the Ichimoku indicator is already located here, which will definitely strengthen the level itself. The downward scenario will become more relevant in the event of a breakdown of 1.0810 and the Tenkan line, with a mandatory close below 1.0800.

In the meantime, I maintain a positive mood for the pair and expect growth to 1.0936, 1.0955, and 1.0968. If you define trading recommendations, these are purchases after short-term declines in the area of 1.0840.

In conclusion, let me remind you that today is a rather difficult day for trading. In the evening, after the Fed's decision on rates and during Jerome Powell's press conference, there is a high probability of sharp and multidirectional movements, so be careful and do not rush.

Good luck!