European stock markets opened in the red zone, but the changes are minimal. Volatility during the day is unlikely to exceed average values as layers are waiting for the results of the FOMC meeting. Changes in monetary policy are unlikely, but changes in procurement volumes are possible, and rate forecasts can also be adjusted, although the Fed is likely to try to avoid changes on this issue.

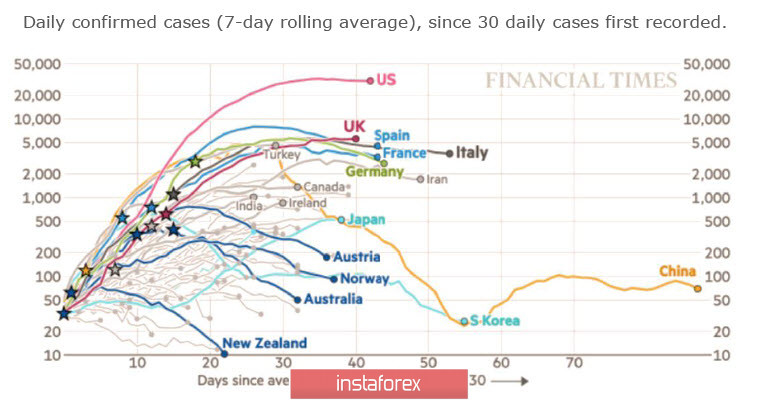

The prospects for the New Zealand and Australian dollars is now more positive than the market average, primarily because the spread of coronavirus infection in New Zealand and Australia follows a less negative scenario than in most countries. New Zealand is clearly ahead of the curves of the spread of the virus, and according to ANZ Bank, this progress gives a good chance of opening the economy. Australia is lagging behind, but not significantly, so internal factors will help strengthen the positions of NZD and AUD, and the more panic declines, the more they will win against other currencies.

Weak external demand will be the main hindering factor in these conditions. This factor is key for export-oriented economies, since it objectively contributes to lower export prices and weak budget filling.

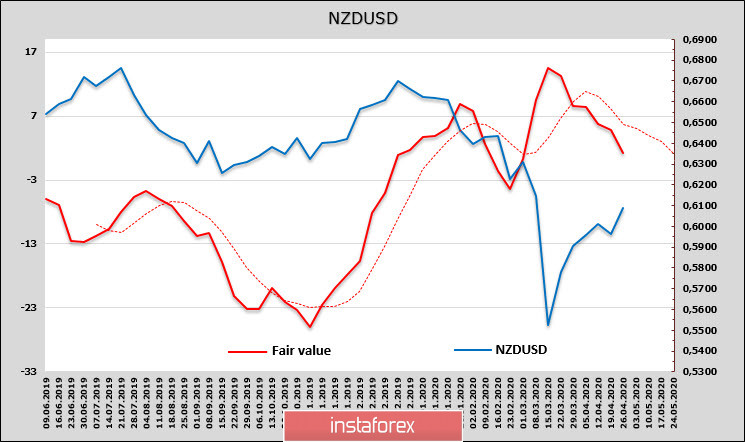

NZD/USD

The New Zealand dollar experienced some problems after Westpac forecasted a reduction in the RBNZ rate to a negative level of -0.5% by the end of the year. Westpac justifies its position primarily by a sharp slowdown in exports due to a decrease in global demand, which will cover the global economy in the 2nd quarter, which will cause the currencies of commodity countries to suffer more than others.

Assuming that a deep drop in global demand seems almost inevitable, the markets still give the kiwi an advantage in the pace of recovery due to an earlier exit from quarantine, as a result of which, all losses were quickly recovered.

Despite the decline in the net short position in kiwi on the CME, the bears' predominance is still significant. The estimated fair price is higher than the spot price, which serves as additional support for NZD, which is "pulling up" to the calculated level, but the direction is confidently downwards. Therefore, hopes for a strong growth of the New Zealander may not be implemented.

A short-term impulse has not yet been developed, and so testing the resistance level of 0.6129 looks very likely. The estimated price is above 0.63, which means that the strengthening of the kiwi does not pose a threat to exporters. Further movement to 0.6170/90 should be supported by the overall growth of positivity, if the Fed does not give a reason for the resumption of sales today, then we must proceed from the fact that short-term growth will continue and grow into medium-term. Nevertheless, the clearly bearish direction of the estimated price indicates that speculators are still very cautious and are not ready to buy kiwi.

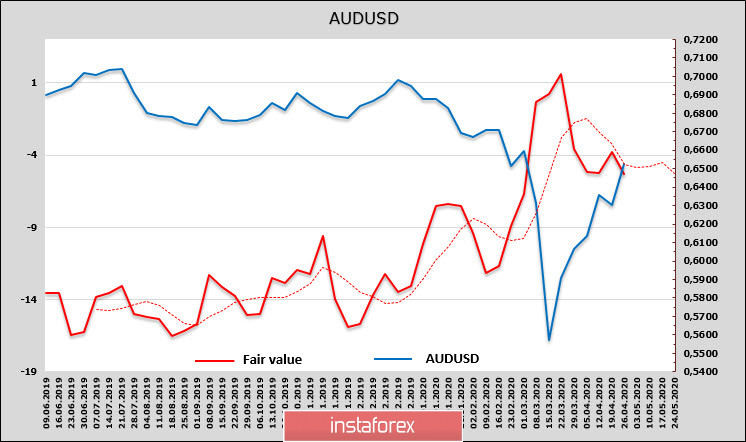

AUD/USD

The position of speculators on CVT for the Australian currency is similar to the position for other commodity currencies - the total short position remains wide, and its reduction by 104 million, to 2.187 billion, does not yet give reason to believe that the reversal took place.

The estimated price is almost equal to the spot price, this factor has stopped pulling up the AUD. Now, the main factor is the speed of recovery from the pandemic and the gradual recovery of global demand.

Moreover, we can't help but note the unexpectedly strong quarterly inflation report from the RBA. All forecasts are exceeded, that is, the fall in prices in March was not as deep as predicted, the result favorably distinguishes Australia among other developed economies, where the fall in consumer demand is noticeably deeper.

Analysts at NAB noted the unusually strong growth of the Australian dollar against the US dollar, who now expect AUD/USD at 0.6750 at the end of the year, that is, they maintain a bullish look at the Australian currency. It has already recovered about 2/3 of its fall in 2020, and the medium-term bullish channel looks convincing. At the same time, we are already seeing a third impulse in the short term with two corrections after the formation of the base on March 19, which increases the chances of a deeper correction. Resistance is at 0.6660/80, where a local peak can be formed.